In the last 2 weeks, digital currency markets’ value has dropped significantly. However, lower prices have not led to higher trading volumes. Data shows cryptocurrency spot market volume has slipped from $1.4 trillion in November 2021, to this month’s $593 billion in volume. The volume and open interest for Bitcoin futures has also fallen dramatically over the past 2 months.

December: Crypto volumes fall month over month

When cryptocurrency markets lose substantial value traders usually look at trade volume to determine if it increases to sustain current prices. Crypto spot market volumes have continued to fall since a large number of coins reached all-time highs during the second week in November.

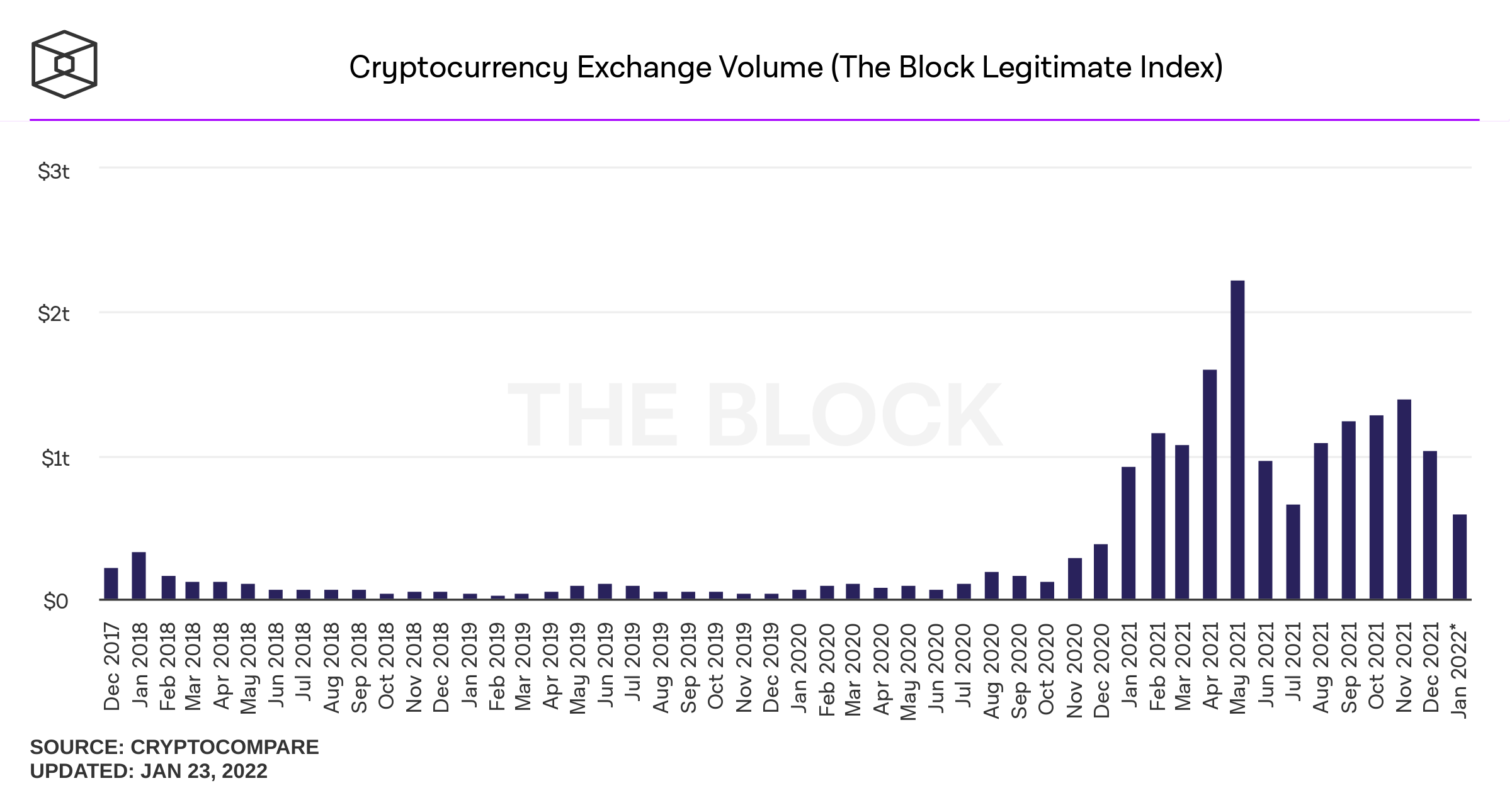

Data from theblockcrypto.com’s exchange volume dashboard, which sources data from cryptocompare.com metrics, indicates spot market volume has fallen month-over-month since November.

