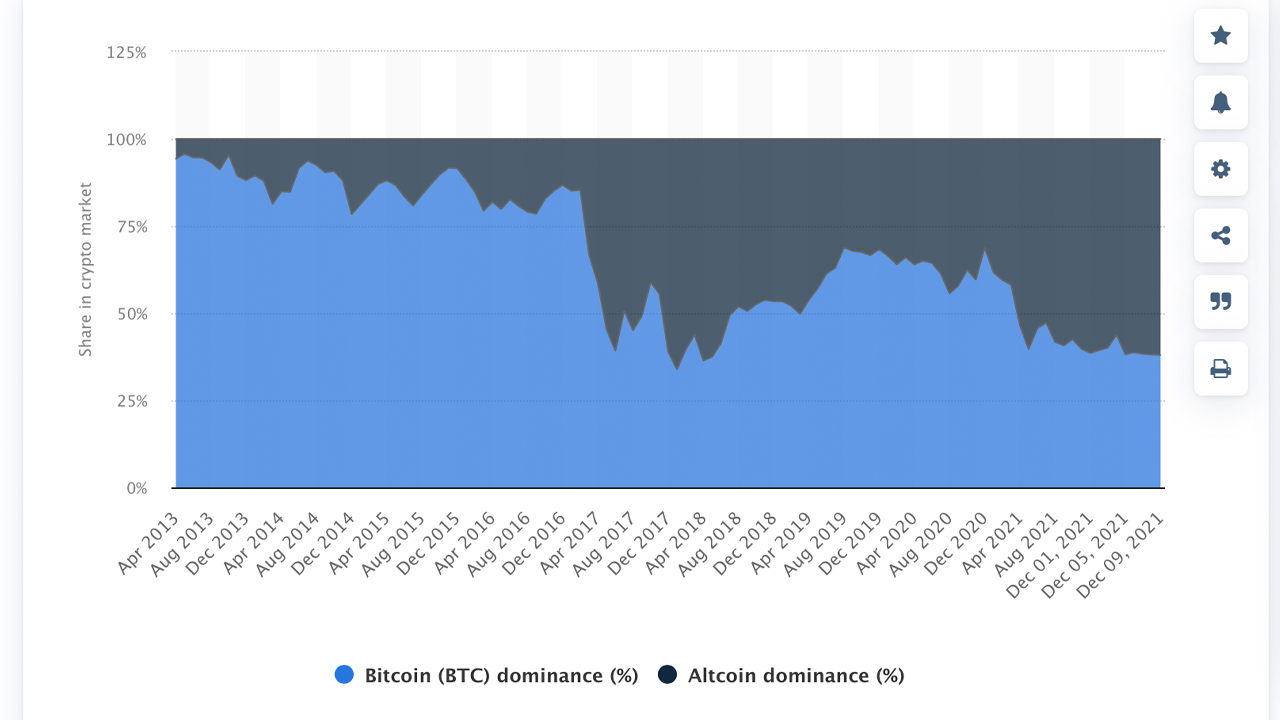

Bitcoin dominance, at 37%, has fallen to its lowest level in nearly three-and-a half years. This was on June 3, 2018. Bitcoin dominance hovered at just over 60% last March. But, since then many digital asset market caps has risen in value, gaining prominence in the market rankings.

Bitcoin Price Drops below 38%

At the moment, approximately 12.247 crypto assets are traded worldwide on 542 exchanges. The crypto market has lost over 7% in the last 24 hour, falling to $2.16 Trillion by 8:00 am (EST)

While people measure the individual crypto market capitalizations regularly, bitcoin’s market valuation dominance, compared to the rest of the capitalizations, has been measured since the existence of multiple crypto markets.

BTC dominance was very high in the 90-90 range during the first couple of years. BTC dominance reached 94% in May 2013.

It was compared to crypto assets such as namecoins, novacoins, litecoins, terracoins, feathercoins, freicoins, and litecoin. Between May 2013 and February 2017, bitcoin’s market dominance remained above 80%.

Bitcoin has been stuck in the 80% area since February 26th 2017. It has only managed to reach 70% this year, just one year after its peak of 70%.

11 coins, plus Bitcoin and Ethereum, command over 20% of the Crypto Economy

BTC’s dominance is currently coasting along at 37.7% while ethereum (ETH) commands 18.6%. While ethereum is a formidable foe, many other crypto caps have been moving in on bitcoin’s dominance territory.

More than 15% of $2.18 trillion in crypto currency is owned by xrp, binance coin (tether), solana coin, usd coins, cardano and cardano. These coins are equivalent to 20.63% in the crypto economy.

These coins include ethereum, removing SHIB and all hold over 1% in crypto market value dominance. Since January 2021, when BTC’s dominance was 70%, a myriad of altcoins have been nipping at bitcoin’s market cap heels.

What do you think about bitcoin’s low dominance levels today? Comment below to let us know your thoughts on this topic.

Image creditShutterstock. Pixabay. Wiki Commons. Statista.

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.