The release of Ethereum 2.0 has piqued everyone’s curiosity in staking their current crypto holdings for a profit. But, it isn’t as simple as just depositing some coins, then watching your gains increase, or at least, not without third-party assistance.

Rocket Pool is a way for anyone to get involved in the creation of Ethereum.Without the need to setup and maintain a network. It allows new users to Ethereum 2.0 to be onboarded and also makes it possible for less technical users to take part in stakestaking.

Staking isn’t for everyone, especially considering that Ethereum’s slashing mechanism makes it easy to lose money for acting maliciously, even if it is unintentional. It seems that Staking pools, Rocket Pool, are the only viable option.

This guide will explain the Rocket Pool Ethereum decentralized staking protocol. It also explains how to buy Rocket Pool on CoinStats.

Let’s dive in!

What is a Pool?

Rocket Pool is a network decentralized nodes providing Ethereum 2.0 blockchain validation service. This network provides access to users with a minimum amount of ETH tokens and those without technical skills to run a node.

Instead of depositing 32 ETH minimum, investors may stake their capital with 16 ETH. Rocket Pool also automates this process and handles all validators, without any user involvement.

However, Ethereum investors can still stake tokens using Rocket Pool. Once staked, all assets are locked until Ethereum’s proof-of-stake implementation reaches Phase 2.

Rocket Pool can’t override the lockup but it does an adequate job at balancing risk via tokenized stake.

A stake of 16 or 32 Ethereum is awarded to the user with the token rETH. This token represents both stake and yield. As with any ERC-20 token, stakeholder can use rETH to unlock assets. They have the option of selling them, using it on DeFi platforms or keeping it in cold storage.

RPL Tokens and Tokenomics

RPL is an ERC-20 token that serves as the protocol’s primary token. Users who want to strengthen the project’s security can stake it on Rocket Pool nodes. However, it is not required to operate a node.

Rocket Pool users who have at least one validator and stake RPL earn an additional commission based on their security deposit. If the user does not perform node tasks or loses more than 32 ETH due to slashing his RPL deposit, the RPL will be lost in the proportion of the ETH losses.

RPL is limited to 18 million tokens. 16 million are in circulation. According to CoinStats, the asset’s market cap is $496.8 million at a price of $31.08 per token at the time of writing.

The coin has speculative value as well, as investors bet on the project’s future success as a prominent ETH2 staking platform. RPL has increased from $0.4 to 2.81 by 2020. RPL’s value soared to an all-time record $58.40 in 2021.

How to Purchase Rocket Pool With CoinStats

CoinStats users can purchase crypto tokens by using its built-in Swap tool. CoinStats offers the highest swap rate because it combines all its decentralized exchange aggregaters (1inch to 0x), etc.).

