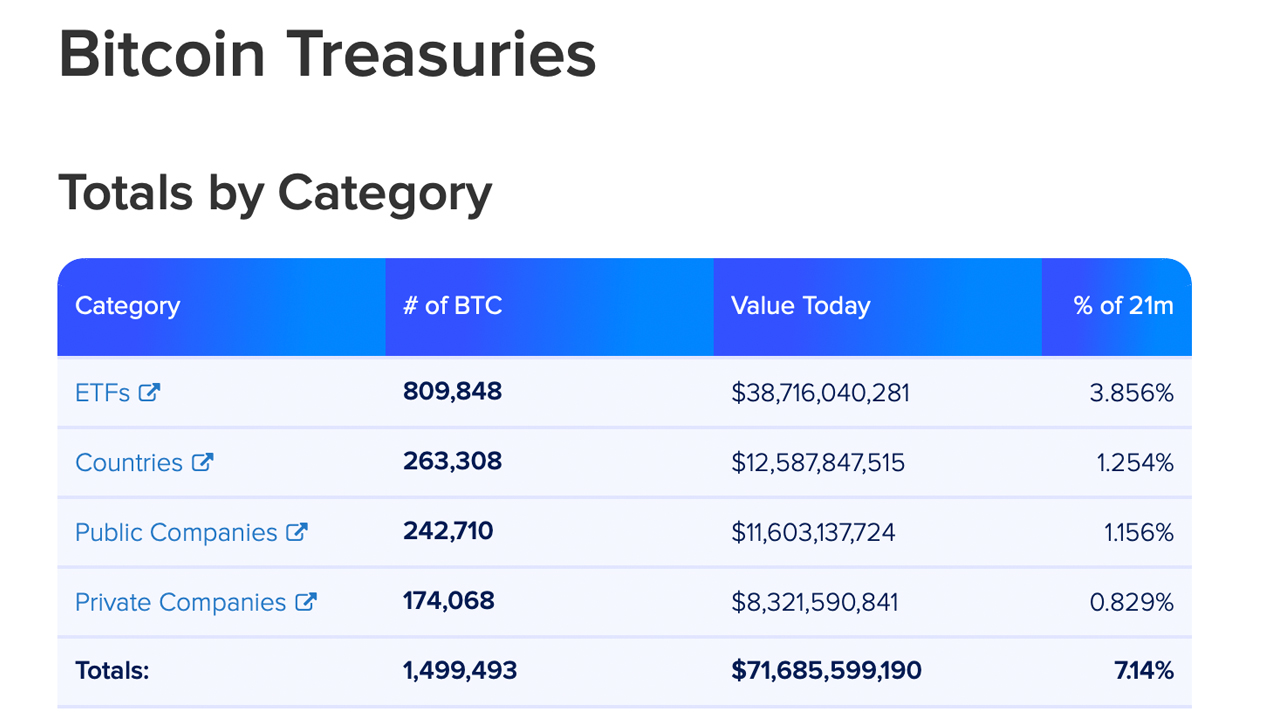

42 companies had bitcoin in their balance sheets 304 days ago. This was roughly nine months before the current crisis. The total bitcoin held on these accounts was 1,350,073 on March 1, 2021. At the moment, metrics show that there are only 59 businesses, some countries and exchange-traded fund (ETF) holders of 1,499,493 Bitcoin in treasuries.

Private and Public Companies, ETFs, and Countries — Treasuries List Highlights 59 Firms With Bitcoin on Their Balance Sheets

Over the last 12 months, a great number of companies have disclosed that they have added bitcoin (BTC) to the firm’s balance sheet and even countries like El Salvador are now storing BTC in their national treasury.

Bitcoin.com News announced that 42 companies were comprised of both public and private businesses, as well as bitcoin funds, on March 1, 2021. At the time 1,350,073 BTC was held by the company’s and it represented 6.43% out of the 21 million maximum supply.

Now similar to Microstrategy announcing a BTC purchase every so often, the Salvadoran president Nayib Bukele has also been telling the public about El Salvador’s BTC acquisitions. To celebrate December 21, El Salvador bought 21 BTC.

The Bitcoin Treasuries list hosted on buybitcoinworldwide.com shows that there are 59 companies that hold BTC on their balance sheets and five different countries. The web portal states that these entities hold 1,499 493 BTC as of the date of writing.

These figures are equivalent to $71.6 million in USD and 7.14% from the 21,000,000 BTC supply. Bitcoin Treasuries lists that BTC is owned by five countries. The first is Bulgaria. But, there is controversy over the fact that the Bulgarian authorities have 213,519 BTC. Many people believe these coins were sold.

In April 2018, the regional news publication Bivol explained that Bulgaria’s finance minister, Vladislav Goranov, explained that the BTC was sold. Goranov noted that the BTC was sold to “several sovereign wealth funds and Asian investors.” It also noted that Deloitte and the FBI helped facilitate the sales and the BTC was sold for €15,000 per unit.

If that stash is taken off the Bitcoin Treasuries list’s aggregate, the current BTC held by companies and four countries would be 1,285,974 BTC worth $61.1 billion. So, according to Bitcoin Treasuries’s list, El Salvador now has 1391 BTC. The UK government has 46.351 BTC. Finland holds 1,981 BTC. Georgia holds 66 BTC.

