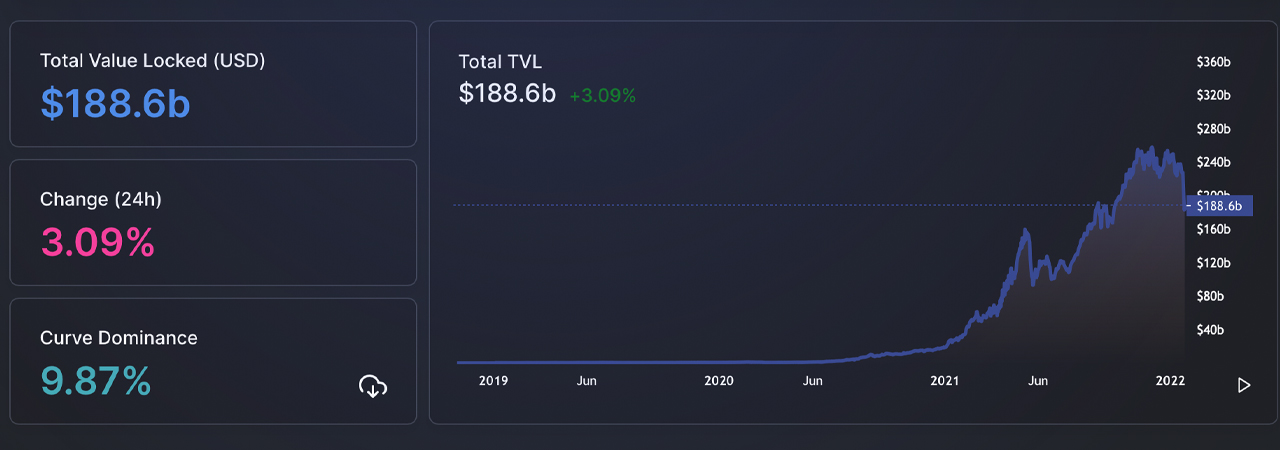

The total value locked (TVL) in decentralized finance (defi) protocols has lost 6.8% during the last 24 hours as crypto markets have experienced more losses. Fantom’s TVL has increased by 46.62% during the week. Fantom managed to take Binance Smart Chain’s (BSC) share down one notch and now has the third-largest defi market share.

Fantom’s Total Value Locked in Decentralized Finance Jumps 46% in 7 Days

Fantom, a defi and smart-chain blockchain project, has officially overtaken BSC this week in terms TVL in defi protocols. Fantom’s current holdings of $11.73Billion were updated on January 24, 2022. This is an increase by 46.62% within seven days.

While year-to-date, Fantom’s native token fantom (FTM) is up 4,671.7% against the U.S. dollar, over the last two weeks, FTM has lost 18.6%. Today, there’s $1.6 billion in FTM trade volume and the project has a market valuation of around $4.9 billion.

Out of the $1.6 trillion crypto economy, the defi token fantom’s (FTM) overall valuation represents 0.31% of the aggregate. Fantom, which is below Tron, and above Stellar, is 13th in the list of $510 billion smart contracts platforms.

Tether (USDT) captures 84.26% of today’s FTM trades, followed by BUSD with 5.8% of FTM pairs. US dollar controls 5.15% FTM swaps, while bitcoin (BTC), has about 3.25%. TRY has around 0.7% of FTM swaps.

While fantom (FTM) is widely traded on decentralized exchange (dex) applications, the top centralized exchange offering FTM is Binance’s 48.96% share followed by Okex with 20.81%. Okex, Digifinex, Kucoin and Hitbtc are the top three most active fantom centralized exchanges.

Fantom’s $11.73 billion TVL in defi is just above BSC’s $11.36 billion TVL. Above Fantom is Terra’s TVL in defi today with $15.75 billion, but Terra’s TVL has slid by 17.51% this week. BSC has lost 19.73% in the past week, and saw around 4.36% TVL depart in the last 24hrs.

The largest defi protocol on Fantom is Multichain with a dominance of 59.79% of Fantom’s $11.73 billion. Multichain’s $7.02 billion TVL is followed by 0xDAO ($3.94B), and Spookyswap ($957.16M). These three protocols command the lion’s share of Fantom’s total value locked in defi.

Fantom holds the record for cross-chain bridge TVL with $5.2 Billion locked. Fantom’s cross-chain bridge TVL has increased by 149% in the past seven days.

What do you think about the Fantom blockchain’s recent defi action this past week? Comment below and let us know how you feel about the subject.

Images CreditsShutterstock. Pixabay. Wiki Commons. Defillama.com.

DisclaimerThis information is provided for educational purposes only. This is not an invitation to purchase or sell directly, nor a suggestion or endorsement of products, services or companies. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.