From $245 billion on Jan 1, 2012, to $255.84 trillion three days later, the total value locked in decentralized financial (defi), increased by 4% over the first 4 days. Convex Finance, which has a TVL $21.27 million more than Curve Finance (defi protocol), is close to catching up. Ethereum is the dominant blockchain with 62.91%, or $160.96 Billion, of total $255.84B locked right now.

In the first 4 days of 2022, Defi TVL increases by 4%

Decentralized finance (defi), which is generating a lot of money, has seen a surge in its value. Statistics from defillama.com show the TVL in defi hit a low of $228.13 billion on December 11 and since then, it’s jumped 12.14% in value. On the first day of 2022, the TVL in defi was $245 billion and it’s increased 4% to date reaching $255.84 billion on Tuesday.

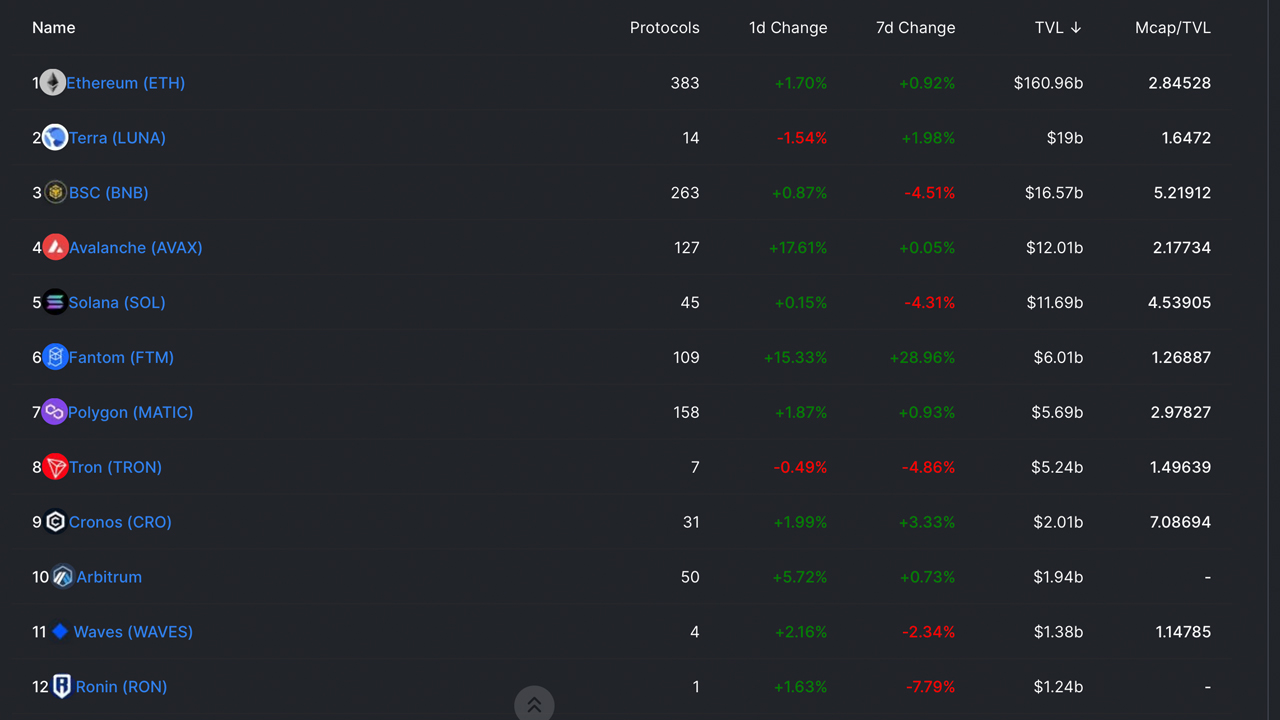

This sum is shared among many blockchains such as Ethereum, Terra and Binance Smart Chains (BSC), Avalanche. Fantom. Tron. Tron. Tron. Tron. Tron. Tron. Tron. Tron. Tron. Tron. Tronos.

Ethereum’s TVL across 383 protocols is $160.96 billion today followed by Terra’s $19 billion across only 14 defi protocols. BSC command $16.57 Billion Tuesday, across 263 Defini Protocols.

BSC and Terra are second- and third largest defi TVLs respectively, but they represent only 22.09% of Ethereum’s current value. Terra saw a 1.9% TVL rise in the past week. Fantom rose 28.96%, to $6 billion. Osmosis soared 40.43%, crossing the $1 billion mark.

