There are pros

- Lower trading fees than on other exchanges

- PancakeSwap members can redeem a number of Non-Fungible Tokens.

- The yields of other exchanges are higher, with yields ranging from 23.52% up to 3788%.

- PancakeSwap offers lottery entry with a prize of 50% from the pool

- For contributing to the exchange’s liquidity, users are highly compensated

- PancakeSwap offers the possibility to trade several BEP20 tokens

- Ability to design your projects with the BSC Community

Cons

- This is not the right place for beginners

- BSC Process is complicated and no native wallet

- It is a complicated process of staking.

PancakeSwap (decentralized exchange) is very popular on Binance Smart Chain. It employs an automated marketplace maker mechanism that facilitates the BEP-20 token trades.

PancakeSwap was launched in 2020 to be a cheaper and more efficient automated market maker (AMM). PancakeSwap Exchange was originally a fork from Uniswap’s Binance Smart Chain. However, it is now much more popular than Uniswap.

PancakeSwap’s daily transaction volume has topped $100 million, making it one of the most popular DApps ever. Furthermore, in less than a year, it has also eclipsed Binance’s own Binance DEX, becoming the most popular DEX on Binance Smart Chain (BSC). What is it that makes PancakeSwap Exchange unique? And what accounts for its incredible success?

You can read our PancakeSwap Review to discover everything you need about PancakeSwap Exchange. We will cover its key features as well the fees and security.

Let’s jump right in!

What is PancakeSwap?

PancakeSwapBinance Smart Chain’s decentralized exchange (DEX), which uses an automated marketmaker mechanism to allow token swaps, is available. A group of unidentified developers released it in September 2020. PancakeSwap also allows anyone to list tokens on an open DEX.

PancakeSwap provides its users with a wide range of features like token swaps, liquidity provision & farming, perpetual trading, staking, lottery, NFT marketplace, launchpad, etc.

It’s one of the few DEXs that provides users access to a range of financial products in a single interface, offering a well-rounded DeFi experience, typically seen in centralized exchanges that work with large operational teams and financing.

DeFi Tracking Platform Defi LlamaPancakeSwap has now become the most popular DEX and DeFi platform (by TVL), with $3.05 Billion in assets. PancakeSwap features its own governance token, ‘CAKE,’ which enables its users to vote on proposals and is often given to liquidity providers and stakeholders as a reward.

CAKE Token

CAKE is PancakeSwap’s native governance token, as well as its rewards and utility token. CAKE holders have the ability to vote on governance, access IFOs, make lottery ticket purchases, and get rebates for trading fees.

CAKE’s current total supply is 315,268,578, with a maximum supply of 750,000,000. CAKE currently holds a market capitalization of $481.8 Million and an emission rate 13.75 CAKE/block.

The Key Features of PancakeSwap

PancakeSwap’s key features are:

- CAKE, PancakeSwap’s native token, is a BEP20 token built on BSC.

- You will experience faster transactions and lower fees on Ethereum-based Decentralised Financing (DeFi).

- It’s an Automated Market Maker, similar to ERC20-based platforms such as SushiSwap and Uniswap.

- This software allows users to trade digital assets with a range of liquidity pools and also collect yields.

- This allows users to loan their digital assets in exchange for liquidity tokens. Users then can stake liquidity tokens to get even more digital assets.

- Users can trade additional BEP20 tokens and use cryptocurrencies to increase liquidity in exchange pools. This allows them to make extra tokens.

- Users can use the SYRUP liquidity to get the native token and earn CAKE tokens, as well as other tokens based the BSC like DODO or UST.

- “Know Your Client” (KYC) and/or Anti-Money Laundering (AML) aren’t required.

- CertiK has verified PancakeSwap and audited it to confirm its security and legitimacy.

- You get a reward of 40 CAKE for each block. But, you can burn 15 CAKE to increase the value.

Binance Bridge

ERC-20 tokens can be traded on PancakeSwap if wrapped on the Binance Bridge. Once they are wrapped, convert them into BEP-20. Your digital wallet can be connected to the Binance Bridge. To receive some Ether called gas fees, your transaction must be validated on Ethereum.

While the high Ethereum gas fees may make this expensive, once you’ve wrapped and bridged your crypto assets to BSC, PancakeSwap’s low fees will save you a lot of trading expenses. After you’ve finished your transactions on PancakeSwap, just use Binance Bridge to transfer your BEP-20 assets back to ERC-20. This bridge allows you to use BSC for tokens such as ApeCoin.

