It’s been five months since the Terra ecosystem collapsed as tens of billions of dollars in value disappeared from the crypto economy in a matter of days after May 7. Terra’s new Phoenix blockchain managed to restart the ecosystem to some degree and since the end of June, Terra’s total value locked (TVL) in decentralized finance (defi) has increased from $350,174 to today’s $41.55 million.

A Look at Terra’s Blockchain Ecosystem Over the Last 5 Months Since the Collapse

The Terra ecosystem fallout was a dark day for the crypto community when Terra’s stablecoin terrausd (UST), now known as UST classic (USTC), depegged from the token’s $1 parity. Before the collapse, Terra’s luna, now known as luna classic (LUNC) was a top ten crypto asset by market capitalization and Terra’s stablecoin also held a top ten position. Prior to the fallout, luna held the seventh position in terms of crypto market caps, and on April 28, Terra’s native crypto asset was trading for $88 per coin.

Precisely one day before Terra’s stablecoin depegged, USTC made it into the top ten crypto asset positions by market capitalization. Terra held the 2nd largest TVL in Ethereum (ETH), with $29.29 trillion on April 29th 2022. The Terra ecosystem today is very different from what it was five months ago.

For instance, LUNC is trading for less than a U.S. penny at $0.00025948 per unit which is a lot lower than the $88 per coin recorded on April 28, and much lower than the coin’s all-time high at $119 per unit recorded two week’s prior. In terms of the new Terra Phoenix blockchain’s native asset which now leverages the name luna (LUNA), it’s down 86.2% lower than the $18.87 all-time high recorded five months ago. The Terra Phoenix chain’s defi TVL, however, has seen growth during the last five months as it has swelled by 12,151% since the end of June.

The TVL at that point was $350,174. Since then, it has grown to $41.55million. While the Terra classic chain held $29.29 billion last April, it’s now just under $10 million today at approximately $9,493,635. Astroport, Terraswap and Anchor have $3.5million each. Anchor is a defi loan protocol that has approximately $1.6million.

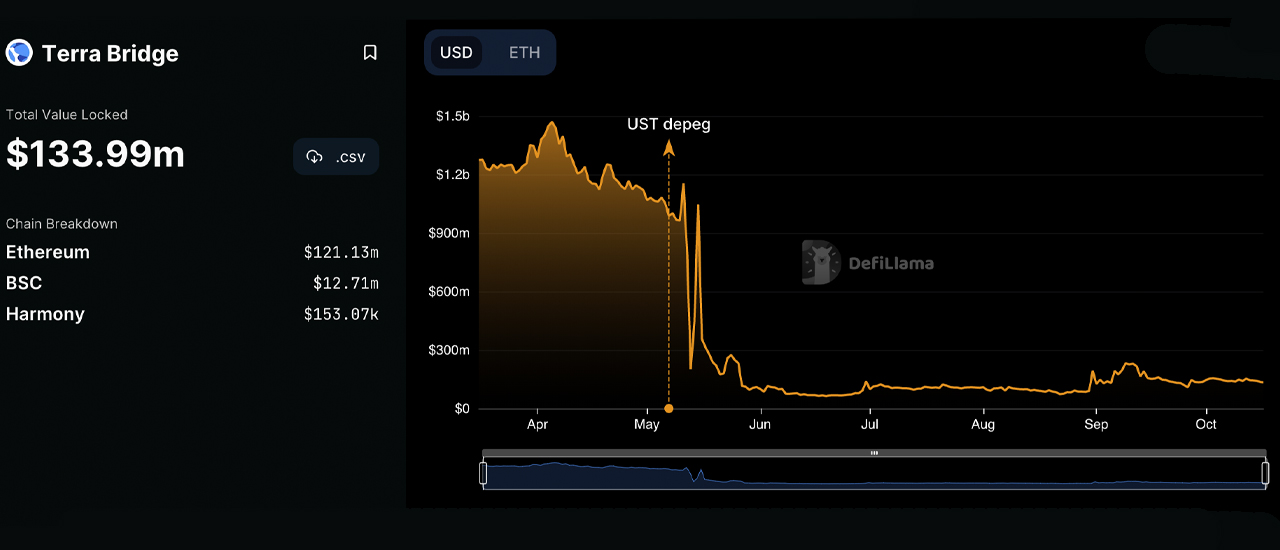

On the Phoenix chain, in terms of TVL held in defi, the decentralized exchange (dex) app Astroport holds around $27.55 million, followed by Risk Harbor’s $14.76 million. Astroport and Risk Harbor are followed by Stader and Spectrum Protocol. Eris Protocol is third in TVL statistics. The Terra Bridge had once been worth $1.4billion in April’s first week, but today it has a value of $132m.

In terms of non-fungible token sales, the new Terra chain’s sales data is not documented as well as the classic chain’s NFT sales before the collapse. Terra Phoenix chain supports more than half a dozen NFT markets, despite the low sales. In terms of the total value between the two native coins LUNC and LUNA, Terra’s blockchain assets between the classic and Phoenix chain is roughly $2.18 billion on October 16, 2022, at 3:00 p.m. (ET).

Terraclassicusd, (USTC), trades for over a penny at $0.03 per unit today. This is on October 16th 2022. It has a market capitalization of $378.49 millions. Statistics show that the cryptocurrency market currently values USTC and LUNA at around $2.558billion. The three assets are incorporated in the TVL on both chains.

While $2.558 billion is a lot for a blockchain ecosystem that collapsed, it’s still a shell of the $49.26 billion in value LUNC and USTC used to be worth prior to the blockchain’s fallout on May 7, 2022. In fact, the USD value of LUNA, LUNC, and USTC today is 94.82% less than LUNC’s and USTC’s U.S. dollar value before Terra’s market crash.

What do you think about the current state of Terra blockchain ecosystem five months after the stablecoin depegging incident and the classic ecosystem’s collapse? Comment below and let us know how you feel about the subject.

Credit to ImageShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.