Bitcoin was created in 2009 because of the lack of trust in the financial system, and centralized control of money. While most cryptocurrency enthusiasts believe it could one day replace physical cash, Bitcoin’s key characteristic is its volatility. Bitcoin’s volatility is well-known. It has seen a significant increase in its value ever since 2009, when it was introduced to the cryptocurrency market.

Since then, investors have been looking for ways to understand Bitcoin’s volatility and use this information as an indicator of its future prices. While it’s practically impossible to rely on a scientifically proven method for buying or selling Bitcoin, there are several ways to understand its volatility better and make well-informed investing decisions.

A Bitcoin Rainbow Chart is a method that can be used to accurately measure changes in market data and volatility. It also helps you make trade decisions. In this article, we’ll tell you what Bitcoin Rainbow Charts are and how to use them to your advantage.

A Bitcoin Rainbow Chart: What is it?

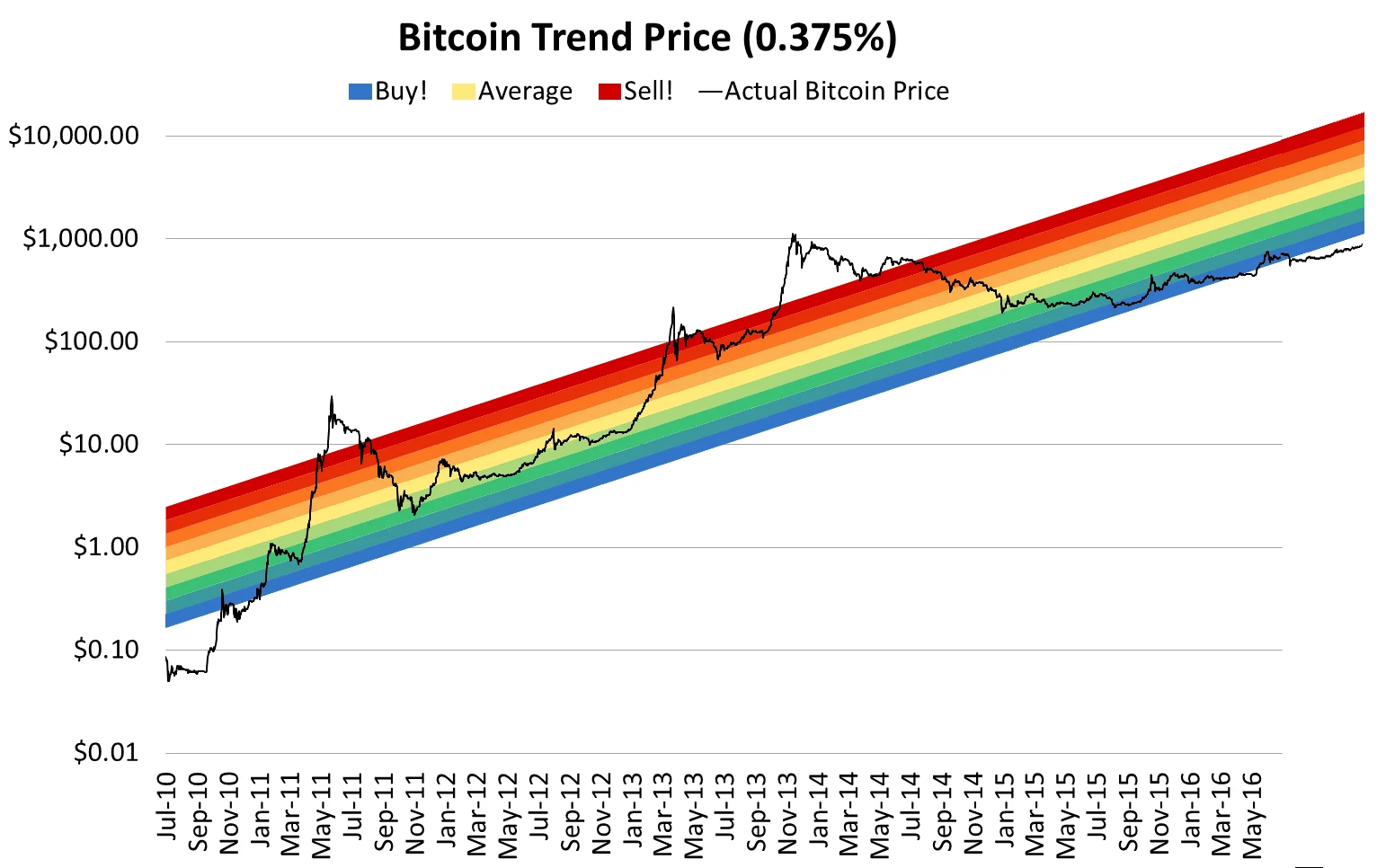

The Bitcoin Rainbow Chart represents the price change over time using a logarithmic regression. To indicate whether it is time to sell, buy or hold Bitcoin, the Bitcoin Rainbow Chart uses coloured bands. The rainbow’s lower bound color is blue, indicating a drop in Bitcoin price, while the red color is its upper bound, meaning an increase in its pricing.