PancakeSwap Exchange: Products and Services

PancakeSwap has been holding on to the status of “largest DEX on the BSC chain” for so long because of its capacity to offer a wide range of financial products and services through a single interface. Its development team has made a lot of these things possible. PancakeSwap’s services have been extended from simple token swaps into an on-chain derivatives marketplace in under two years.

Below is a complete list of the current services offered by this company:

- Spot trading

- Trade Perpetual Futures

- Yield Farming

- IFO – Initial Farm Offering

- Prediction market

- Lottery

- Syrup Pools (Staking).

- NFTs

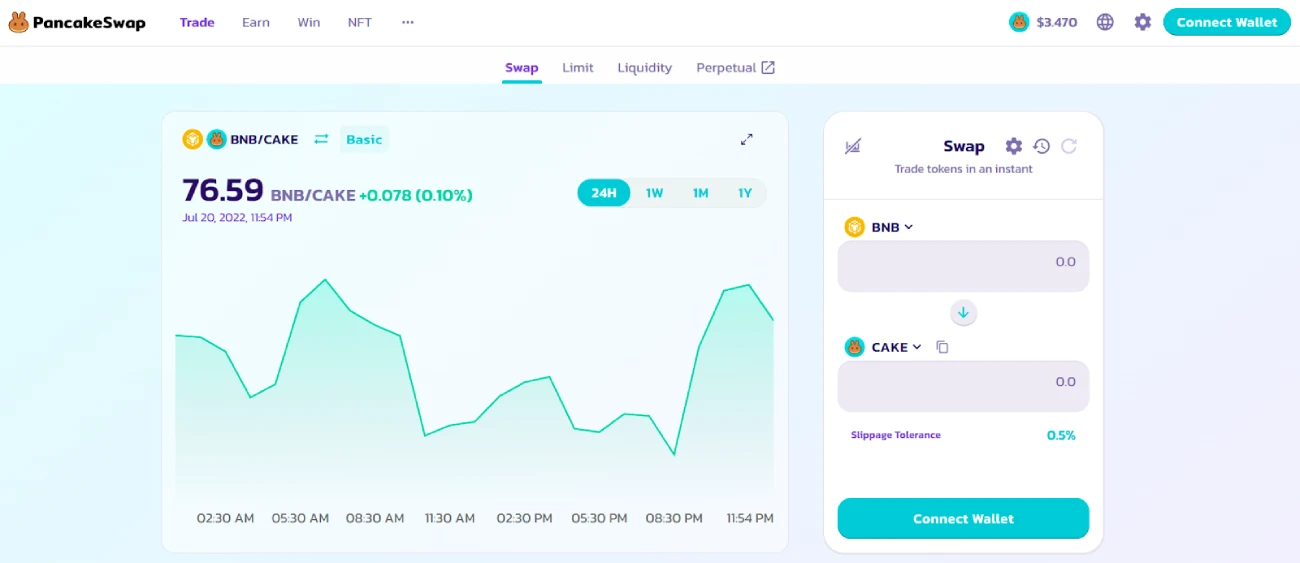

Spot Trading with PancakeSwap

Spot tradingPancakeSwap works by using an automated market maker (AMM), to swap assets within a liquidity pool. AMM swaps occur often live and are determined by the proportion of assets within the pool. The price will be set by this ratio. However, users do not have any control over how much they purchase or sell assets.

PancakeSwap provides a solution by allowing its users to place pre-set orders through the interface’s limit order function. Contrary to centralized exchanges this doesn’t mean that one order can be matched against the other. The AMM will execute a swap in its liquidity pool once it meets the price target.

However, remember that PancakeSwap doesn’t accept limit orders for tokens with a fee/tax on the ‘transfer’ of tokens. If users cancel or execute limit orders, they will remain open for as long as the order is not cancelled. The functionality of a configurable expiration date is coming soon.

PancakeSwap uses the BSC network to facilitate transactions that are considerably faster than those on Ethereum. Use the PancakeSwap V2 Swap to complete swaps. The previous version, V1, is less prone to slippage which can lead to financial loss.