Although November’s volume was $1.4 trillion in November, the December record for revenue reached $1.04 trillion. Data for the January 2022 month is still incomplete, but $593 billion has already been reported.

Even though November’s spot market volume was larger than December’s and the three weeks of January, the $2.23 trillion in volume recorded in May 2021 was double the size. The daily exchange volume is the same as two months ago, with daily crypto trade volumes lower than usual.

The settlement of $53.27billion was made on November 2, 2021. Data from January 22nd, 2022 shows that $24.65billion had been recorded. Although monthly and daily volume of the crypto-asset spot market have fallen, it is still possible to see the same for futures and options markets.

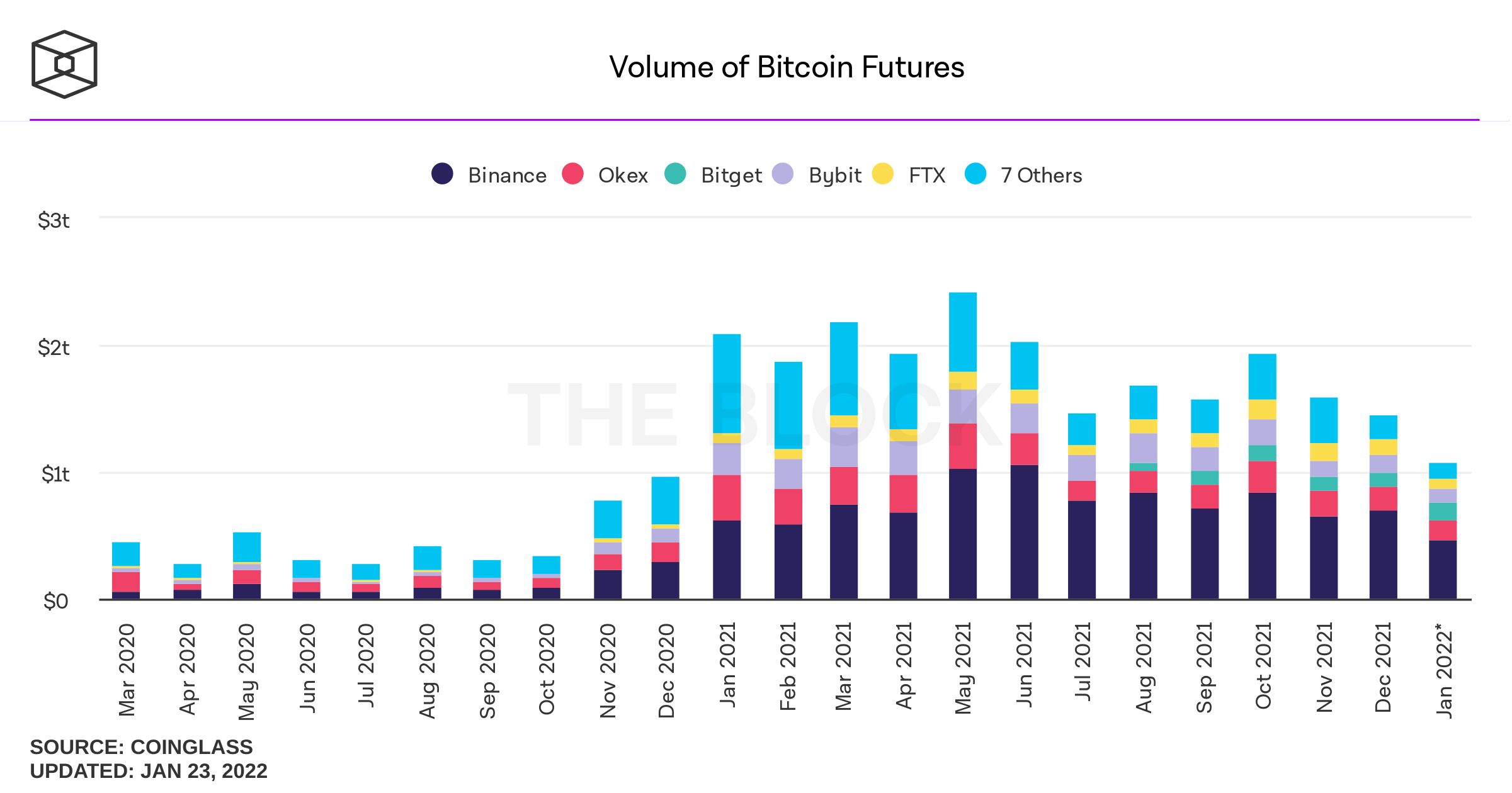

The day after BTC reached an all-time high price of $28 billion on November 10, 2021 the open interest in bitcoin futures was at $28 billion. Open interest across all of the bitcoin futures markets was $14.64 billion according to January 22 metrics.

