Reports claim that Amazon recently made an investment in Dibbs, a marketplace for fractional trading cards. Built on the Wax blockchain platform, this platform allows you to buy and sell small amounts of collectible trading card. Reports further add that the financial terms of Amazon’s backing of Dibbs have not been disclosed.

Amazon Enters the Digital Collectibles Space, According to Reports

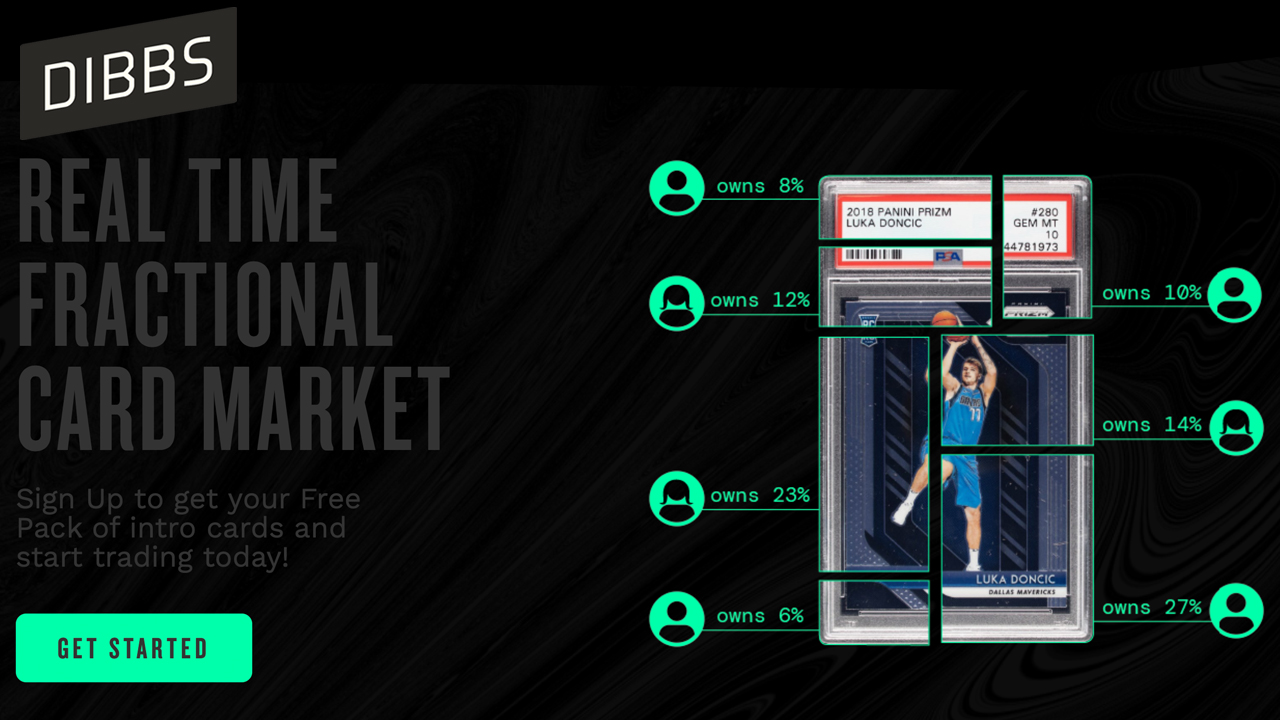

The rise of digital collectibles and non-fungible token assets (NFT) has been a big deal in 2021. It seems like everyone is interested in a share of this billion-dollar market. Recent reports revealed that Amazon invested in Dibbs, a trading-card platform. “We’re thrilled to announce that Amazon entered the collectibles space by investing in [Dibbs.io],” the official Wax blockchain Twitter account tweeted on December 8. “[Dibbs] is a real-time fractional card market using Wax vIRL NFT technology.”

Dibbs began in 2020. It allows users to list their collectible trading cards, mint them into NFTs and then fractionalize the NFTs. While Amazon’s investment has not been publicized, the startup raised $16 million in a Series A funding round in July. DeAndre Hopkins and Chris Paul were Series A Dibb investors. Kris Bryant was among them. Skylar Diggles-Smith also participated. Foundry Group, Tusk Venture Partners also supported the Series A July.

The company has formally introduced a marketplace called “Sell with Dibbs” which allows owners to sell their collectibles and price and fractionalize pieces as well. Evan Vandenberg is the founder of Dibbs and its chief executive. He explains that NFTs as well as digital collectibles have made it more accessible. “For too long, the collectibles market has been riddled with barriers to entry that render it inaccessible and inequitable,” Vandenberg said in a statement this past week. Vandenberg added that:

Traditional ownership is limited by the new metaverse. Moving these collectibles, which genuinely represent an individual’s online persona, into the digital domain is essential for the future of ownership and identity.

In 2021, Dibbs will be a big deal with other types of digital collectibles and fractionalized collectors

Dibbs’ CEO noted that his startup does not only concentrate on cards, and that the company is looking at other opportunities. “Cards are one thing that we do, but it’s one thing,” Vandenberg remarked. “This can be so much bigger than cards.” Besides the Dibbs concept, fractionalizing NFTs has become a significant trend that is seeing exponential growth. Platforms like Otis and Fractional are leading the charge in blockchain projects that use fractionalized NFTs.

Along with the Doge NFT, cryptopunk collectibles were also fractionalized. The Ross Ulbricht Genesis NFT Collection, which raised more than $6 million last week at an auction, was sold. Now the collection is being broken down and divided among decentralized autonomous organizations (DAO).

Do you have any thoughts about Amazon investing in the NFT fractional trading platform for NFT cards built on top the Wax blockchain, Dibbs. Please comment below to let us know your thoughts on this topic.

Images CreditShutterstock. Pixabay. Wiki Commons. Dibbs. Amazon.

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.