The importance of volumes in decentralized exchange (dex), has increased this year. Dex apps have dealt with large to very large volumes on centralized crypto trading platforms. Uniswap capturing 71% if all Ethereum-based crypto-ex applications, Ethereum-based platforms have processed $21 Billion in the past seven day. A report by The Block Research with recently revised metrics shows that dex platforms generated $1 trillion in volume last year.

Digital Asset Report: 2021 Dex Volumes Hit New Heights

Decentralized finance (defi) has grown a great deal this year and as the end of 2021 approaches, there’s more than $250 billion of value locked in defi protocols, according to defillama.com. Metrics also show that Uniswap has the highest 24-hour volume of any blockchain-based dex application with $1.45 Billion today. Data shows that Uniswap holds $8.81 Billion in total value (TVL), which is less than Curve Finance’s $22.36 Billion TVL.

Below Uniswap, with $848M in 24-hour volume and 24 dex leaders is Pancakeswap. Below Pancakeswap’s 24-hour volume is Trader Joe ($453.7M), Curve ($453.1M), Sushiswap ($401M), Uniswap v2 ($380M), and Spookyswap ($185M). Just recently, The Block Research published a comprehensive 150-page report covering the “2022 Digital Asset Outlook,” and the research covers both centralized and decentralized exchange volumes.

The vice president of Research at theblockcrypto.com is an example. Larry Cermak, explained in a tweet on December 16, that “The Block’s legitimate volume index, the spot volume in 2021 will surpass $14.5 trillion, which is 8 times larger than last the volume we saw last year.” Statistics from the study and a report authored by Yogita KhatriDextrade volume also showed that the volume of dex trades was over $1 trillion by 2021.

