Fear and uncertainty have been weighing on the global market. The Federal Open Market Committee will decide Wednesday whether to change the current monetary ease policy or raise the benchmark interest rate. Analysts and economists worry that the Federal Reserve’s hawkish views will cause markets to tighten too soon after it increased U.S. money supply faster than ever before.

Allianz Chief Economic Adviser: ‘Fed Maintained Its Transitory Inflation Narrative for Way Too Long’

The Federal Reserve is the focus of all attention this week. conversation has turned into speculationThe FOMC will hold a meeting in the near future. On Wednesday, the FOMC will take a decision at 2 pm (EST). This will be followed up by a press conference hosted by Jerome Powell, central bank chair. Global stocks dropped sharply last week, and crypto markets also suffered as the value of the cryptocurrency economy plummeted by billions. Both precious metals, such as silver and gold, managed to withstand the market crisis and are now up by a small percentage over the last thirty days.

As the U.S. central bank has hinted at tightening quantitive easing (QE) and raising interest rates, the Fed’s critics believe the pivot is too fast. Mohamed El-Erian (chief economic advisor to Allianz), is among those who are being criticized. “The first policy mistake was completely misunderstanding inflation,” El-Erian said on Tuesday. He added that the Fed’s Board of Governors “maintained its transitory inflation narrative for 2021 way too long, missing window after window to slowly ease its foot off the stimulus accelerator.”

FOMC Tomorrow will most likely have a range of today and tomorrow

— TraderSZ (@trader1sz) January 25, 2022

The Fed appears to be inching closer to tightening monetary ease quickly. Analysts and traders are now wary of creating new market positions. “I would be very [reluctant] to look at getting in or adding to positions to anything until we hear from an increasingly hawkish Fed on Wednesday,” the managing director at Strategic Funds, Marc LoPresti, told the press on Monday.

Market Participants Try to Predict the Fed’s Monetary Tightening Timeline

Analysts have also been following the FOMC meeting on social media, where it has become a trending topic. trying to predictYou can make the decision before it is too late.

A few of the FOMC 2023 dates have been released by Fed. This allowed me to expand the table.

This is the most recent pic.twitter.com/6qwXj1AEVm

— Jim Bianco biancoresearch.eth (@biancoresearch) January 24, 2022

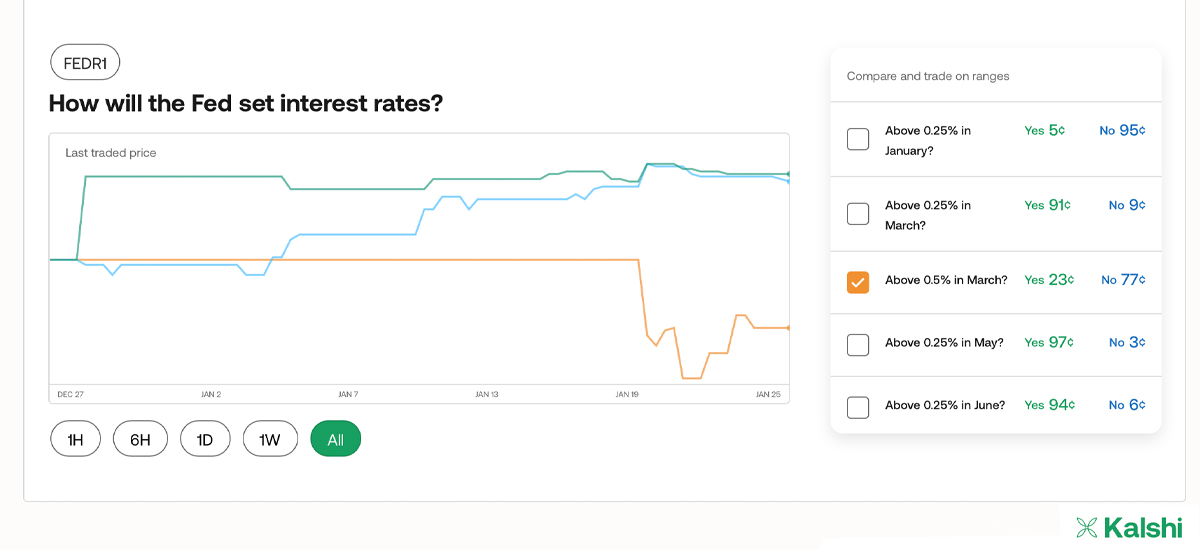

Kalshi.com’s prediction markets attempt to predict when the U.S. central banks will increase the benchmark rate. 98% of those leveraging kalshi.com’s Fed prediction market say the Fed will raise the rate above 0.25% in July.

The month with the lowest number of votes was December 2022, and 84% selected that particular date. The financial analyst on Twitter that goes by the name “Mac10,” explained that market bulls need to break their strength.

“The way I see is that either the market crashes between now and FOMC, forcing the Fed to reverse,” Mac10 wrote. “Or, the Fed comes in hawkish and the market crashes. I don’t see a Goldilocks scenario. The Fed must change for Bulls to be successful. That something is you.”

UBS Executive: ‘This Week’s Fed Meeting Is Likely to Underscore the Fed’s Shift in Policy Priorities’

Mark Haefele, CIO of Global Wealth Management at UBS, thinks the upcoming Fed meeting will “underscore” the Fed’s current line of thinking.

“For much of the past decade, market volatility was calmed by the notion that the Federal Reserve and other global central banks stood ready to step in to support the economy in the event of weakness, exogenous shocks, or an unexpected tightening in global financial conditions,” Haefele said in a statement on Tuesday. “Today, with inflation still elevated, that support feels less certain, and this week’s Fed meeting is likely to underscore the Fed’s shift in policy priorities away from supporting growth and toward fighting inflation,” Haefele added.

If the Fed doesn’t change its mind at Wednesday’s FOMC meeting, then I expect everything to fall more than many people think.

They will inevitably turn around. #Bitcoin bounces fast in a BIG way📈.

— Joe Burnett (🔑)³ (@IIICapital) January 24, 2022

According to Metrics, stock markets felt some relief after Monday’s FOMC meeting. Technology stocks like the Dow Jones, NYSE, and Nasdaq ended Monday green. Cryptocurrency markets also saw a similar pattern. The crypto economy gained 8.5% to $1.7 Trillion in the past 24 hours. Leading crypto assets such as bitcoin (BTC), ethereum, and Ethereum have seen a 7-10% increase in their value in the past day.

Let us know your thoughts on the FOMC Meeting and whether the Fed might tighten monetary ease too quickly. Please comment below to let us know your thoughts on this topic.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerInformational: This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.