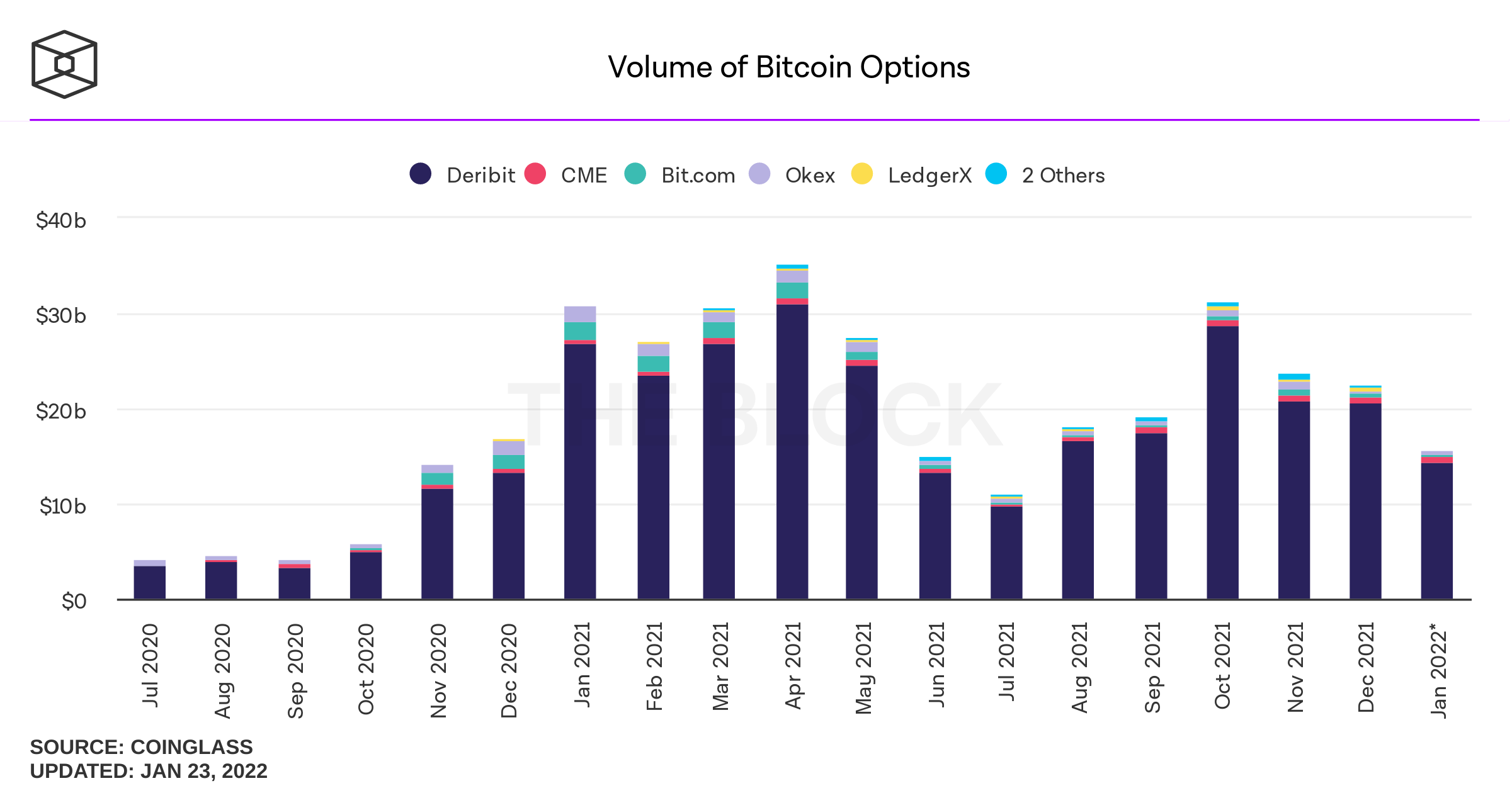

Concerning bitcoin futures volumes: they were significantly higher than November’s. $1.94 trillion was recorded last October and this month, there’s only been $1.08 trillion recorded so far. For the past two months, aggregate open interest has dropped and volumes related to bitcoin options also fell month over month.

The crypto economy has been negatively affected by low volume on crypto spot and derivative markets. Up volume typically indicates bullish trading, but that hasn’t been the case in recent times.

Let us know your thoughts on the recent decline in volume in crypto market. Please comment below to let us know your thoughts on this topic.

Images CreditsShutterstock and Pixabay. Wiki Commons. The Blockcrypto.com Dashboard.

DisclaimerThis information is intended for general purposes. This is not an invitation to purchase or sell directly, nor a suggestion or endorsement of products, services or companies. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.