The Rainbow Chart, a long-term Bitcoin valuation tool, provides an overview on investors strategy for buying or selling Bitcoin. This is determined by the market sentiment highlighted at each stage of the rainbow.

The Rainbow Chart’s upper colours indicate a bullish market and an excellent time for strategic investors to sell Bitcoin. On the other hand, the lower colors show that the overall market sentiment is down, so it’s a great time to acquire more Bitcoin.

Bitcoin Rainbow Chart History

The first component of the Bitcoin Rainbow Chart was created in 2014 by Reddit user “azop” and posted online. The chart was created in fun ways to display the BTC price trends over time. This chart is known as the Bitcoin Rainbow Chart. It’s so vibrant and accurate it has been called “The Bitcoin Rainbow Chart”.

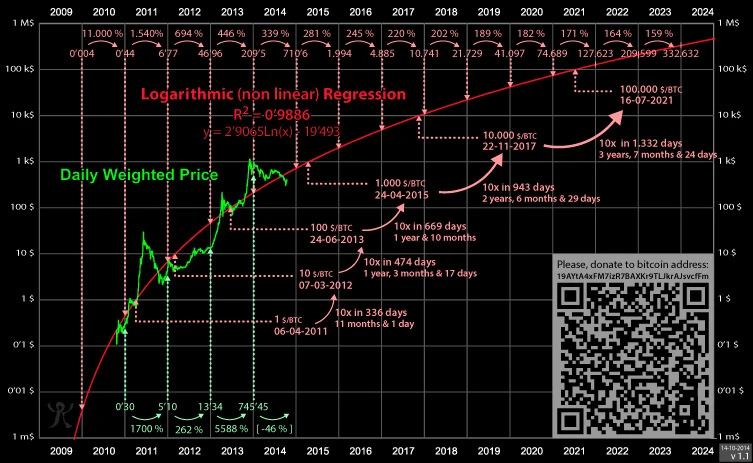

A Bitcoin Talk user, “trolololo”, introduced a logarithmic model of regression in the same year. This statistical model indicated that most cryptocurrency decreased in value or increased quickly at the start, before slowly slowing down as time went by. The logarithmic regression of the BTC logarithmic charts was then added, creating the Bitcoin Rainbow Chart. The curve initially rose abruptly, but then it began to flatten out.

How to interpret Bitcoin’s Rainbow Chart

While the Bitcoin Rainbow Chart can’t be predictive, it has largely been correct throughout the history of BTC.

Rainbow Price Chart includes nine color ranges, including:

- BTC in Blue: A fire sale

- Bluish-Green: Buy zone

- Green: Cheap accumulate buy zone

- The lightest green is still affordable

- Hold the BTC Yellow

- This is a bubble: Light orange

- FOMO increases with dark orange

- Red: Selling Bitcoin

- Dark Red: Maximum bubble territory.

The BTC Rainbow Chart is Accurate!

Although the BTC Rainbow Chart is updated with the most current data, it provides comparisons of adoption rate and speed as well as stable prices for the future. Regression lines, however, are often drawn in high-timeframes. So, they don’t need to be adjusted often and can’t be used for short-term predictions. Logarithmic regression charts are drawn using the market’s lower and higher prices. However, if the price trades in the middle, the lines become very unstable.

The Rainbow Chart is able to forecast future BTC prices. Past Bitcoin price movements have shown that whenever there has been a Bitcoin halves, the price will be raised to the Dark Red area. On May 11, 2022 was the Bitcoin halving. The price moved up to the Dark Orange band meaning FOMO or time to sell. As the next Bitcoin halving is expected to happen in the middle of 2024, it’s essential to keep track of future predictions and use this data to enter or exit a trade accordingly.

Tip: Bitcoin inflation slows down when the number of Bitcoins entering the market falls by half.

The rainbow Chart also applies to other cryptocurrencies. For example, investors can use an Ethereum Rainbow Chart for insight into Ethereum’s price.

Conclusion

If combined with other indicators such as the Fear and Greed Index and RSI (relative Strength Index), then Rainbow Chart could prove to be a valuable tool. You can use the logarithmic regression curves to find Bitcoin’s “Fair value,” i.e., the natural regression of the price of an asset, stock, or crypto coin.

While color bands are based on a logarithmic approach, however, they can be arbitrary and have no scientific foundation.

Join now CoinStats to check the “Bitcoin Rainbow Chart” on our website and stay up to date on all crypto news!

Information about InvestmentsThis site contains information that is intended to be informative. It does not recommend you to purchase, sell or hold any financial products or instruments. Information on this site is not based on any financial institution. It may be different from information you get from service providers.

Market risks, such as the possibility of losing principal, are all part and parcel of investing. Because cryptocurrency can become volatile due to secondary activity and is highly sensitive, it’s important to do independent research. Get your own advice. Only invest the amount you can afford. CFD trading, stock trading, and cryptocurrency trading can have serious risks. CFDs can result in losses between 74-89% for retail investors accounts. Future performance does not necessarily reflect past performance.