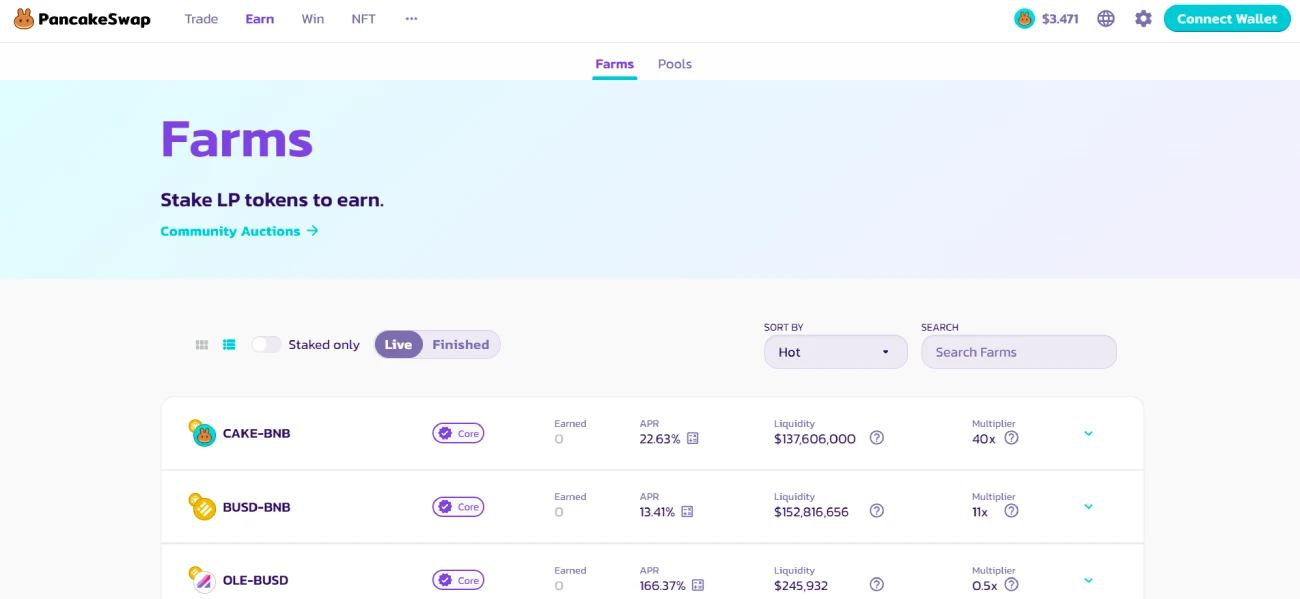

PancakeSwap Yield Agriculture

Users can farm rewards in the form of CAKE tokens by supplying liquidity to PancakeSwap’s Liquidity Pools. PancakeSwap has several yield farms. To obtain the tokens for that specific farm, you must stake 2 tokens. PancakeSwap each farm has its yield rate and multiplier. Make sure you know the farm that you are interested in before you start supplying liquidity. CAKEBNB Farm has a 40x multiplier. This means it gets 40 CAKE every block that is produced.