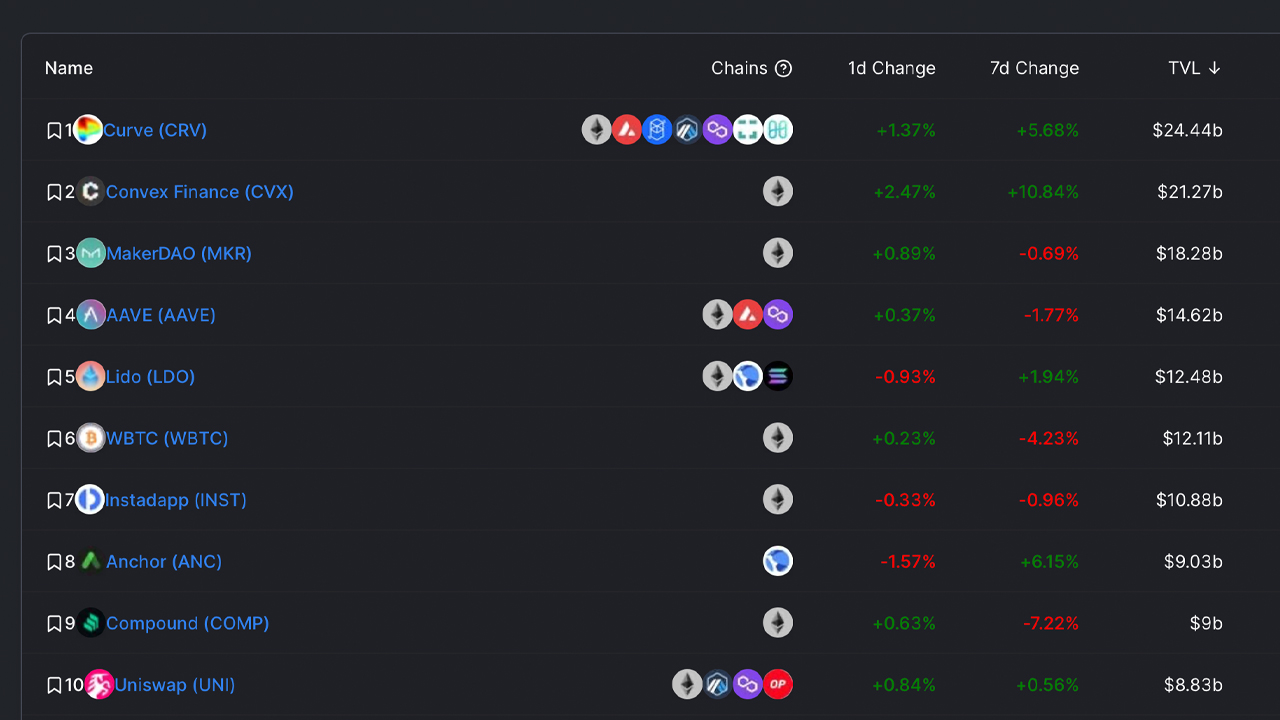

Fuse Jumps 183%; Curve Takes Control of 9.55% Of the TVL In Defi.

According to Metrics, Curve holds the biggest TVL today in defi across seven chains at $24.44 billion. This is 9.55% of the total $255.84 billion. Convex ($21.27B), Makerdao ($18.28B), Aave (14.62B), Lido (12.48B), WBTC (11.211B), Instadapp (10.88B) are the next three.

Today’s TVL of cross-chain links to Ethereum is $24.67 trillion. This represents an increase of 1.5% in the last 30 days. There are 87,855 unique addresses within the cross-chain Bridge TVL.

The largest TVL Tuesday was Polygon bridges, which have $6.6 billion. Ronin’s $6.1 billion is the second highest. Avalanche ($5.8B), Arbitrum $2.8B, Fantom ($1.4B), Optimism ($538M) and Fantom ($1.4B). According to market valuation, the top seven smart contract platform blockchain platforms have seen their value drop between 3.2% and 12.5% in the past week. Solana (Ether), Cardano and Polkadot as well Terra, Avalanche & Polygon are the seven top smart contract platform blockchain platforms.

Algorand (+3.2%) and Near (+12.6%) saw seven-day gains, while Chainlink (+5.3%) has been the 8th through 10th-largest smart network networks. FUSE (fuse) was the biggest smart contract network gainer over seven days this week, jumping 183.6% against US dollars.

The Enigma (ENG), grew by 48.8% over seven days while the Velas (VLX), grew by 35.7% during this week. Velas Network AG recently partnered with Ferrari the Italian luxury sport car maker. Poa network (POA), which lost 49.8%, was the largest smart contract platform losser this week. CPH (CPH), however, suffered a 37.8% drop in value over seven days.

How do you feel about the defi action of this week? Comment below and let us know how you feel about the subject.

Images CreditsShutterstock. Pixabay. Wiki Commons. defilama.com.

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or imply loss.