The fear and greed index fell to levels not seen since July last year, following the Bitcoin crash that cost $42k.

Bitcoin Fear And Greed Index Points At “Extreme Fear”

In a CryptoQuant article, an analyst noted that BTC’s fear and greed index dropped to low levels.

The “fear and greed index” is a crypto indicator that measures the general sentiment among investors in the market.

Indexes use numbers to express sentiment using a numerical scale from zero to 100. If the value of the indicator is above 50, it means that current holder sentiments are greedy.

Market fearfulness is indicated by values lower than 50. Index values below 25 and those above 75 fall into the “extreme” category, signifying extreme fear and extreme greed, respectively.

In bull runs, it is more likely to remain in the greed area. Extremely greedy values in the indicator have been a sign that Bitcoin’s price is on its way down. A top may also be possible.

However, extreme fear could indicate that there is a bottom.

Bitcoin Whales Contribute 90% Of Money Inflow of Exchanges, How Can We Follow and Make Profits?| Bitcoin Whales Contribute 90% Of Money Inflow of Exchanges, How Can We Follow and Make Profits?

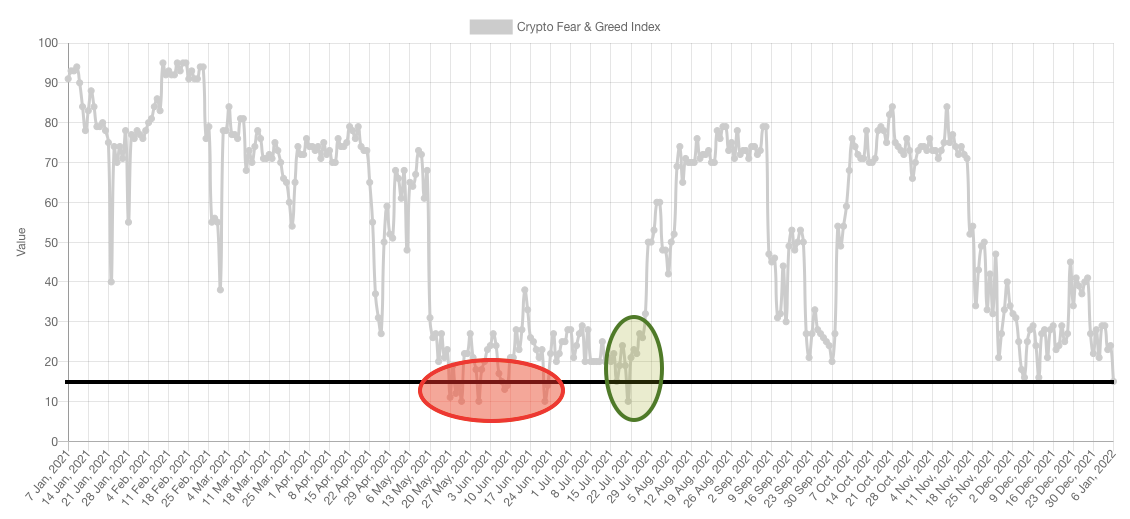

Here’s a chart showing the Bitcoin fear-and-greed index trend over the last year.

Source: CryptoQuant| Source: CryptoQuant

The indicator is now at 15. This is the lowest metric since July last year.

Similar Reading: Start of Bear Period| Start Of Bear Period? The Current Bitcoin Trend Is Very Similar to June

Interestingly, July was the same day that such low Bitcoin prices occurred as the date when Bitcoin’s price reached its lowest point. However, the quant in the post notes that this doesn’t necessarily mean that the current price has hit a bottom as well.

After the May crash, months May and June saw extreme fear sentiments several times.

So, it’s rather possible that the current low values of the indicator may persist for a while, just like back then, before the price finds its way back up.

BTC Prices

At the time of writing, Bitcoin’s price floats around $42.4k, down 12% in the last seven days. In the past month, crypto lost 16%.

Below is a chart showing the change in BTC’s price over the past five days.

BTC dropped further to $41k yesterday after the price crash to $42k a few weeks back. Source: BTCUSD at TradingView| Source: BTCUSD on TradingView

Unsplash.com featured image, Charts from TradingView.com and CryptoQuant.com charts