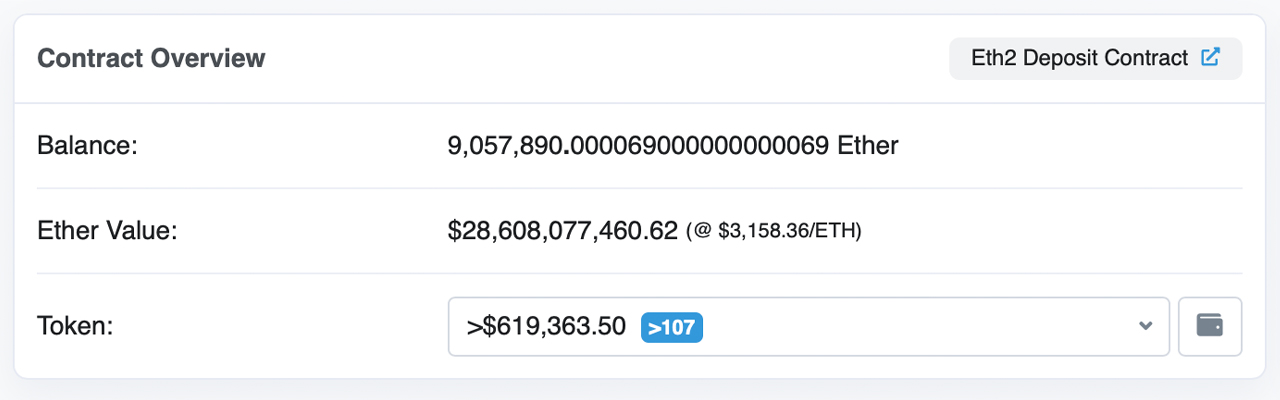

The number of ether locked in the Ethereum 2.0 contract has exceeded 9 million ethereum or more than $28 billion using today’s exchange rates. Since September 20,21’s first week, the amount of Ethereum in the contract has grown by 22.29%. The contract was originally held 7.4million ether.

Ethereum 2.0 Contract Exempts 9,000,000 Ether

The proof-of work (PoW), side of Ethereum’s network, has reached all-time highs in hashrate tapping at above 1 petahash each second (PH/s). However, Ethereum 2.0 is moving forward with ether locked into the ETH2.0 contract.

In essence, you need 32 ETH in order to qualify as a validator. When the ETH 2.0 contract first launched, Bitcoin.com News reported on Ethereum’s co-founder Vitalik Buterin contributing funds to the contract on November 6, 2020.

On January 17, 2022, etherscan.io data indicates that there’s approximately 9,057,890 ethereum worth over $28 billion (at the time of writing) in the ETH 2.0 contract. On January 16th, 2022 data showed that 9 million Ethereum had been added to the contract.

Year-to-date, ethereum’s price is up over 150% but during the last 30 days, ether has shed 18.5% and two-week stats indicate ether has lost 17.5% in value against the U.S. dollar. While Ethereum’s market cap dominance was 18-20% during the course of 2021, today ETH dominance is around 17.9%.

Bitcoin.com News had reported that the contract was worth 7.4 millions. However, the stash at the time was $29.3 trillion. In addition to 9 million ether that was locked in the ETH 2.0 contract and 1,541,113 ethereum valued at $5.8 billion, EIP-1559 has also been implemented.

The value of the ETH 2.0 contract, and burned ethereum after the introduction EIP-1559 is $33.8 billion at the time this article was written.

Let us know your thoughts on the nine million Ethereum locked up in the Ethereum 2.0 Contract. Comment below and let us know how you feel about the subject.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.