Let’s take a look at How to Buy Rocket Pool to ETH on CoinStats

Step 1: Connect your wallet

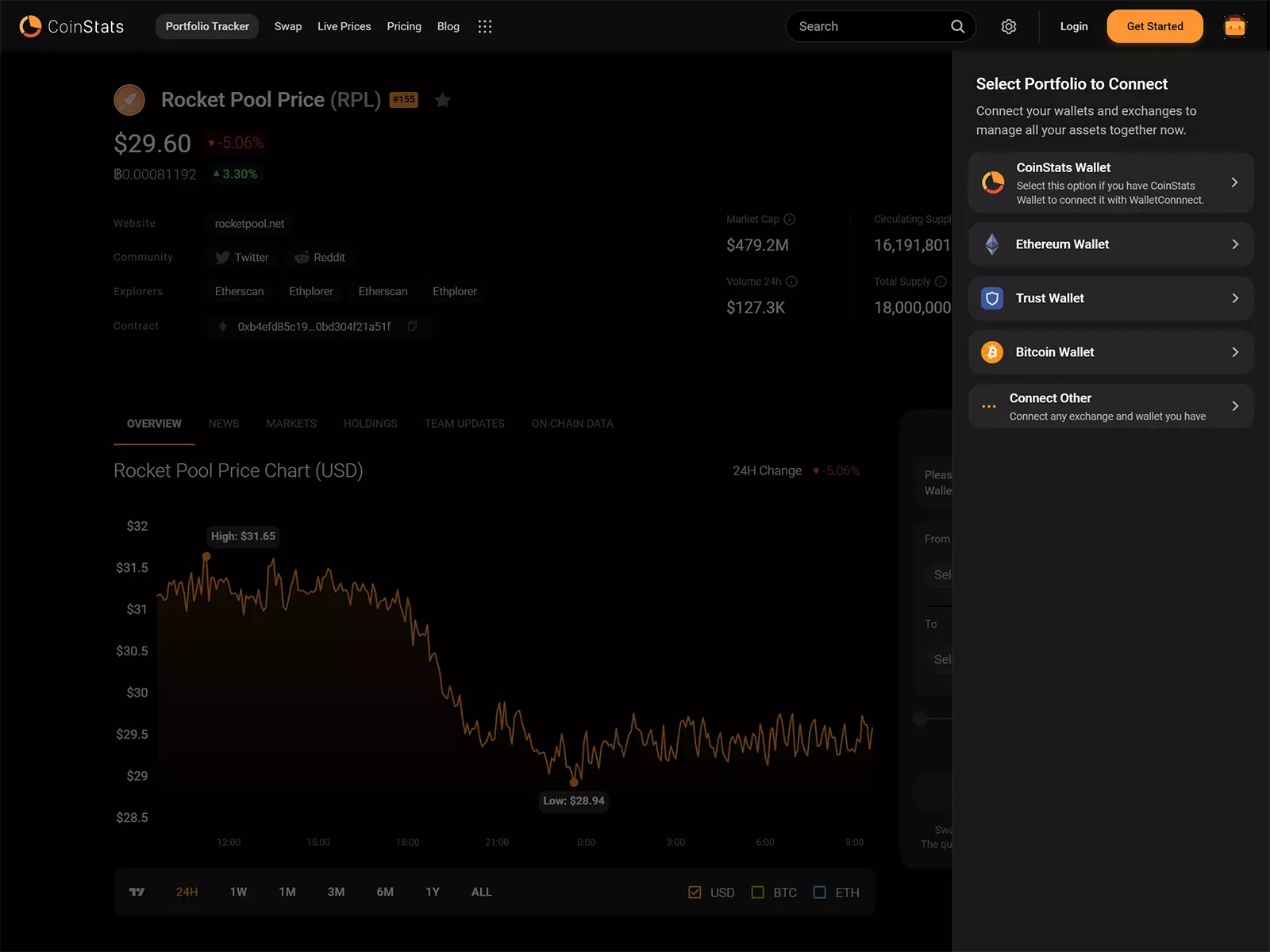

Search for RPL Price on coinstats.app. Scroll down to the “swap” features and connect the wallet in which you have the RPL token.