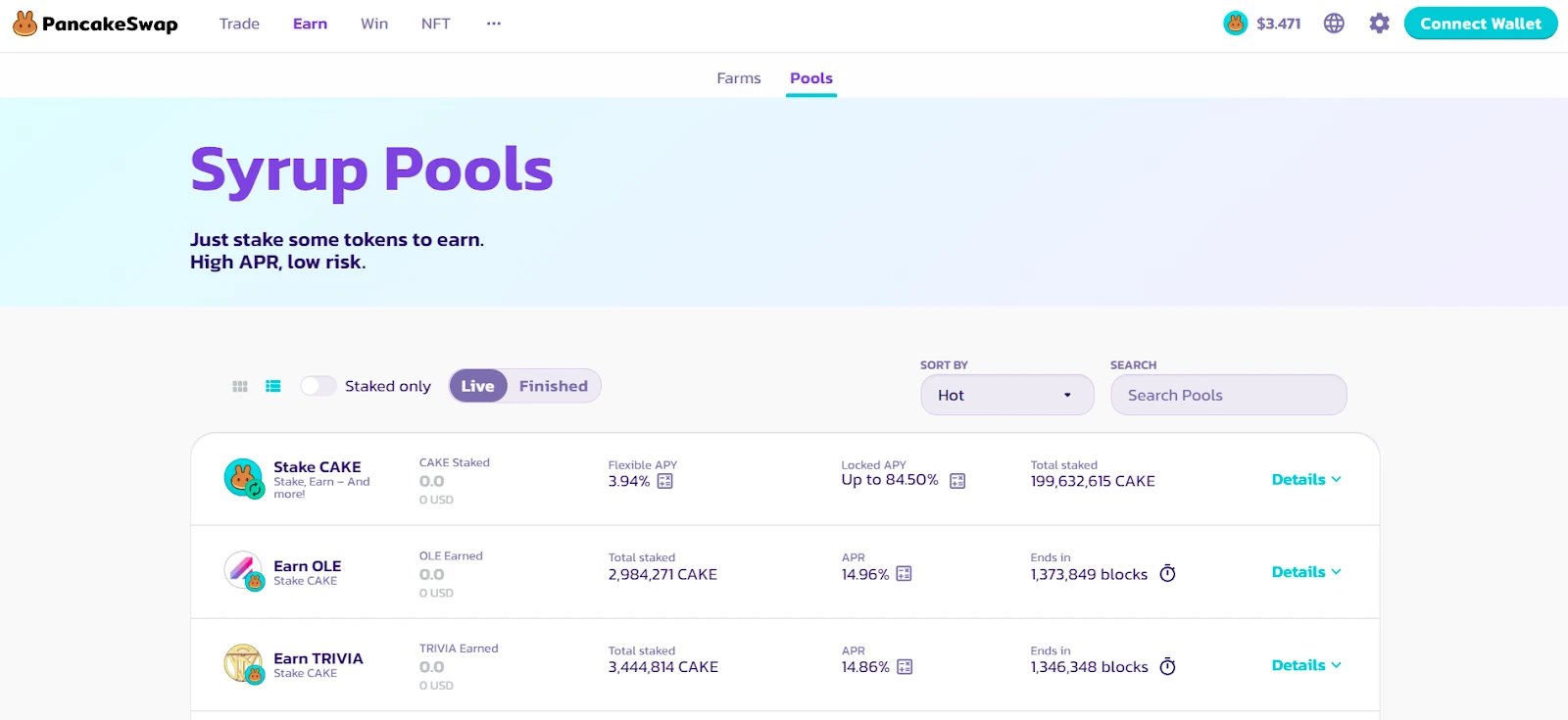

PancakeSwap Syrup Pools – Staking

Syrup Pools enable users to stake CAKE in order to receive CAKE tokens or other rewards. CAKE Syrup Pool lets users choose between locking and flexible stakes. Although the locked option has a higher APY, it requires that tokens be kept secure for a certain period. You can withdraw your tokens whenever you like with the flexible staking option, which has a lower rate of APY.

