Bitcoin dropped to $18,600, losing support and trending lower near its annual low of $179,000 The currency managed to stop the bleeding, but sentiment seems to have changed from fearful to dubious.

Bitcoin trades at $18,300, with a 4% and 9% losses in the previous 24 hours. However, it has rebounded over the past hour. Other major cryptocurrencies followed BTC’s price into the abyss and are recording massive losses on low timeframes with Cardano and Solana showing the worst performance.

The Inflation Has Yet to Find a Bottom. Will Bitcoin Follow?

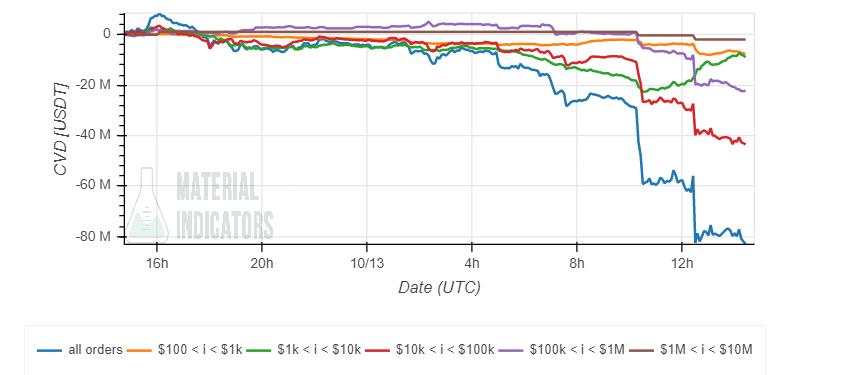

Material Indicators’ data show that there was a significant increase in selling pressure among all investors going into the Consumer Price Index, the US benchmark for inflation. Market expectations were exceeded by this indicator, printing 8.2% in September 2022.

The chart shows that everyone, from whales to retail, is trying to lower Bitcoin prices in response the U.S. Federal Reserve’s (Fed) new interest rate increase. This financial institution is trying to reduce inflation by raising rates and shrinking its balance sheets.

However, today’s CPI print confirms that inflation is sticky and likely not peak in 2022. The Fed will be able to support the Fed’s decision to increase interest rates, despite the positive economic growth indicators in the U.S. This fact, along with other factors, could have a negative impact on Bitcoin and other traditional financial markets.

The chart above shows the crypto market’s reaction to an aggressive monetary policy from the Fed, but legacy markets have reacted in a similar way. Commenting on BTC’s price action and inflation, an analyst for Material Indicators said:

Although inflation may not be at its peak, FED rates will rise aggressively. 75 BPS baked in for Nov, 75 BPS likely for Dec TradFi and Crypto markets are Bearish AF THE BOTTOM isn’t in.

Caleb Franzen provided further data to indicate that market participants expect two additional 75 basis point (bps), hikes at the Federal Open Market Committee. As a result, BTC’s price is experiencing high volatility triggered by extreme market sentiment.

The market is under enormous pressure to value a Fed that’s hawkish, with less and fewer chances for a change in direction. Investors are pricing this in. The $17,600 level remains strong support while $20,500 is critical resistance at the time this article was written.

Bitcoin traders should be prepared for a break above or below those levels. The global market pressure will not abate as long as the inflation trend is upward.

CME futures currently price in the possibility that the Federal Reserve will raise the target fed funds rates by +0.75%.

The market is offering a 4.2% probability of +50bps and a zero chance of +100bps.

Inflation measures that are underlying the core CPI continue to increase, and this indicates that they are hot. pic.twitter.com/CqKKebjRR9

— Caleb Franzen (@CalebFranzen) October 13, 2022