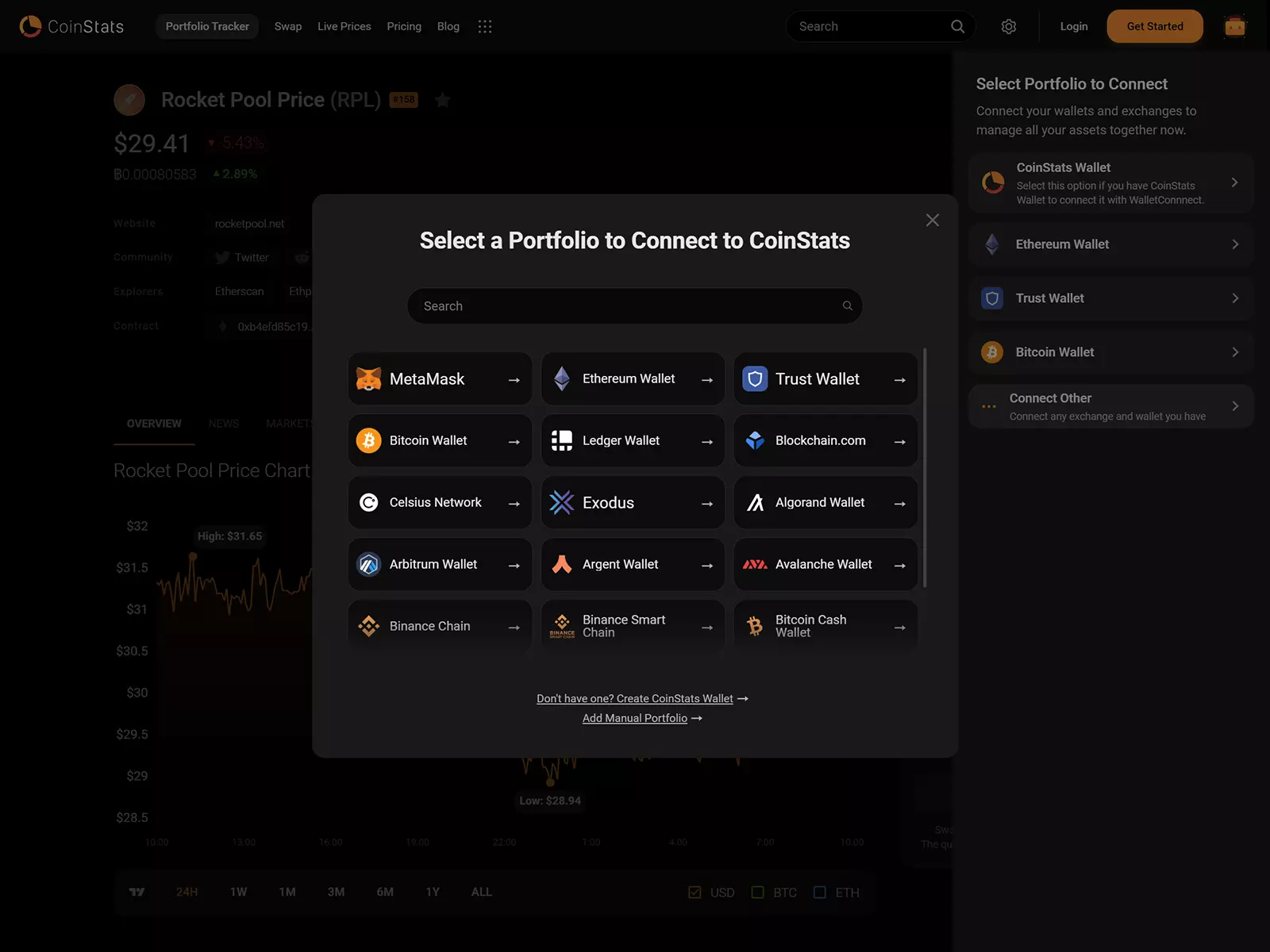

Once you click on the “Connect” button, you will be able to see various wallet choices offered by CoinStats. Find your wallet and then connect it.

