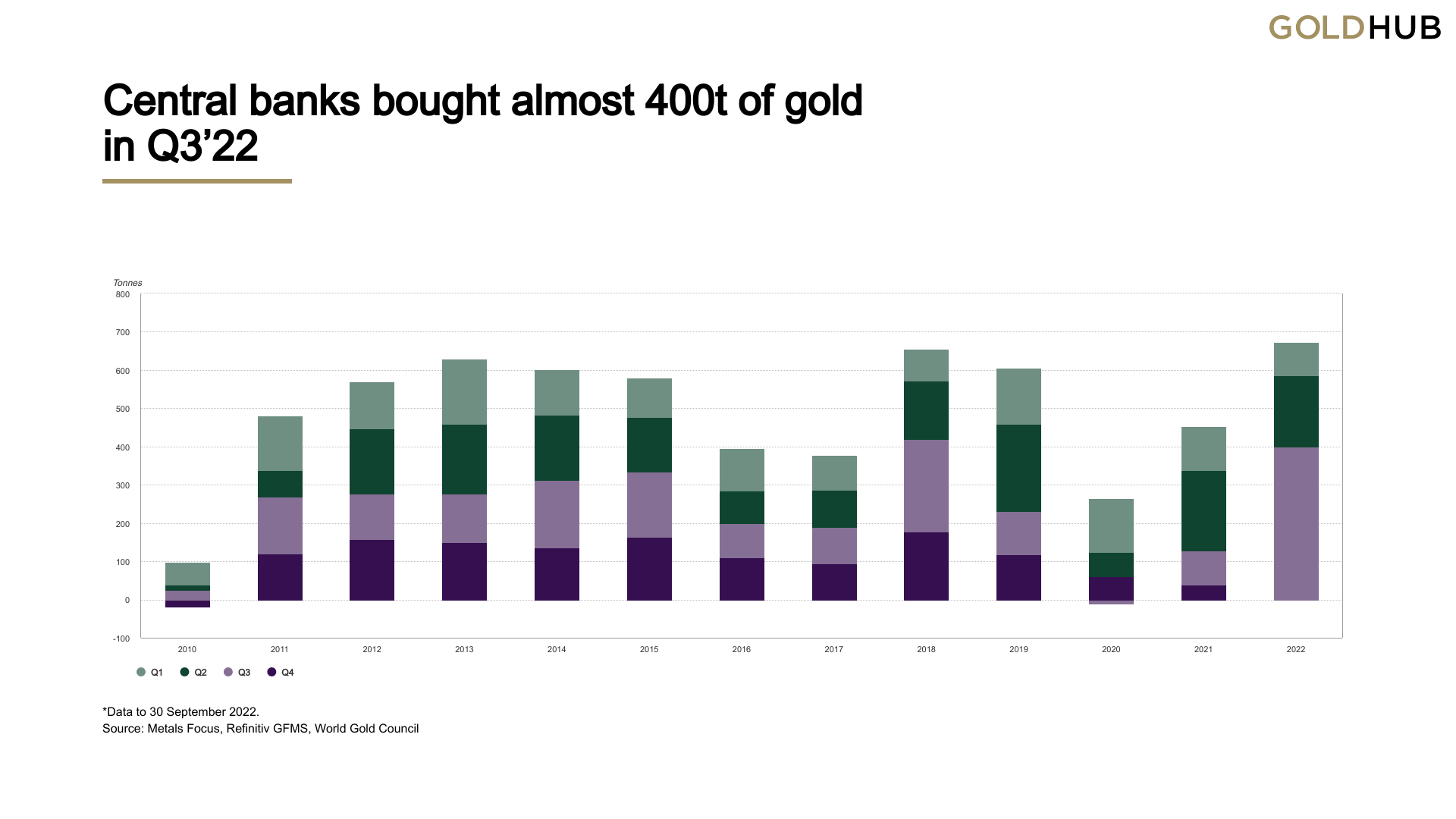

According to the World Gold Council’s (WGC) latest quarterly report, worldwide gold demand, excluding over-the-counter (OTC) markets, was 28% higher year-over-year. Although demand was higher than in the previous year’s third quarter, gold purchases by central banks reached an unprecedented quarterly record for Q3 2022. The quarterly report indicates that the world’s central banks purchased close to 400 tons of gold and the WGC study says that it’s the “most on record.”

