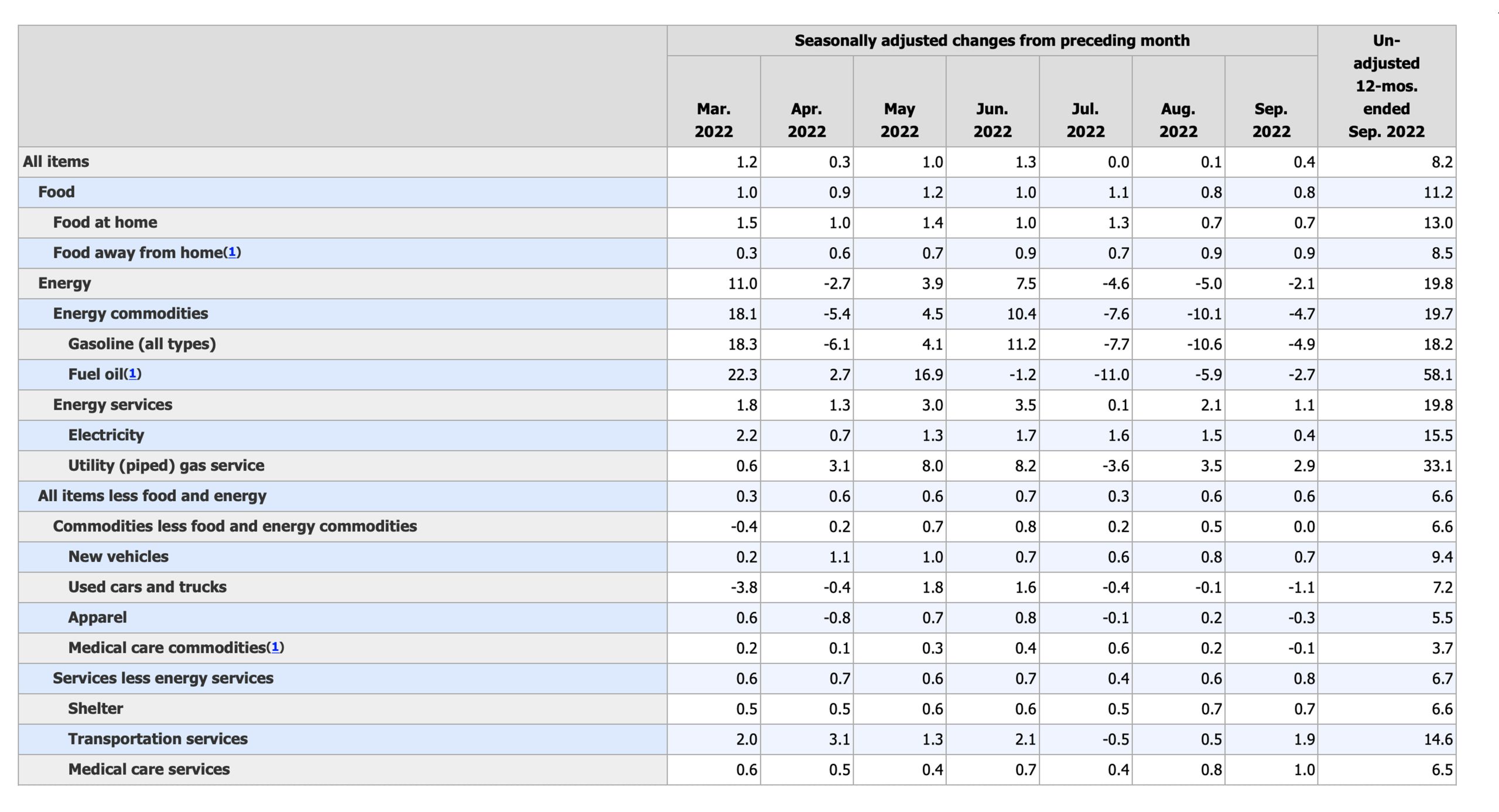

Inflation data released by the United States shows that prices for consumer goods have continued to rise despite fears of a slowdown. On Thursday, the Consumer Price Index (CPI), which was published in its summary, showed an 8.2% increase for the year to September. The core index rating experienced the largest annual growth since 1982.

September’s CPI Data Was Worse Than Expected, Report Signals an Aggressive Fed Rate Hike on the Horizon, Global Markets Shudder

U.S. inflation figures for September have been released and show that CPI has fallen more than predicted. According to the U.S. Bureau of Labor Statistics’ CPI summary published on October 13, the report shows the “Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4 percent in September on a seasonally adjusted basis after rising 0.1 percent in August.” The Bureau of Labor Statistics’ report adds:

In the 12 most recent months, all item index has increased 8.2% before seasonal adjustments.

The latest CPI stats also show that the “index for all items less food and energy rose 0.6 percent in September, as it did in August.” Immediately after the report was published all four major U.S. stock indices dropped significantly against the U.S. dollar with Nasdaq shedding the most losses on Thursday. After the CPI Report was published, crypto markets and precious metals fell against the greenback in the exact same way.

US #inflationIt was hotter than anticipated. The September CPI increased 8.2% YoY, compared to 8.1% as expected. The Core CPI rose to 6.6% YoY which is the highest level since 1982. pic.twitter.com/WLTqzd6o1M

— Holger Zschaepitz (@Schuldensuehner) October 13, 2022

Precious metals, such as gold and silver, also saw a decline on Thursday. Silver is currently down 1.68 percent and gold is at 1.37% respectively. Both platinum and palladium also suffered losses of between 1.59% – 2.91%. Further, Thursday’s metrics show that crypto economies have also suffered heavy losses. The entire market capitalization all of the available digital assets has fallen below the $900 trillion mark.

The global cryptocurrency market cap stands at $886.38 million, which is close to 4% less than the previous 24 hours. Of course, the worse-than-expected inflation data from the Bureau of Labor Statistics’ CPI report is making investors believe an aggressive Federal Reserve will hike the federal funds rate by another 75 basis points (bps). According to the Investing.com Twitter account, the “Fed funds futures [is]Now pricing [in a]100% Chance of Fed Rate Increase at 75 bps [the November] meeting following CPI data.”

How do you feel about the U.S. Bureau of Labor Statistics latest inflation report? And the reaction of the markets to the publication of it? Please comment below to let us know your thoughts on this topic.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerInformational: This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. This article does not contain any information, products, or advice that can be used to cause or allegedly to cause any kind of damage.