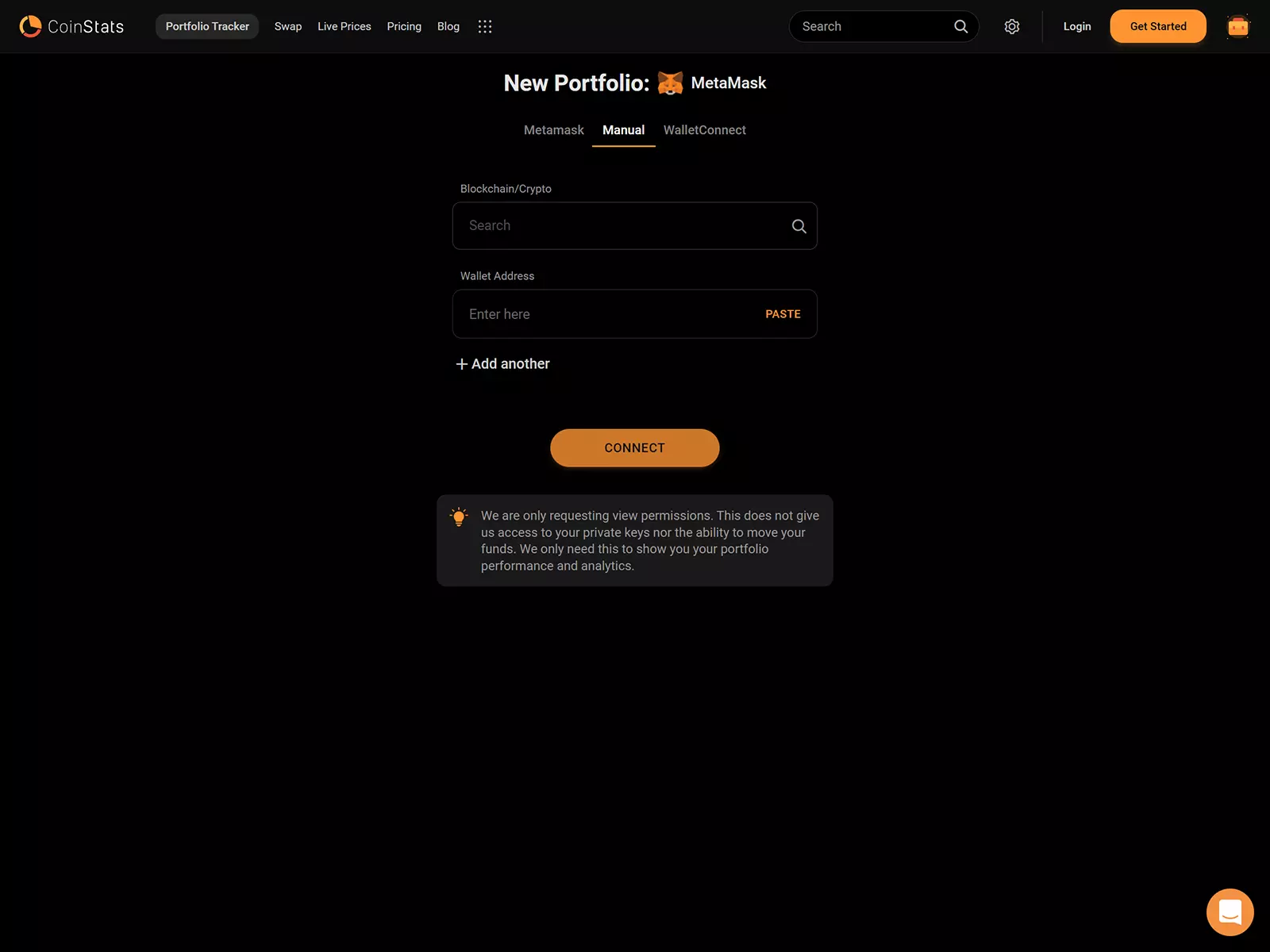

It is possible to connect by scanning the QR code via WalletConnect, or manually entering the Blockchain/Crypto address and Wallet address into your mobile or web application.