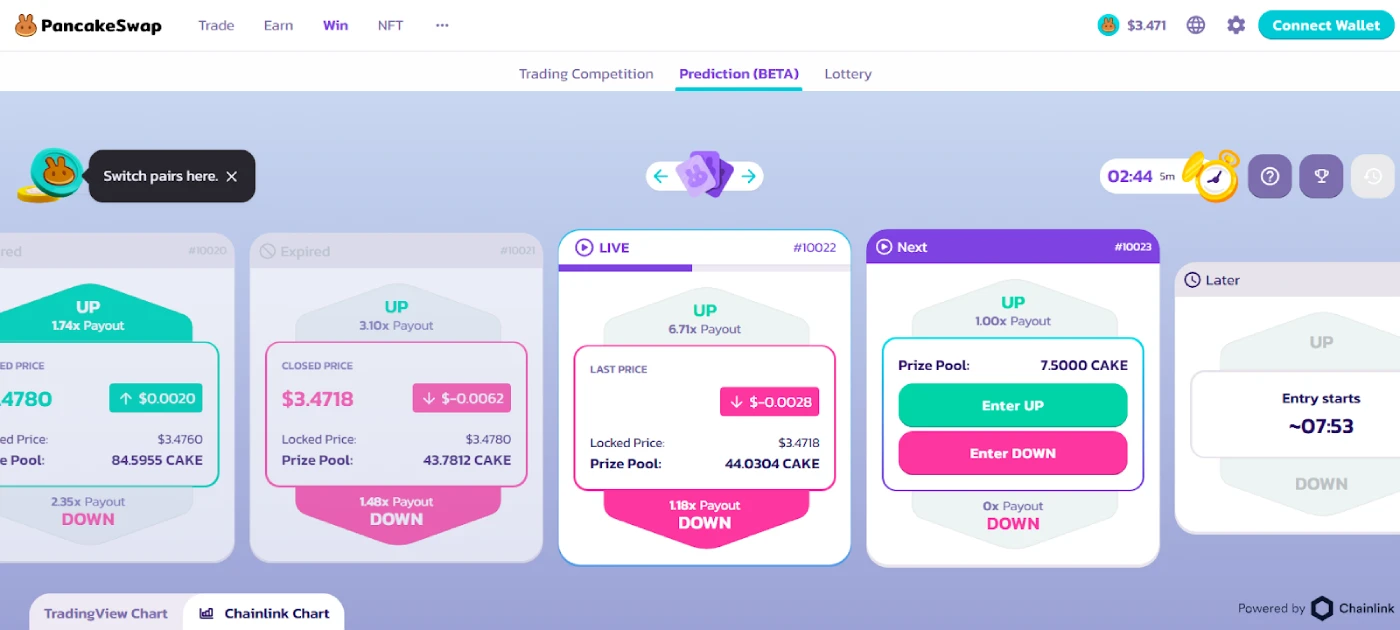

PancakeSwap Prediction Market

PancakeSwap’s prediction market lets users earn tokens by correctly predicting the price movement of BNB-USD or CAKE-USD pairs. The price of a PancakeSwap product can be predicted by users. BNBCAKE or CAKE will change in five minutes.

These results will be counted and rewards distributed according to the final price at round’s end.

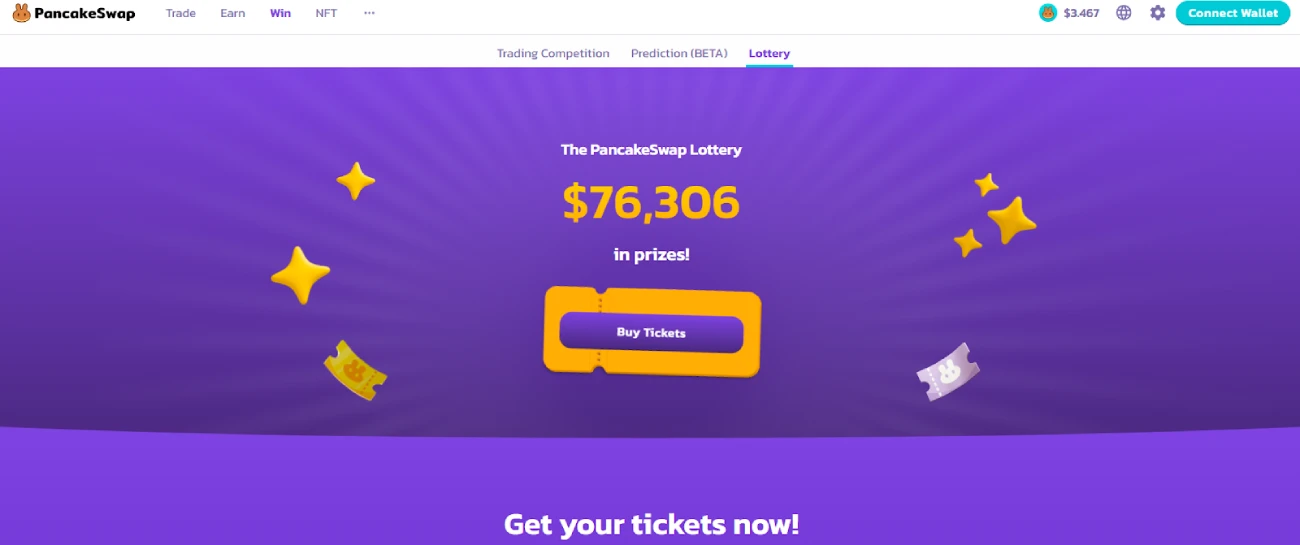

PancakeSwap Lottery

PancakeSwap Lottery lottery tickets can be purchased. Each ticket is unique and contains a 6-digit combination. A random six-digit combination is generated at the end of each lottery session, which lasts between 12 – 36 hours.

To win, users must possess tickets matching the winning combination left to right. Your payout will be higher if your numbers are closer to the winning combination.