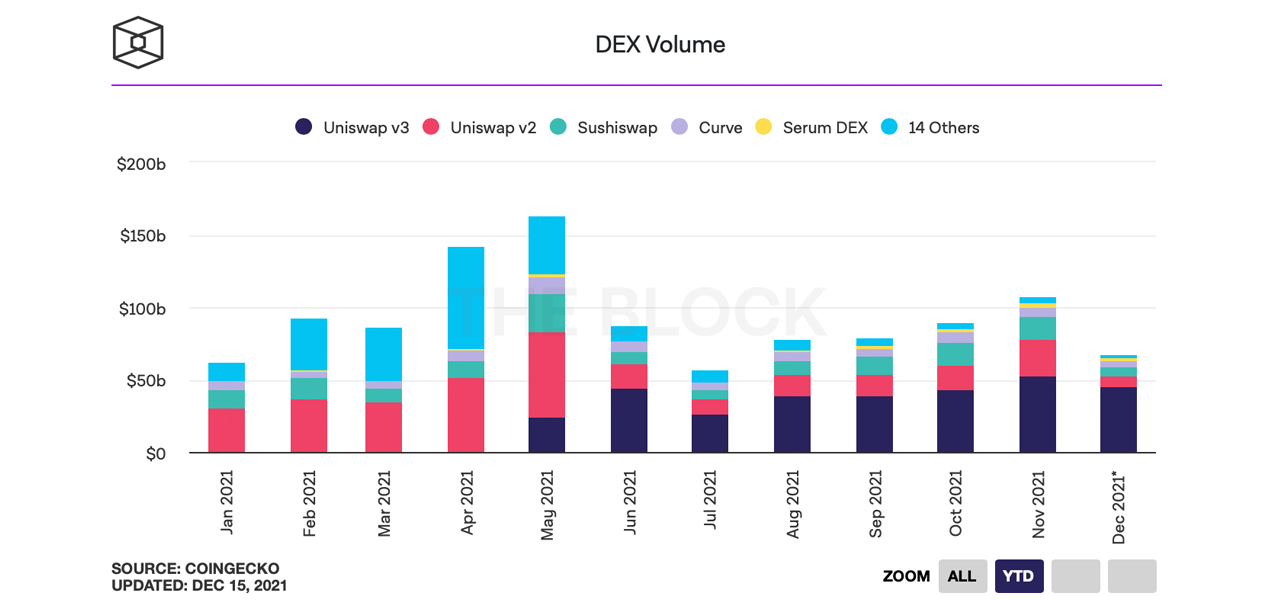

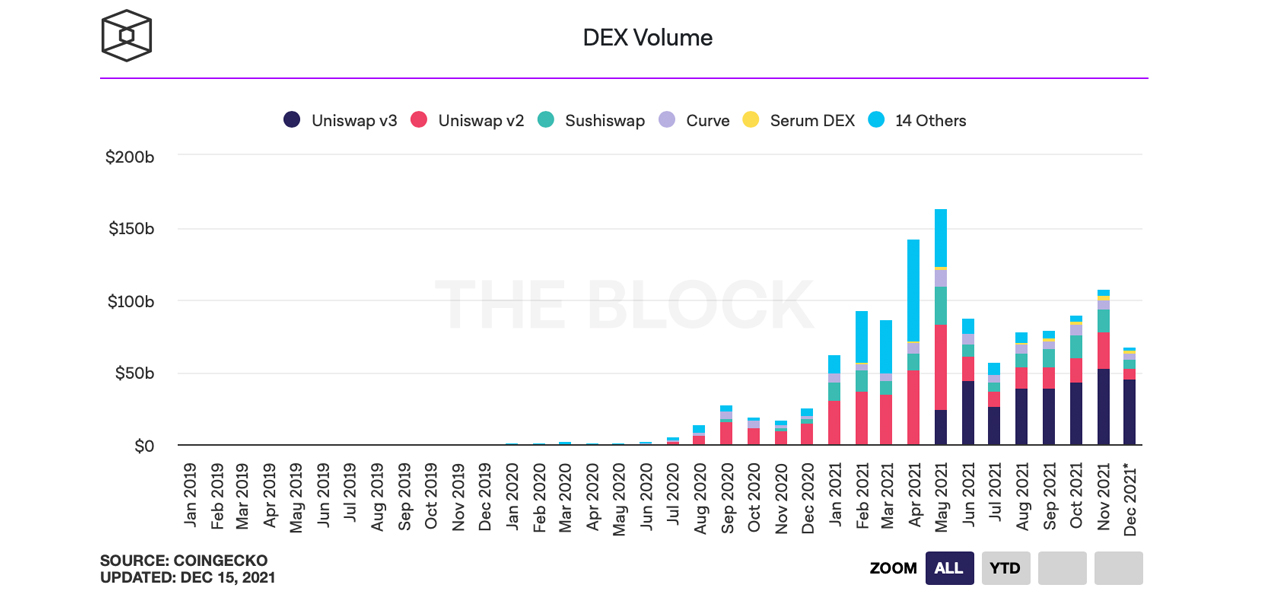

“Overall, monthly dex volume peaked in May 2021 at $162.8 billion, and the most considerable month-over-month growth was in January, with a 137.3% gain,” the 2022 Digital Asset Outlook report notes. “However, the volume has not fully recovered from the May crash, and the dex-to-centralized exchange spot volume ratio remained under 10% throughout the year.”

The report also highlights dex aggregators. Dex aggregators, such as 1inch, only account for 13.9% in total dex volumes according to the report. “1inch was the leading dex aggregator throughout the year with a market share of 64.9%, followed by 0x API (Matcha) at 16.8%,” the researchers detail. The scope of the researcher’s 2022 study delves into numerous other subjects like market performances, derivatives markets, mining revenue, on-chain volumes, stablecoins, and a summary of venture funding in 2021.

Do you have any thoughts about this year’s decentralized exchange volume (dex) exceeding $1 trillion? Comment below and let us know how you feel about the subject.

Images CreditsShutterstock. Pixabay. Wiki Commons. Theblockcrypto.com

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.