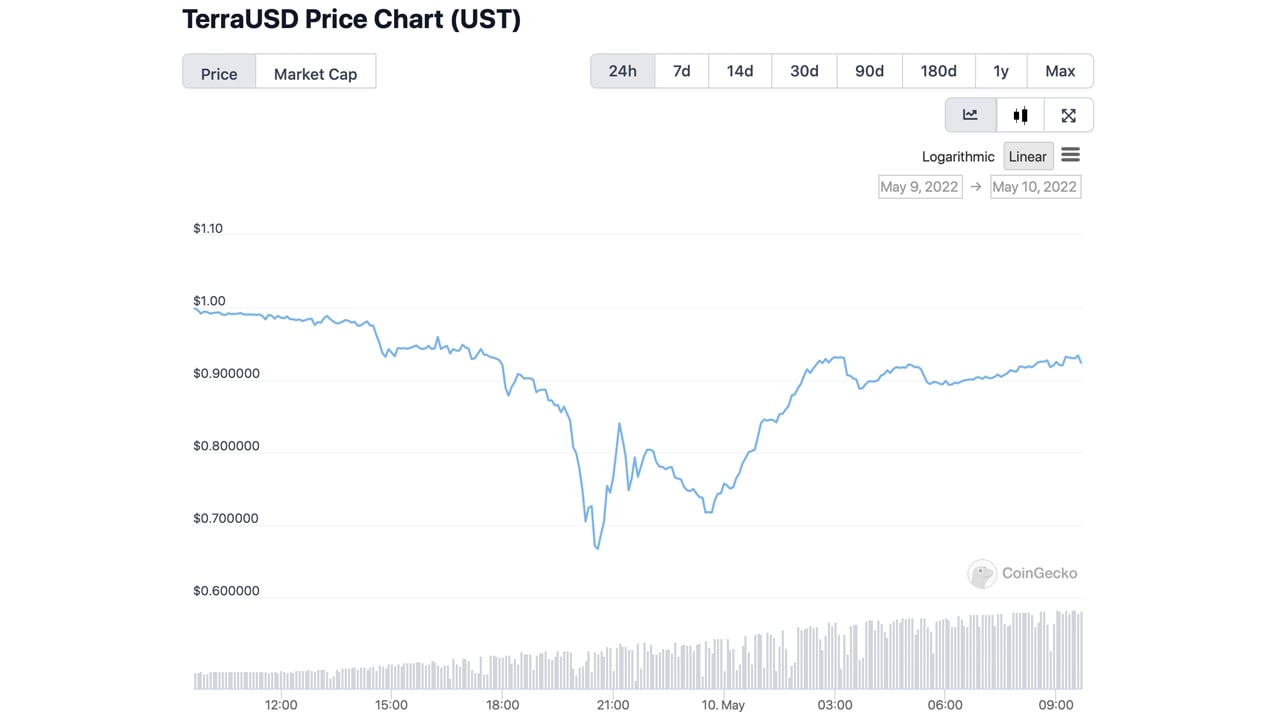

The stablecoin (UST) fell to $0.66 an unit on Monday, May 9th 2022 after losing parity with U.S. dollars. The topic of stablecoin is one that has been the center of crypto discussion for the last 24 hours. Many have speculated on its future and bet it will either fail or rebound. The stablecoin had climbed back up to $0.934 per piece by Tuesday morning at 9:15 AM (ET).

Rumors spread like wildfire as UST Stablecoin plunges to $0.66/unit

The Terra blockchain project has been suffering in recent times, as the network’s native asset LUNA has shed 43.6% against the U.S. dollar during the past 24 hours. Moreover, the stablecoin terrausd (UST) has also been dealing with intense pressure as the token’s value plummeted from $0.99 to a low of $0.66 per unit. UST was able to drop as low as $0.62 on some exchanges during extreme selling periods. Just before UST dipped $0.09 lower than the $1 peg, Terra’s co-founder Do Kwon told the public that the team was “deploying more capital.”

A-Team is currently being assembled.