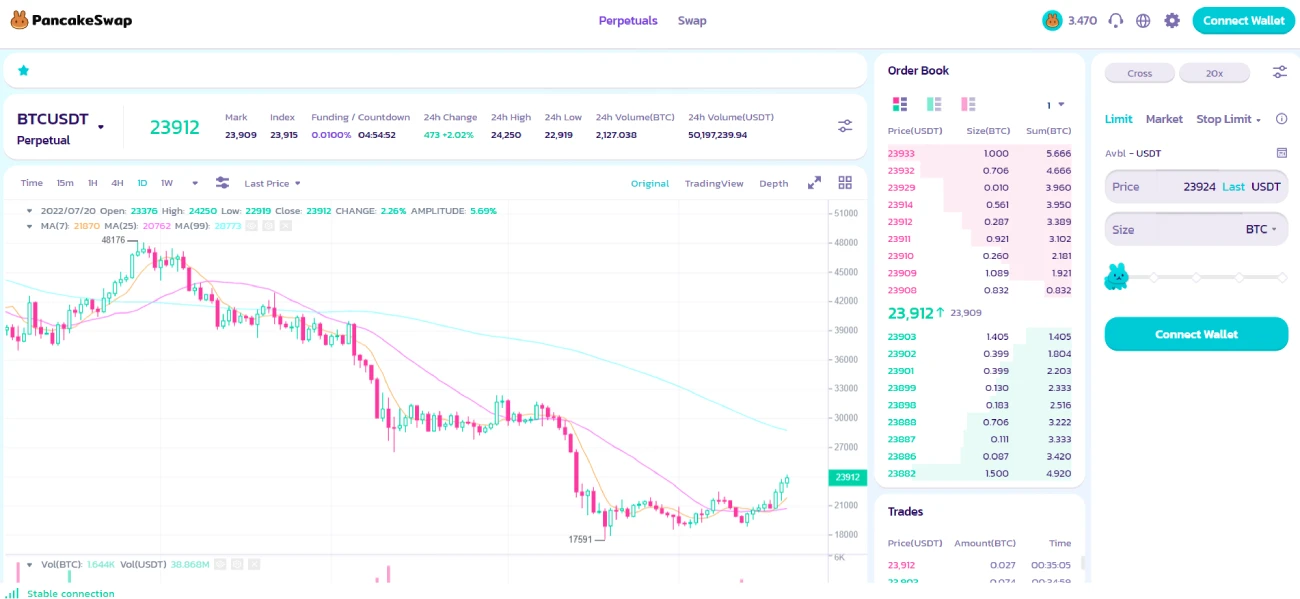

PancakeSwap’s Perpetual Futures Trading

PancakeSwap is partnering with ApolloX Finance in order to make it possible for customers to trade perpetual options contracts via its interface. With off-chain ordering book matching and settlement, the trading infrastructure allows customers to trade perpetual futures contracts using their interface. The system also provides critical features, including limit orders, stop orders, post-only and other order types. All of this while protecting privacy and security for a DEX. I.e., it doesn’t require KYC or use intermediaries when engaging with smart contracts.

PancakeSwap Initial Farm Offerings (IFO)

PancakeSwap has introduced an innovative Initial Coin Offering (ICO), called the Initial Farm Offering. Users must create a “profile” on PancakeSwap to participate in an IFO. The IFO pool will allow users to commit CAKE tokens for the purchase of the token. A user’s iCAKE number determines how many CAKE tokens they can invest. iCAKE can be used to determine how much CAKE you have staked in fixed-term CAKE staking pools. It also calculates the duration of your fixed-term CAKE position.