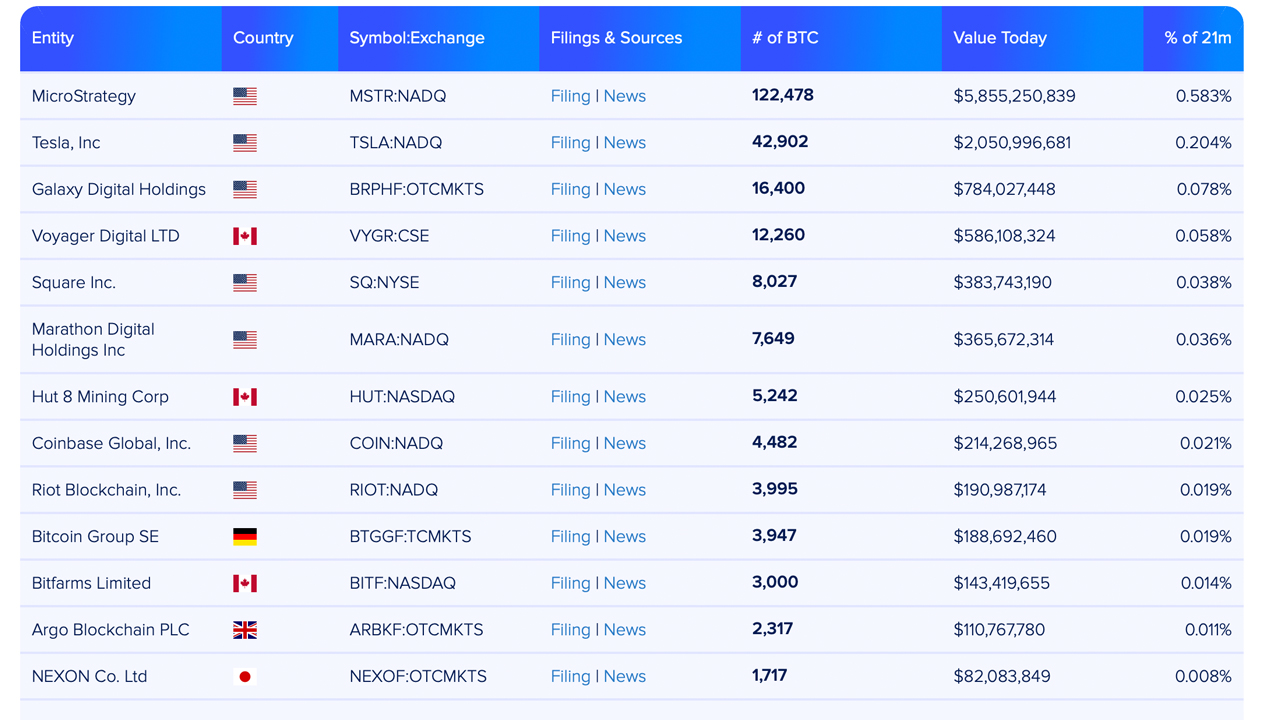

Microstrategy, Tesla, Galaxy Digital Hold the Top 3 Public Company Positions — Block.one, Tezos Foundation, Stone Ridge Hold the Top 3 Private Company Positions

The Bitcoin Treasuries list would then be relegated to private companies and public firms. Microstrategy is the publicly traded company that has the highest amount of Bitcoin at the moment of writing, or $5.8 million worth, according to Bitcoin Treasuries.

However, the company’s CEO Michael Saylor told the public it purchased 1,914 BTC on Thursday. According to the Bitcoin Treasuries List, Galaxy Digital and Tesla hold the 2nd and 3rd largest bitcoin amounts respectively in relation to public companies.

According to the list, Tesla has 42,902 BTC and Galaxy Digital has 16,400 BTC. These two public companies are closely followed by Square Inc. (12,260 BTC), Voyager Digital LTD (8,027 BTC) and Marathon Digital Holdings (7.649 BTC).

That leaves 39 public companies holding BTC on their balance sheets with firms like MOGO Financing (18 BTC), Phunware, Inc. (127 BTC), Coinbase Global, Inc. (4,482 BTC), and Brooker Group’s BROOK (BKK) (1,150 BTC).

Six other private firms also hold bitcoin, including Block.one (145,000), The Tezos Foundation (17500), Stone Ridge Holdings Group (10000), Massachusetts Mutual (3500), Lisk Foundation (1.898) and Seetee AS (1.170).

Grayscale’s Bitcoin Trust Dominates the Entire Bitcoin Treasuries List, ‘Who Owns All the Bitcoin’ Lists Are Not Entirely Accurate

According to the listing, 14 funds own 809,848 BTC. The Grayscale Bitcoin Trust, (GBTC), holds 648.069 BTC. Following GBTC there are funds such as CoinShares / XBT which holds 48,466 Bitcoins, Purpose Bitcoin ETF, with 22,411 Bitcoins, and 3iQ Coinshares Bitcoin Bitcoin ETF, which holds 21,237 Bitcoins.

The Bitcoin Treasuries list gives a fairly good glimpse of a number of companies claiming to hold BTC on their balance sheet and it’s a great deal larger than it was last year. However, just like the discrepancy with the Bulgaria bitcoin stash mentioned above, none of the so-called “who owns all the bitcoin” lists are entirely accurate.

In fact, without cryptographic proof, these types of lists don’t hold water when it comes to actual onchain verification and actual “proof-of-reserves.” Despite this issue, the lists are useful for a visual perspective, of what could be the case, if a majority of these entities are being truthful about their BTC reserves.

How do you feel about Bitcoin Treasuries’ list at the close of the year. Please comment below to let us know your thoughts on this topic.

Images Credits: Shutterstock, Pixabay, Wiki Commons, buybitcoinworldwide.com’s Bitcoin Treasuries list.

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.