— Terra (UST) 🌍 Powered by LUNA 🌕 (@terra_money) May 9, 2022

Luna Foundation Guards (LFG) empty the LFG Bitcoin wallet, which used to hold approximately 70.736.37 BTC. The wallet is now empty and there are no bitcoins in it. This is also true for LFG Gnosis safe addresses, which held $143million on May 3. The wallet today holds $135.58 in Ethereum and other small-value ERC20 tokens. LFG, Do Kwon and Do Kwon informed the public that $1.5 Billion in bitcoin and UST would have to be lent out to market makers on Monday. But the actual moves are not as transparent.

Despite the plunge in UST to $0.66/unit, many theories swirled about the crypto market. There has been claimsCitadel Financial Services, an international hedge fund and financial service company, was established in 1992. involved. Reports further claimBinance’s order books were halted due to the UST sale-off. Binance temporarily halted UST withdrawals and LUNA for a short period. Additionally, there’s been talk of well-known crypto funds bailing out Terra as well, by funneling billions back into the stablecoin’s ecosystem.

“There is a rumor spreading about Jump, Alameda, etc. providing another $2B to ‘bail out’ UST,” theblockcrypto head of research Larry Cermak tweetedTuesday evening. “Whether this rumor is true or not, it makes perfect sense for them to spread. The biggest question here is, even if they can get it to $1 by some miracle, the trust is irreversibly gone.”

Anchor TVL Drops 43% In One Day, as UST Rises to $0.93

Social media has been full of discussions about Terra losing their trust in UST and LUNA. “No matter how this ends, I don’t want people to call UST decentralized again,” the bitcoin advocate Hasu tweetedMonday. “Even the little collateral backing it has is intransparent and controlled by a single party. Use to execute discretionary open markets operations. This is like 10x worse than the Fed,” Hasu added.

😶 $UST stablecoin peg breaking…

The same applies to central banks trying to protect a currency peg. Once the market has cast a vote of no confidence, it is rare that your prop-up funds have enough assets to keep the dam from falling. pic.twitter.com/x3llQtABmv— Tuur Demeester (@TuurDemeester) May 9, 2022

Lyn Alden, an investor made a statement regarding the Terra catastrophe after it happened. she predicted it could happen last month. “Terra’s multi-billion-dollar algorithmic stablecoin UST blew up today,” Alden said. “Aside from destroying the value of LUNA, they used their bitcoin reserves to try to defend the peg, kind of like a flailing emerging market using its gold reserves to defend its FX.”

UST was able to recover from losses in the late trading hours and early trading on Tuesday morning. Terrausd (UST), which is currently at $0.934/unit, has seen a 6% drop in its $1 parity. Terra’s co-founder Do Kwon has not tweeted since saying the ‘A-team’ was deploying capital, even though the co-founder is very well-known for defending his project. LFG, however has not provided any updates to the public since it was launched. last tweet,It promised to provide further updates.

Take note of my words. Politicians will use the UST’s failure to control stablecoins to die and promote CBDCs as evidence.

It isn’t good.

— Dennis Porter (@Dennis_Porter_) May 10, 2022

In addition to the problems with LUNA’s and UST’s price, the decentralized finance (defi) lending protocol Anchor has shed 43.7% of its total value locked (TVL) during the past 24 hours. Anchor’s TVL is approximately $7.22 billion, with $95.08 million of Avalanche collateral. Anchor used to be the third largest defi protocol. It has now fallen down to sixth place.

People in tradfi making fun of UST… not realizing their stablecoin also depegged by 8% this year.

— Erik Voorhees (@ErikVoorhees) May 10, 2022

Many wonder what’s going to happen if UST regains its $1 parity with trust in the stablecoin so shaken. Many UST owners may be waiting in the $0.99 range or closer to it, hoping that they will cash out the stablecoin so they can move on. UST currently trades at $0.934141. An investment of 5,000 UST, however, would be equivalent to $4670.70.

What do you think about the Terra project’s issues and the recent UST de-pegging? Please comment below to let us know your thoughts on this topic.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.