Bitcoin’s trend is sideways in the U.S weekend, with its price dipping between $19,500 to $20,500. This support might come under pressure as number one cryptocurrency Bitcoin struggles to keep its current levels.

Bitcoin (BTC), which trades at $199,000, has a 1.4% profit for the past seven days, and sideways price movement in the past 24 hours. BTC’s price is heavily underperforming other cryptocurrencies as Ethereum (11%), Cardano (14%), and Polkadot (10%), recorded significant profits over the same period.

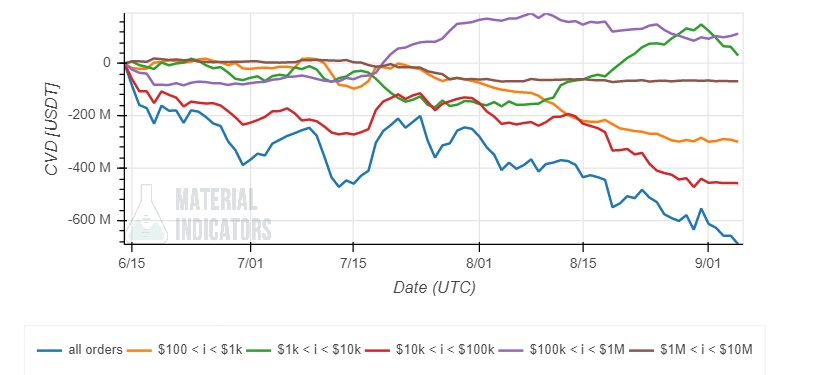

Material Indicators’ data indicates that there is a possibility of a Bitcoin local top in the near future, as liquidity increases around it. The volume of selling orders has increased in the past week due to Bitcoin trading sideways. It might be a resistance that prevents BTC from recovering the $20,000.

See the graph below. As ask liquidity grows, bid (buy), orders decrease at around $19,000. This is contributing to the weakness of this key level in short time frames. $19,000 is the next support, currently holding $15 million worth of buy orders.

A rise in demand liquidity is correlated with an increase of selling pressure by small investors to Bitcoin whales. As the price of Bitcoin trended to the upside in August, larger players took advantage of the relief and “dumped” into the market.

The smaller investors followed suit, though with a slower reaction. The Bitcoin whales are still flat, with only around $100,000 in bid orders showing an increase.

A Glassnode report also shows that Bitcoin whales were selling their coins when the Bitcoin price rises. It is part of the second phase of distribution for crypto markets after a capitulation. Glassnode observed:

After months of accumulation, market rallied above $24k. However, as WoC 34 was and 35 explains, exit liquidity was available via distribution and profit taking.

Bitcoin Can Reclaim $20,000 in the Short Term

The key area of resistance is $24,000, as mentioned above, and $24,500 as whales with over 10,000 BTC are using this zone to “aggressively distribute coins into the range”, the report noted. To prevent any further decline and regain bullish momentum, bulls need to push beyond these levels.

Users have noticed that Bitcoin’s price has been moving around $19,500, causing short positions to mount. Over the past week, the market has liquidated millions from wiped-out shorts as BTC’s price trends closer to $20,000.

This may give the market enough ammunition to shorten the squeeze over $20,000 and get into areas of crucial resistance.

To fold Binance shorts, it took only a 2 % pump.

These guys are doing what in tarnation? pic.twitter.com/Zn4g6qvBpm

— Byzantine General (@ByzGeneral) September 5, 2022