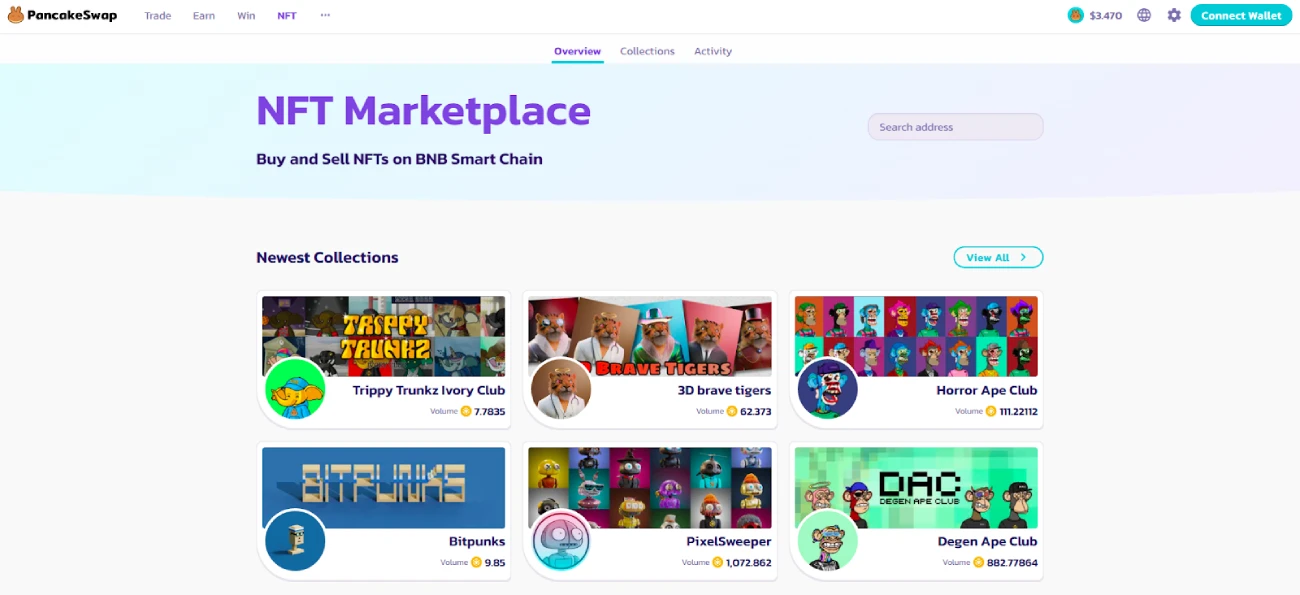

PancakeSwap’s NFTs and NFT Marketplace

PancakeSwap keeps up with the rest by creating its own NFT collection and giving users the ability to make personalized profiles by linking to NFTs. PancakeSwap has its own NFT marketplace to trade white-listed NFT collection.

The best way to win NFTs is through trading teams, in which traders are competing for the most trading volume during a time period. Or, you can use PancakeSwap airdrops events.

PancakeSwap Farming and Staking

PancakeSwap Liquidity pools are funded with users’ deposits, and in exchange for their contributions, users get Liquidity Provider (LP) tokens, also known as FLIP tokens. This token can be used by users to claim their share as well as a part of trading fees.

PancakeSwap lets users farm CAKE or SYRUP tokens. For CAKE, you can deposit your LP tokens to the farm. The CAKE tokens may then be staked for SYRUP which can be used to purchase tickets in various lotteries.

Holders of CAKE are granted a set amount of CAKE per block. Users can also stake CAKE to receive incentives. CAKE can be distributed to network liquidity providers as BEP20 tokens. Users may also earn 170 percent in APY for staking CAKE within the pool. To stake CAKE on an exchange, users will need either a Metamask wallet (or a Binance chain Wallet) with CAKE or (Binance Coin/BNB).

Follow these steps to get started in staking

- Go to the PancakeSwap website under “Finance” and click the “Connect” button in the upper righthand corner of the homepage.

- Users can choose “Connect” or “Binance Chain Wallet,” which will open the wallet.

- The user can choose “Pools” from the left-hand menu to see a list of active pools ready to accept a stake, such as the CAKE Pool.

- After identifying the pool, the user can click “Approve CAKE,” which will access the user’s wallet.

- The user can then click “Confirm” and wait for the transaction to be confirmed on the blockchain, which takes around 3 seconds.

- The pool’s format has changed, and the user can now select the “+” option on the CAKE Pool. Users may now input the amount they want to stake and click “Confirm.”

- The user’s wallet will appear, allowing them to verify the transaction details before clicking “Confirm,” which will take a few seconds to approve on the blockchain.

- Once completed, the user’s stake and CAKE balance will be updated. From here, the user may “Harvest” to claim their CAKE rewards or “Compound” to reinvest them by choosing the corresponding option offered.

PancakeSwap Fees

PancakeSwap has lower fees than other DEXs, which may lead to users being tempted. You’ll be charged a 0.25% trading fee for swapping a token on PancakeSwap. Surprisingly, most trading fees are refunded to liquidity providers to encourage them to provide liquidity on PancakeSwap.

This is the way that the transaction fee of 0.25% will be paid:

Sent to the PancakeSwap Treasury – 0.03%

CAKE buyback and burn – 0.05%

Return to Liquidity Pools as an incentive for liquidity providers – 0.17%

Also, remember that certain tokens may have a “tax” on transfers or sales of the token, in addition to the fees mentioned above.

The Perpetual Futures Market Fees

PancakeSwap’s perpetual futures market employs an off-chain order book and an on-chain settlement method, meaning that users must pay “maker” and “taker” fees. Fees for trading are 0.022% for makers and 0.077% for takers. CAKE will be the default payment method for fees, followed by APX (ApolloX’s token) and USDT. CAKE traders will be able to receive a reduction of 5%, which is equivalent to 0.019% and 0.0665% in takers.

The PancakeSwap Withdrawals and Deposits

PancakeSwap platform exclusively accepts deposits and withdrawals from users who want to utilize PancakeSwap’s perpetual futures trading product. When you deposit funds, you grant the protocol permission for them to use your money as collateral for margin transactions. You can forfeit this collateral if your positions are not closed or repaid by the protocol before specified price levels.

At the moment, deposit are not accepted outside of USDT, BUSDOr, APX CAKE. You can withdraw funds by closing any active trades, and clicking the withdraw option in the assets tab.

