The onslaughts continue to be a challenge for crypto. Like other financial markets it has experienced a lot stress due to the ongoing political tensions. The digital assets have been holding up well and investors are finding solace. Although the returns have not been spectacular, it hasn’t caused a significant drop in price. But it hasn’t helped market sentiment much.

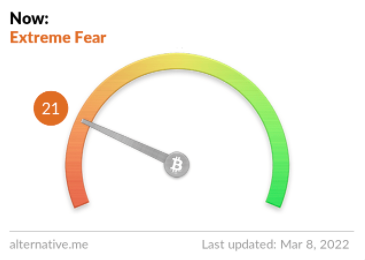

Investor sentiment is a major driver of the crypto market. Sentiment can also be a sign of market direction depending on the extent to which it skews. Currently, market sentiment is very much in the negative territory as evidenced by the Fear & Greed Index.

Extreme Fear Causes Market Fall

The Fear & Greed Index is an index that measures market sentiment across a number of factors. It uses this method to give investors a rating on the market. As the sentiment index has fallen into extreme fear territory, this week was not a positive one for crypto markets. After spending the majority of last week in the neutral territory, the Fear & Greed Index has not pointed its finger at Extreme Fear.

Green Mining Company HIVE Secures Deal To Buy A Number Of Intel’s New ASICs| Green Mining Company HIVE Secures Deal To Buy A Number Of Intel’s New ASICs

This is due to falling prices. The price of bitcoin, which was at the $40K-$44K mark last week, began to fall after the weekend. The digital asset fell below $40,000 again by the start of week two. This took the entire market with it. The sentiment rapidly turned negative and the index fell into extreme fear territory.

Market goes into extreme fear | Source: Alternative.me

The March month will likely follow February’s lead, closing out Fear month. Currently, the crypto market is at a score of 21 on the Fear & Greed Index. Although this is not the lowest index score in recent years, it’s still quite low.

It’s time to get into crypto!

Given the volatility of cryptocurrencies, timing market movements can prove difficult. Investors can still use indicators to determine the optimal time to get into the market. One of those indicators that investors often use to determine if they should enter the market is the Fear & Greed Index.

Similar Reading: Crypto Markets Recover Following Weekend Decline| Crypto Markets Slightly Recover After Weekend Decline

There is a saying in the investing world, “buy when there is blood on the streets”. This means that assets should be bought when the market is low. A good indicator of a buying opportunity is the fact that others may be afraid or wary about entering the market. The belief that when this happens, people start packing their bags. As a result, assets’ value will rise.

Source: Crypto Total Market Cap on TradingView.com| Source: Crypto Total Market Cap on TradingView.com

But, sometimes things don’t go according to plan. Sometimes even investing in digital assets while the market is low doesn’t guarantee that there will be a rebound. It is not easy to predict the crypto market’s future. Investors may believe that prices will fall further, but they often do. Therefore, the ideal time to purchase crypto depends on individual investors’ experience.

TED Featured Image, Chart from TradingView.com