A recently published forecast stemming from the Federal Reserve Bank of Cleveland’s Inflation Nowcasting data indicates upcoming U.S. consumer price index (CPI) metrics will likely be elevated. The newly predicted CPI levels were recorded the same day America’s gross national debt surpassed $31 trillion on October 4, as the country’s growing debt continues to rise rapidly.

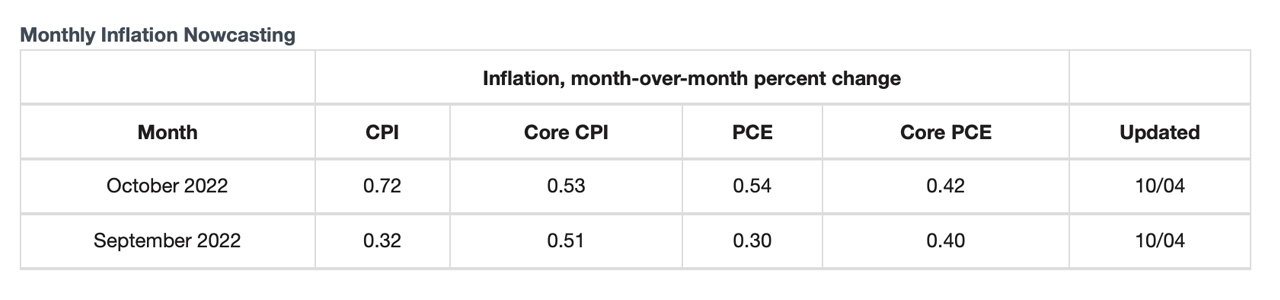

Fed’s Nowcasting Report Shows Inflation May Not Have Peaked, Data Predicts September and October Core CPI to Jump 0.5%

If inflation persists, the U.S. central banks may not want to slow down rate increases despite all the criticisms the Federal Reserve received for raising its benchmark lending rate. According to the Inflation Nowcasting report, the CPI readings in September and October are expected to be much higher than anticipated. Nowcasting in economics is like the weatherman’s forecasting the weather as the economic indicator utilizes three points in time (present, very near future, very near past) to predict future outcomes.

The Cleveland-based U.S. Federal Reserve System’s Fourth District branch uses nowcasting to predict the inflation rate increases in the future, and the most recent update is not pleasant. This report projects a 0.3% monthly increase in September, and 0.7% for October. The Cleveland Fed’s Inflation Nowcasting report also shows core CPI will increase by 0.5% for both months. Although the Inflation Nowcasting reports are a forecast, they can still be inaccurate at times.

Americans won’t hear about September’s CPI report from the U.S. Bureau of Labor Statistics until October 13. While the Fed’s target is 2%, the report for August’s inflation rate had shown the CPI was still running hot at 8.3%. Shadowstats.com published alternative inflation rates statistics on September 13. They indicate that the CPI has risen to above 10%. CPI data from October 3rd 2022 is shown on the Truflation dashboard. It shows that it has increased by 8.67% year-over-year. Although shadowstats.com shows record highs, Truflation stats indicate that inflation peaked on March 11, 2022 at 11.93%.

U.S. bureaucrats and the country’s central bankers have blamed the nation’s skyrocketing inflation on things like the Covid-19 pandemic, supply chain shocks, and the ongoing Ukraine-Russia war. A number of economists blame the U.S. government’s and the Fed’s stimulus and spending following the onset of the pandemic. The Federal Reserve has increased the monetary supply in the past few years as never before, but the U.S. government spent trillions on infrastructure and aid. The U.S.’s gross national debt reached $31 trillion on Tuesday October 4, 2022.

According to the New York Times, the National Debt exceeded the threshold in an U.S. Treasury Department Report. According to the NYT, Michael A. Peterson (chief executive officer at the Peter G. Peterson Foundation), stated that increased interest rates might increase government spending. According to the Peterson Foundation’s estimates, higher rates could lead to an extra trillion on top of what the U.S. government will spend on interest payments in ten years.

“So many of the concerns we’ve had about our growing debt path are starting to show themselves as we both grow our debt and grow our rates of interest,” Peterson said. “Too many people were complacent about our debt path in part because rates were so low.”

What do you think about the Cleveland Fed’s Inflation Nowcasting report and the national debt skyrocketing past $31 trillion on October 4? Comment below to let us know your thoughts on this topic.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.