PancakeSwap Supported Wallets

PancakeSwap’s users can choose from a wide range of options Options available for walletsThere are many options available, such as MetaMaskWalletConnect (MathWallet), WalletConnect (TokenPocket), and Trust in your wallet. MetaMask can be used to store BEP-20 assets.

PancakeSwap can be connected to many other crypto markets, so you have the option of choosing from a variety of wallets.

PancakeSwap Security

PancakeSwap, an open-source project, has been subject to many security audits by Certik and Peckshield. Official documentation shows that there were 9 security audits.

PancakeSwap uses multisignature to sign all contracts, and has a time lock option. Furthermore, for maximum transparency, the majority of PancakeSwap’s code is publicly available, and all of their contracts are checked on BscScan.

Mobile Apps

PancakeSwap doesn’t have a mobile app. You can instead access PancakeSwap’s mobile ecosystem by downloading multiple Android and iOS apps. Apps supported by PancakeSwap include Trust Wallet and WalletConnect.

PancakeSwap Customer Service

PancakeSwap doesn’t officially provide customer support for you to get in touch with. Users can access the troubleshooting page on the PancakeSwap website, which covers typical issues such as “price impact is too large” or “PancakeSwap router has expired,” as well as workarounds and an explanation of why they occurred.

Although there’s no customer support, you can get help from the community via the various chat rooms available on Telegram or Discord. We found PancakeSwap’s Telegram more entertaining and responsive than its Discord Channel. However, be aware that you’ll be bombarded with ‘support lines’ and ‘customer service’ scammers claiming to be able to assist you with your problem. DO NOT ENTER INTO THESE CHATS. It is possible to modify your privacy settings so that these calls are blocked.

ApolloX offers a ‘support ticket system’ for PancakeSwap’s perpetual futures market users to ensure they always get prompt support.

Questions

1. PancakeSwap: Is it legit?

Yes, PancakeSwap has undergone an audit by CertiK, demonstrating that it’s a trustworthy exchange. Your funds won’t be at risk of being stolen by hackers if a breach occurs because the exchange doesn’t hold any of your assets.

2. How Cryptocurrencies can be traded

PancakeSwap makes it possible to exchange a variety of cryptocurrency, such as Elongate. Kabosu. USDT. Doge/Dogecoin. Ethereum. Zilliqa. Safemoon. As long as the cryptocurrency exists as a Binance Smart Chain token, it’s available on PancakeSwap.

3. What is Slippage Tolerance in PancakeSwap Exchange?

Slippage tolerance is the difference in the anticipated price for a trade and the actual price at which it is completed (what you see), is the amount of uncertainty. This occurs because trading is not immediate, and an asset’s price might vary during the processing of a transaction. You can specify the slippage tolerance to protect you against getting less than what you want for your swap.

4. PancakeSwap Is Better Than UniSwap

It is difficult to answer this question. Both PancakeSwap (and Uniswap) are excellent cryptocurrency exchanges. However, they work on separate networks. PancakeSwap offers the best option for holders of BEP-20 tokens who wish to use Binance Smart Chain. Uniswap may be the best option if you wish to limit your Ethereum activity to only the Ethereum blockchain.

PancakeSwap Review: Our Verdict

PancakeSwap, a DEX with a great design, offers many ways to earn money via tokens, farms and pools. It’s a safe and reliable exchange, audited by CertiK and enabling users to profit from the turbulent cryptocurrency market. PancakeSwap does not offer customer support, but there are many social media channels where you can reach the community or team.

If you’re looking for detailed steps to buy CAKE tokens, you can check out our guide on PancakeSwap: How do I buy it?.

Our website is also available. CoinStats blogLearn more about wallets portfolio trackersLearn more about tokens and cryptocurrencies, as well as our comprehensive reviews of different cryptocurrency exchanges. BKEX, Make a change today, Bybit, Crypto.com, BitMEX, FinexBox, Binance, WazirX, etc.

You want to dig even deeper? Explore our articles to learn more about the roots of blockchain technology and decentralized financing. What is DeFi?, How to Purchase CryptocurrencyYou can find out more.

Information about InvestmentsInformation on this site is for informational purposes only. CoinStats does not endorse any recommendation to sell, buy or hold securities or financial products or instruments. This information does NOT constitute financial advice or investment advice.

Because cryptocurrency can fluctuate so much, you should do independent research and seek your own advice. Only invest in what you can afford. Trading stocks and CFDs can be risky. CFD trading can cause losses of between 74-89% in retail investor accounts. It is important to consider all aspects of your financial situation before you make any investments. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant regulators’ websites before making any decision.