The Bitcoin price is hanging by a thread as it retraces its gains from yesterday’s trading session. The price action is being dominated by macroeconomic forces as Bitcoin, the top cryptocurrency in market capitalization, looks towards the dark abyss for a new leg down.

Bitcoin prices trade at $19,000. There is a 5% loss, and a profit of 1% over the last seven days and 24 hour. BTC has identified two support levels that could be used to stop further downsizing.

Bitcoin price reacts bearish to ECB interest rate hikes

Today was poised to be a volatile day as the Chairmans of two of the world’s largest central banks, the European Central Bank (ECB) led by Cristine Lagarde and the U.S. Federal Reserve (Fed) led by Jerome Powell, made important announcements.

A 75-basis points rate increase was announced by the ECB, which is also its biggest ever. In the coming months, the financial institution will continue to hike as they aim to “dampen demand and guard against the risk of a persistent upward shift in inflation expectations”.

The ECB wants to prevent the Euro from falling against the U.S. dollar, in addition to stopping inflation (the same goal as the U.S. Fed). People have been shifting to the dollar in light of current macroeconomic uncertainties and the rise in global energy prices.

It has caused a collapse in European currencies, legacy financial markets and the Bitcoin price. Lagarde announcedAccording to their measurements, the Euro witnessed a minor spike that could indicate an optimistic market view.

Tweet

Bitcoin and Liquidity: Can Bitcoin Help?

Powell and Lagarde agreed that there is more financial pain in the near term. Although the Bitcoin price initially reacted negatively to this, it is now at critical support. It may be possible to rebound from $19,000

To prevent any further downturn, bulls should maintain this support level of $18,600. NewsBTC yesterday reported that bulls must reclaim higher levels of $19,000 and above $20,500.

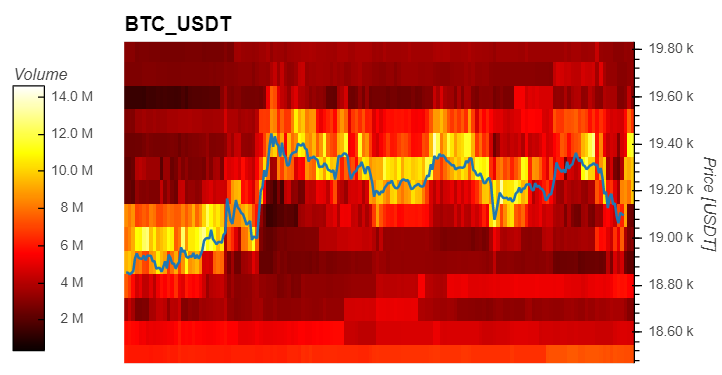

Material Indicators data suggests that there are short-term headwinds. The Bitcoin orderbook has seen a surge in sell (or ask) liquidity. With around $10,000,000 in ask orders, $19,000.400 appears to be a critical timeframe resistance.