According to on-chain data, the Bitcoin leverage ratio (ATH) has reached a new record high. The possibility of a price correction may be imminent.

Bitcoin Leverage Ratio Reaches New Highs, Correction Incoming?

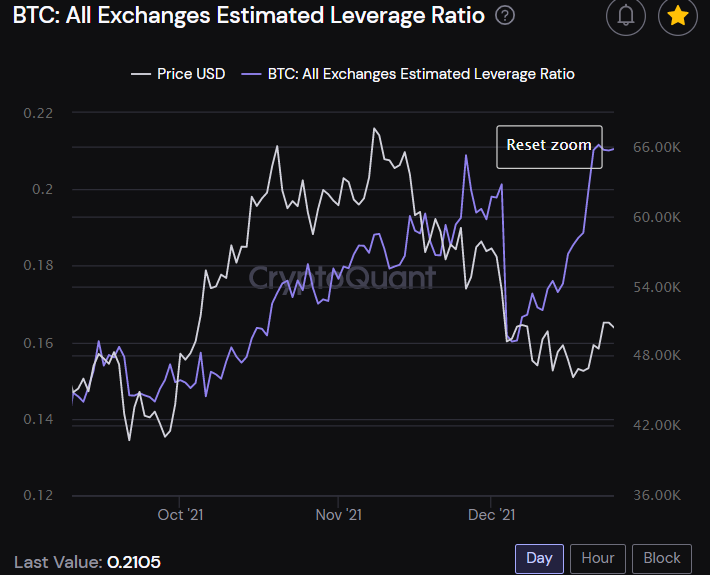

An analyst pointed out in a CryptoQuant posting that the BTC leverage has recently reached a new ATH. The possibility exists that there will soon be a correction to get rid of all this excess leverage.

The “all exchanges estimated leverage ratio” is an indicator that estimates how much leverage is used by Bitcoin investors on derivatives exchanges, on average.

Here are two closely related metrics. The first is the “open interest,” which measures the total amount of futures contracts currently open in the market. And the other is the “exchange reserve” that tells us how much BTC is stored in derivatives exchange wallets.

Leverage ratio equals open interest divided with the reserve. This measure allows you to see if investors are currently taking low or high risks.

If the indicator is worth more, that means that investors have taken on greater leverage. The indicator’s high values could be a sign that investors are taking on more leverage, leading to greater volatility in Bitcoin.

Related Reading: Quant Explains Why Large Bitcoin Leverage Ratios Can Turn Around Prices| Quant Explains How Large Bitcoin Leverage Ratio Can Help Turnaround Price

On the other hand, low values of the indicator imply there isn’t much leverage in the market right now. Below is a chart showing the change in BTC’s leverage ratio over time.

Source: CryptoQuant| Source: CryptoQuant

The Bitcoin leverage ratio is on the rise, as you can see from the graph. This metric has also reached an all-time record.

Related Reading| Growth Of Bitcoin ETFs & Other Instruments Doesn’t Support Supply Shock Narrative

A quant thinks that high levels of this ratio could mean that the price of the coin will correct soon, wiping out all of its excess leverage.

BTC price

At the time of writing, Bitcoin’s price floats around $50.9k, up 11% in the last seven days. The crypto suffered 6% losses over the last 30 days.

Below chart displays the five-day trend of Bitcoin’s prices.

BTC's value jumped up a few weeks ago but has been moving sideways since. Source: BTCUSD on tradingView| Source: BTCUSD on TradingView

Bitcoin has established a footing above the $50k price level in the past few days, but it’s unclear at the moment when the coin might retest higher levels. This recovery could be wiped out if the leverage ratio continues to rise.

Unsplash.com featured image, Charts from TradingView.com and CryptoQuant.com charts