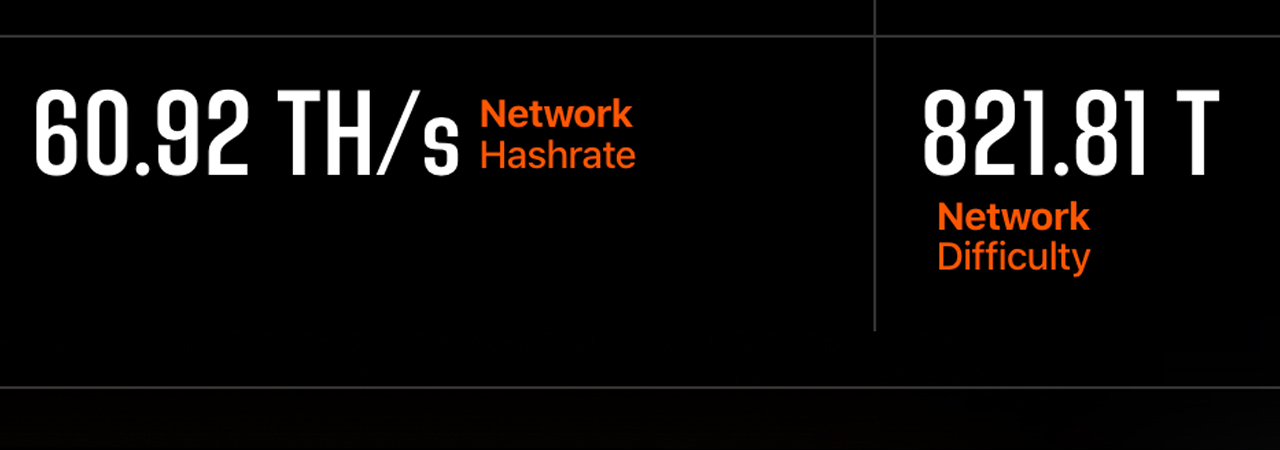

Following Ethereum’s transition from proof-of-work (PoW) to proof-of-stake (PoW) roughly five different crypto assets were the main beneficiaries of Ethereum’s former hashrate. Anonymous developers started an Ethereum PoW-fork named ETHW 24 hours after The Merge. The fork managed to generate 60.92 terahash/second (TH/s), of hashpower. However, ETHW has lost a considerable amount of fiat value, dropping 90.72% from the crypto asset’s all-time high (ATH). In the 24 hours since its launch, the newly introduced coin lost over 39%.

ETHW Chain is Now Online, Exchanges Announce Their Support

Ethereum’s transition to PoS has bolstered Ethereum Classic’s hashrate and a small handful of other crypto assets that leverage the Ethash algorithm. The new PoW fork has created Ethereum ETHW. ETHW is a PoW variant of Ethereum, which was previously reported by Bitcoin.com News.

Blockchain is operational now according to reportsETHW had some issues when it started the network. It was reported that the ETHW core developers mistakenly leveraged a Chain ID that’s tied to the Smart Bitcoin Cash Testnet.

The new ETHPoW(ETHW) chain uses exactly the same Chain ID that the “Smart Bitcoin Cash Testnet”. shortName “gon” as in “gone” like your coins in a replay attack?🤔Can’t make this stuff up and it just keeps getting better LMAO!!! 😂😂😂😂 https://t.co/1DFl4KyeO7

— Cascadia Coin (@cascadia_coin) September 15, 2022

The error caused many observers to ridiculeThe project but other saidThe fact that blockchain developers chose to use a Chain ID that was in use did not make any difference. As the blockchain was launching, the ETHW Team has announced exchanges and mining pool that will support it.

📢 New token available today: $ETHW @ethereumpow

💪 Trading begins NOW

⏳ Deposits & withdrawals start Sept 16 at approximately 15H30 UTC

✅ $ETHWAlready distribution is underwayLearn more 👇https://t.co/MnsL2p19vT pic.twitter.com/t6s7R2HJXd

— Kraken Exchange (@krakenfx) September 16, 2022

On Friday morning (ET), ETHW’s Twitter account tweeted about Huobi, Poolin, Kraken, Dex Screener, Bitrue, Kyber Network, and Math Wallet supporting the new ETHW asset. However, the ETHW token has lost over 39% USD and ETHW is down 90.72% since its ATH.

ETHW loses close to 40% USD value in 24 hours, Chain gathers 60 Terahashs of computational power, Ethereum Classic still reigns PoW champ

Out of more than 12,000 crypto assets in existence, ETHW’s market cap is ranked #2,666. According to data, ETHW saw $113.38 Million in worldwide trade volume over the last 24 hours. It hit an all-time low today of $9.04 per unit, having fallen to $113.38 million in global trade volume 14 hours earlier. ETHW traded between $9.04 and $23.33 per unit on Friday, according to the 24-hour trading range statistics. During the past hour, ETHW’s price has fluctuated between $11.94 per unit and $12.27 per unit.

The ETHW Project has been able to collect approximately 60.92 TH/s Ethash hashpower via The Merge. This means ETHW’s hashrate is only 26% of the size of Ethereum Classic’s hashrate at 232.51 terahash per second (TH/s). ETHW’s USD value only represents 36% of ethereum classic’s (ETC) U.S. dollar value when it used to be closer to parity, two days ago.

ETC, which is ranked #119 on September 16, is ranked #19. ETC also has $1.46billion in worldwide trade volume over the last 24hrs. There are currently two Ethereum-based PoW options, but ETC is still the leader in price and trade volume along with the three-fold larger hashrate.

What do you think about ETHW’s recent price action and the 60 TH/s of hashrate the network has managed to gather since The Merge? Comment below and let us know how you feel about the subject.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This is not an invitation to purchase or sell directly, nor a suggestion or endorsement of products, services or companies. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.