Step #2: Pick a Token

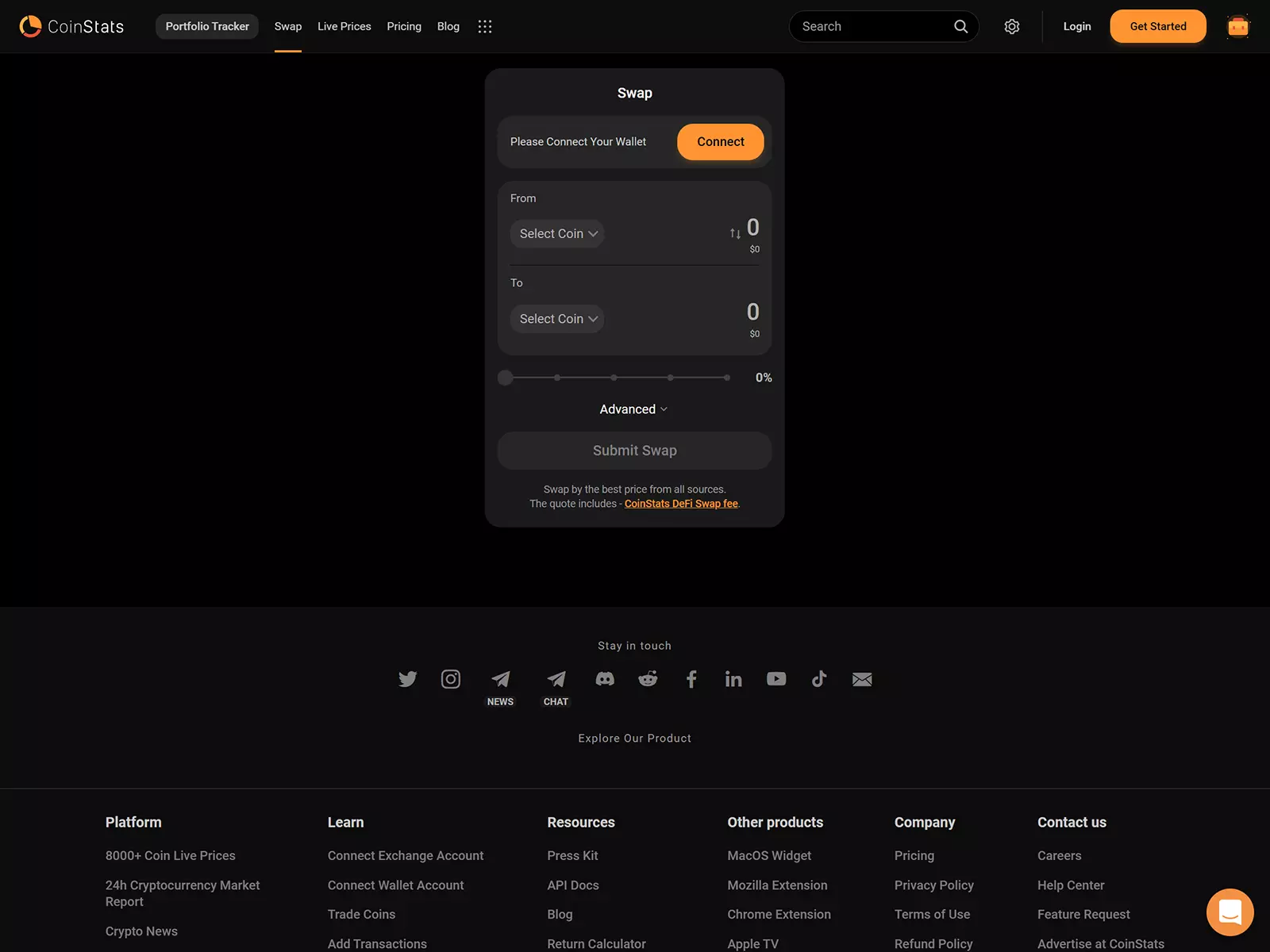

Once your wallet is successfully connected, you can choose which token you want to exchange by giving the information in USD/EUR or cryptocurrencies.

We are, for example, swapping RPL to ETH.

In the “From” field select the RPL token from your wallet, and in the “To” field, select “ETH”.

Step 3: Click on Swap

To change slippage or gas settings, click on Advanced Options. When you’re finished with customizing, scroll down to the bottom of your screen and click the “Submit Swap” button.

After you’ve submitted your swap request, you’ll be prompted to confirm it. To begin the swap, review the information appearing on your web or mobile app screen, and click the “Confirm” button.

The transaction has been processed. Your gas parameters will determine the pace at which your transaction is processed. You can trace your transaction from the loader appearing at the bottom right corner or from the wallet’s home page.

NOTE:Network Transaction Fees, also called gas fees, will be assessed to your account. The transaction fee charged by Blockchain to execute a transaction is known as Network Transaction Fees. Gas fees can be described as being paid in the currency native to the network (i.e. Ethereum to pay for gas fees. CoinStats may also charge a swap fee, in addition to gas fees.

Closing Thoughts

This year, Ethereum is seeing a resurgence as institutions who have finished amassing Bitcoin are now turning their focus to the blockchain industry’s greatest smart contract ecosystem. Grayscale, along with other companies may buy ETH bulk to speculate but we know that investors will opt for staking as a way of diversifying their investments.

Staking pools remain the best option for people who don’t have any technical knowledge about blockchain and computers. Rocket Pool makes it easy to help the Ethereum 2.0 network. You can deposit assets or delegate control to an operator through Rocket Pool. What’s the best thing about Rocket Pool? You don’t even need 32 ETH to join a mini-pool, 16 ETH is more than enough!

Rocket Pool is a great option for ETH2 holders, offering both lower requirements and quicker rewards. Now you can begin to stake your token without needing infrastructure, incentives, or commissions.

To learn more about cryptocurrency exchanges and portfolio trackers as well as wallets and tokens you can visit the CoinStats Blog. You also have access to our detailed buying guides for various cryptocurrencies such as How do I Buy NEXO? What is DeFi?, How do I Buy cryptocurrency.

Our Investment Advice:This website contains information that is intended to be informative. It does not recommend you to purchase, sell or hold any financial products or instruments. Information on this website is not based on any financial institution. It may be different from information you get from service providers.

Market risk can include the loss of principal. Because cryptocurrency can fluctuate and is sensitive to secondary activities, it’s important to do independent research and seek advice. You should never invest more than what you can afford. CFD trading, stock trading, and cryptocurrency trading can present significant risk. CFD trading can cause losses of between 74 and 9% in retail investor accounts. It is important to consider all aspects of your financial situation before you make any investments. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant regulators’ websites before making any decision.