Bitcoin finally feels some relief following a period of relentless selling pressure at the beginning of 2022. First crypto trades on market cap at $36,815 and earns a 9.6% profit within 24 hours.

Similar reading: BTC Supply Shock: Only 12 % of BTC Supply Are Available On Exchanges Now| Bitcoin Supply Shock: Only 12% Of BTC Supply Is On Exchanges Now

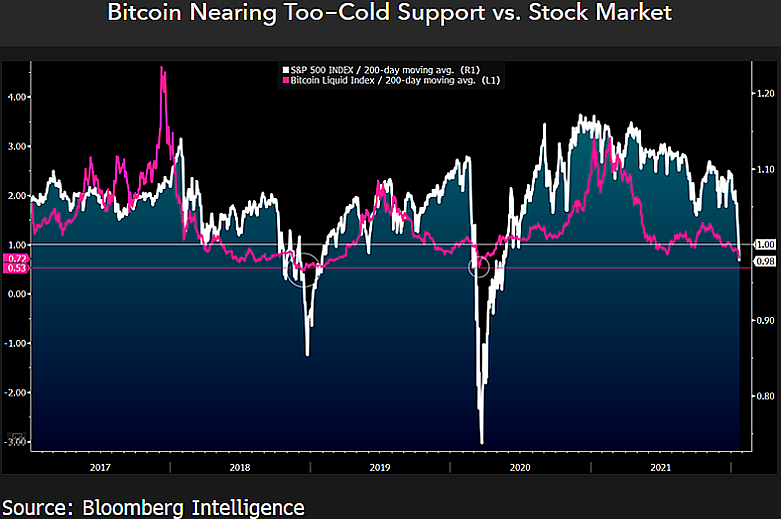

Bitcoin is moving towards a 1:1 correlation to the U.S. Stock Market, in the short term, according to Bloomberg Intelligence’s Senior Commodity Analyst Mike McGlone. According to Bloomberg Intelligence’s Senior Commodity Analyst Mike McGlone, the crypto market is reacting to any shift in U.S. Federal Reserve’s monetary policy.

The financial institution has hinted at an increase in its interest rates to, at least, a 0.25% in 2022’s Q1 and a tapering of their asset purchase. Inflation is being stopped as the CPI has reached a record high of 40 years. It has led to a selloff, which began in the fourth quarter of 2021.

In addition, investors seem to be trying to get ahead of a potential hike in interest rates, a thesis which could receive confirmation tomorrow during the FED’s Federal Open Market Committee (FOMC). Bitcoin might regain its critical support level of $33,000, if the institution hint at a harder shift.

The expectation of such and other events could lead to investors sitting on cash waiting for the right time to trade BTC. The demand for risk assets remains low, and this could continue in the future.

John Nash Analyst believes the FOMC meeting is already priced in with a “too early” reversal in Bitcoin and other cryptocurrencies. However, Nash expects to see a stronger bounce towards $40,000, before BTC’s price dives back into the $25,000 to $28,000 range.

Bitcoin needs to turn $36,000 from local resistance and $38,000 in support for it to move towards $40,000. After, Nash believes investors should follow the old adagio but with a twist: “Buy in May and go away”.

The Rise of Bitcoin in 2022

McGlone seems to agree with him on this point. On current market conditions, the Bloomberg expert is bullish about Bitcoin and cryptocurrency. In fact, he believes the upcoming shift in economics will provide legitimacy for the digital asset market, at the very least, BTC and ETH. He said:

Cryptos are likely to see price reversion after being the poster child for speculative inflationary excesses in 2021. But Bitcoin will win.

Related Reading| TA: Ethereum Turns Red, What Could Trigger Steady Recovery

Others expect similar results with BTC being able to track the traditional stock market and gradually decoupling as BTC shows greater strength when stocks are weak. According to MacroScope (a pseudonym), the market capitalization of crypto has decoupled from futures. According to the analyst said:

BTC is no secret. It has been closely tied to stocks and has become an asset that can be risky. However, stocks are taking a tumble so be on the lookout for decoupling. It could be either gradual or abrupt. A few scenarios are possible (longer tweet). If it happens, would be “shot heard ’round the world” for macro managers.