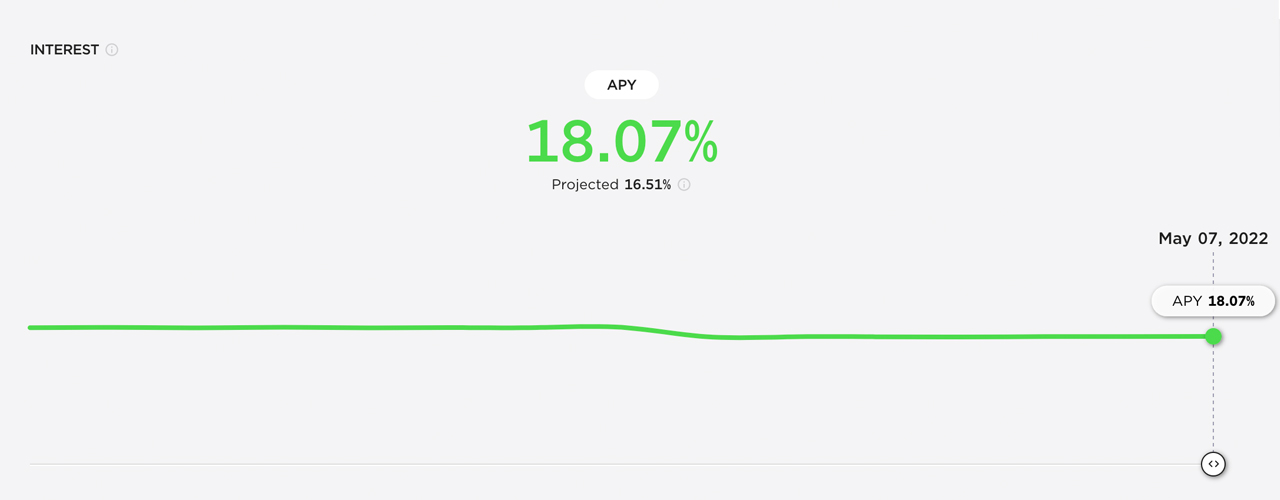

Following the governance vote that aimed to implement a semi-dynamic earn rate for the Anchor Protocol, the decentralized finance (defi) platform’s earn rate adjusted downward for the first time this month. After holding steady with a 19.4% annual percentage yield (APY) since the project started, Anchor Protocol’s earn rate is now roughly 18% APY for the month of May.

Defi Lending Protocol Anchor’s Earn Rate Adjusts Downward

Anchor Protocol, a lending platform that offers loans to individuals and businesses with $16.5 million in total value (TVL), is today’s third largest defi protocol. Statistics show that during the last 30 days, Anchor’s TVL has increased 9.25% since last month.

About 45 days ago, the team responsible for the lending protocol AnnouncementThe proposal passed. Now, the decentralized market for money would earn a variable rate. Anchor users would receive a constant 19.4% APY rate for their UST deposits each month before the proposal.

Today’s semi-dynamic adjustments were made to the deposit rates at the beginning of May after the Governance vote was passed. Depositors now receive around 18% APR. The earn rate has been adjusted to allow for a change in yield reserve. It can be increased or decreased per month up to 1.5%.

The current 18% APR means that depositors will receive less this month than before the adjustment change. Furthermore, in June the earn rate could very well change again depending on the protocol’s yield reserves.

Anchor Protocol supports now two blockchains. Avalanche support has been recently added. While $16.27 billion stems from Terra-based tokens, $202.48 million worth of Anchor’s TVL is comprised of Avalanche-based tokens. Currently, there’s $2.9 billion that’s been borrowed from the Anchor Protocol in defi loans.

Following the most recent changes, Anchor’s earn rate fluctuates. defi forex reserve purchasesLuna Foundation Guard, (LFG), made. Non-profit organisation based in Singapore uses the reserves to support terrausd and LFG has 80,394 BTC valued at $2.89 Billion. AVAX – $100,000,000.

With Anchor Protocol changing its incentives to a semi-dynamic earn rate, it will be interesting to see if it affects the platform’s TVL, which has seen growth month after month. During the past 24 hours, Anchor’s TVL has dropped by 2.89% and this week it’s dipped by 0.66% in the past seven days.

What do you think about the Anchor Protocol’s earn rate adjusting? Do you think it will affect the defi protocol’s popularity? Comment below and let us know how you feel about the subject.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.