Q3 2022 Data Shows the World’s Central Banks Stacked Close to 400 Tons of Gold

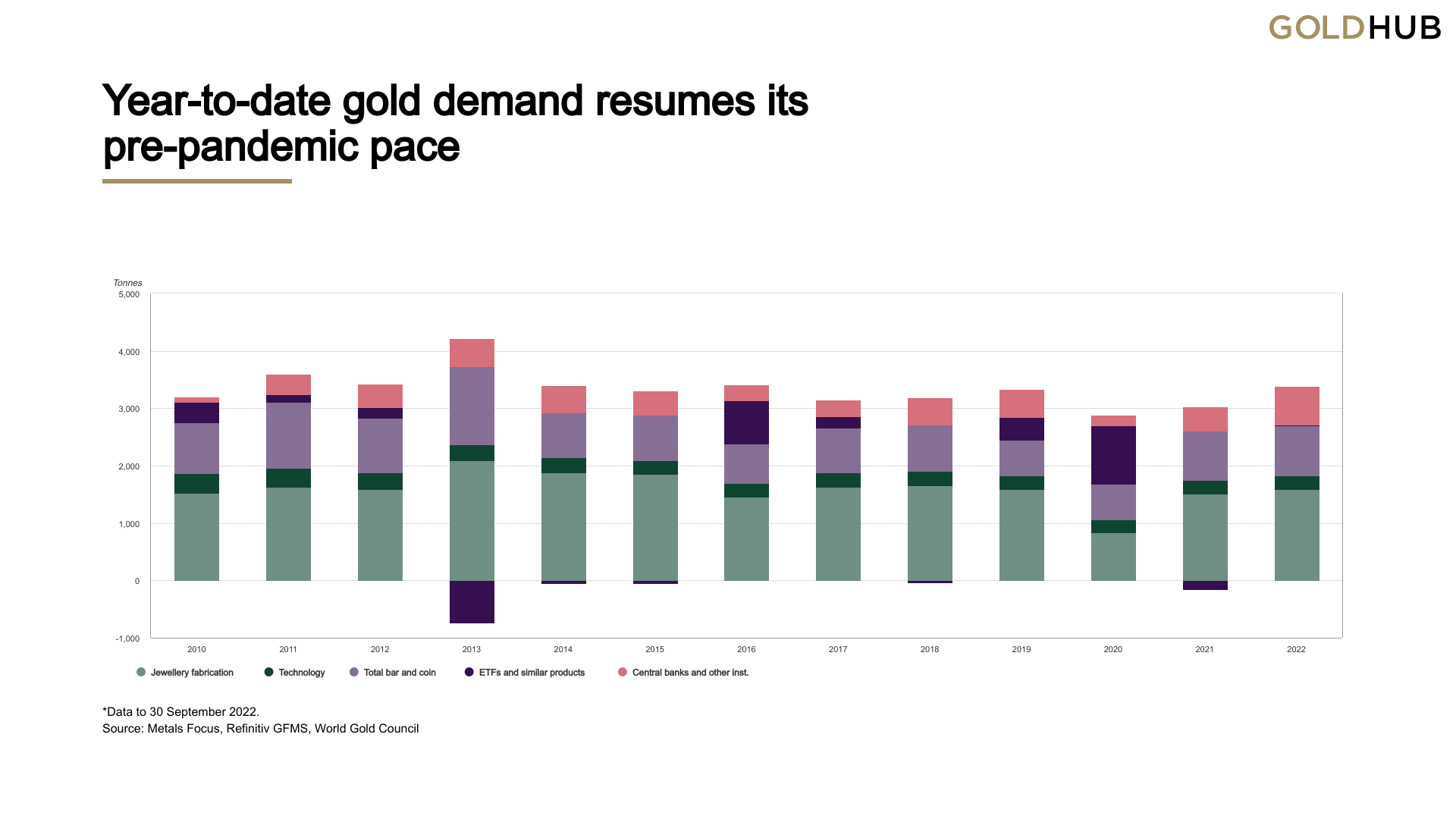

On Nov. 1, 2022, the World Gold Council (WGC) published the organization’s “Gold Demand Trends Q3 2022” report, which highlights the current trends tethered to gold and the precious metal’s markets during the third quarter. WGC’s report, published on gold.org, says the third quarter was healthy and was driven by “stronger consumer and central bank buying.” WGC highlights that these factors helped year-to-date demand “recover to pre-Covid norms.”

“Gold demand (excluding OTC) in Q3 was 28% higher y-o-y at 1,181t,” WGC’s report notes. “Year-to-date demand increased 18% vs the same period in 2021, returning to pre-pandemic levels.”

While consumers have been buying more gold, the demand from central banks for it has increased to an unprecedented level. Turkey, Uzbekistan and Qatar were the top central bank buyers in Q3 2022.

“Turkey remained the largest reported gold buyer this year,” WGC’s report details. ”It added 31t in Q3, lifting its gold reserves to 489t (29% of total reserves). Year-to-date it has added 95t to gold reserves.”

WGC researchers found that Uzbekistan continues to accumulate gold. It purchased 26 tonnes in Q3. The report explains that Uzbekistan has also been “a consistent buyer of gold” during the last two quarters.

Qatar Central Bank bought 15 tons gold at record prices during the third quarter. WGC says Qatar’s gold purchase “appears to be its largest monthly acquisition on record back to 1967.”

WGC reports that some central banks do not report their gold purchase transactions. “The level of official sector demand in Q3 is the combination of steady reported purchases by central banks and a substantial estimate for unreported buying,” the WGC report claims.

Kazakhstan sold 2 tons of gold during the third quarter, and the country’s central bank was the largest net seller in Q3. WGC researchers say that “it is not uncommon” for central banks “to swing between buying and selling.” The WGC study says that the official sector demand for gold confirms the findings from this year’s annual central bank survey.

“The continued trend of official sector demand for gold corroborates findings from our 2022 annual central bank survey, in which one-quarter of respondents stated their intention to increase gold reserves in the next 12 months (up from one-fifth in 2021),” the WGC researchers conclude in the central bank section of the report.

What do you think about the World Gold Council’s Gold Demand Trends Q3 2022 report? What do you think about the central bank’s quarterly purchases being the most on record in Q3 2022? Please comment below to let us know your thoughts on this topic.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.