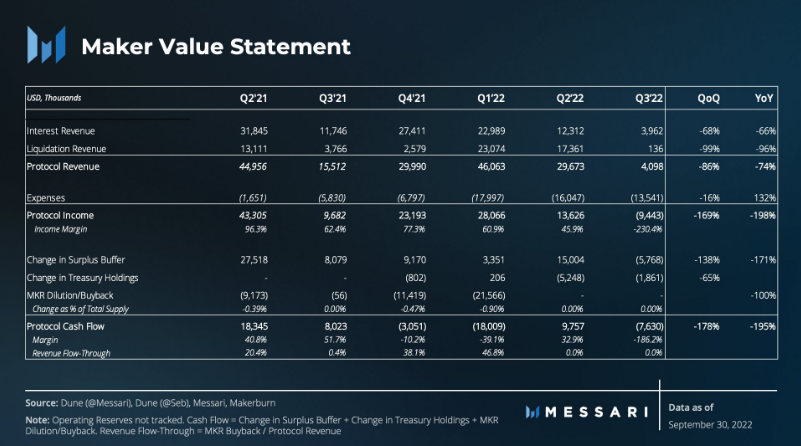

MakeDAO reported a quarterly loss of net income for the first-time since 2020. DAO, the autonomous community which governs Maker Protocol. It is built on Ethereum Blockchain and allows for the loan and borrowing of cryptocurrency assets.

MakerDAO recently saw a sharp drop in its third quarter 2022 revenue. This is due to some liquidations and a drop in loan demand. The community still has high expenses in the current quarter despite its dire situation.

A Messari analyst and co-author of ‘The State of Maker Q3 2022’, Johnny_TVLThis tweet provided insight into the matter. According to his tweet, the analyst stated that DAO’s revenue declined by more than $4,000,000 in the third quarter.

Additionally, the Value dropped by 86% in the first quarter. Such a revenue loss for MakerDAO has been recorded in the community’s report in the first quarter of 2020.

There are many reasons revenue declines

The analyst said that a few liquidations within the system contributed to the drop in revenue. The analyst also pointed out that the reason for this drop was due to weak lending demand.

Wrapped BTC and Ether were the top earners, according to the research analyst. He noted, however that their performance in the third quarter was poor. BTC-based assets fell by 66% while Ether-based assets plummeted 74%.

Borrowers often provide collateral to DAI loans in the form of other crypto assets. The Analyst noted that MakerDAO has seen its collateral ratio drop from 1.9 percent to 1.1 in the same period of last year.

Also, there’s a consideration of the expenses within the quarter, which are not flexible. With a drop of just 16% from last quarter, the report revealed higher Q3 costs at $13.5 million.

MakerDAO: Steps to Increase Growth and Expansion

MakerDAO will take a few actions to help ensure that the Maker Protocol continues its growth and sustainability. The DAO’s first focus was on loans backed by Real World Asset (RWA). It launched the largest RWA-backed loan ever to Huntingdon Valley Bank in Q3 2022, achieving its objectives.

HVB and HVB collaborate in a mutually beneficial partnership. To expand its expansion possibilities, the bank uses the loan as leverage to raise its legal lending limit. According to the MakerDAO, more banks will be attracted by HVB’s partnership.

RWA-backed loans currently account for 12% of total Maker Protocol revenue. This loan will create a vault with 100,000,000 DAI tokens. It also includes a new collateral type within the protocol. It could also generate additional revenue from vault stability fees and DAI mining.

The DAO also took steps to increase its returns on collateral assets. The DAO drew a proposal to invest approximately $500 million in bonds or treasuries. It is intended to increase the yield while taking low risks.

Featured image by Pixabay, chart from TradingView.com