Five South Korean major exchanges have announced that they will delist Litecoin. Recently, the cryptocurrency released an updated to enhance its security and scaleability.

Similar Reading: Litecoin Announces Rollout Date for MimbleWimble. Will LTC See Relief| Litecoin Reveals Rollout Date For MimbleWimble, Will LTC See Relief?

Upbit and Bithumb, Korbit and Gopax will cease offering Litecoin products to their customers. Litecoin is now incompatible to South Korean regulations.

Upbit claims that these trading pairs will not be available as soon as possible in its official delisting announcement. This was published by the platform on June 8.ThLTC/KRW and LTC/BTC. LTC/USDT. According to the exchange, this is because of:

(…) it is believed that the upgrade has been carried out with a selection function that does not expose transaction information.

The decision is guided, the post continued, by South Korea’s Specific Financial Information Act. This regulation demands exchange platforms to check a blockchain’s transaction for “transparency”.

In that way, Upbit and other South Korean exchanges can verify that the user or the transaction doesn’t violate the country’s anti-money laundering regulations. It also helps to prevent bad actors from using illegal activities to get funds.

South Korean exchanges believe that the MimbleWimble Update will enable the Litecoin Network to have these capabilities.

LTC (Local Transfers) can see technology being added that would make transfer records impossible to identify. So we designated it as a major issue. There haven’t been any Upbit deposits yet, so we don’t plan on reflecting deposits.

The MimbleWimble and Litecoin’s new privacy features seem to affect South Korean exchanges. Over the past 2 years, however, major trading platforms have removed privacy coins.

Monero, Zcash and other exchanges worldwide made the same decision. This possibility could be unleashed by the MimbleWimble for LTC.

Litecoin Unaffected By South Korean Exchanges’ Decision

At the time of writing, LTC’s price seems unaffected by recent developments. Trades for $62. The price of LTC continues its sideways movement.

The larger cryptocurrency cryptocurrencies such as Bitcoin or Ethereum continue to follow the same course, but they still remain limited and are unable break through local resistance. Only Cardano, due to a spike in network activity, as well Chainlink (LINK) because of its roadmap on staking seem to be disconnecting from the entire market.

Santiment, a Research Firm noted:

The opening week of June saw crypto prices fall dramatically, although there was little to no movement in Bitcoin or Ethereum. Altcoins on the other have demonstrated significant decouplings between them, with ADA and LINK And HNTPerform well.

Litecoin Drops 87% Trading Volume In Q1 2022| Litecoin Drops 87% Trading Volume In Q1 2022

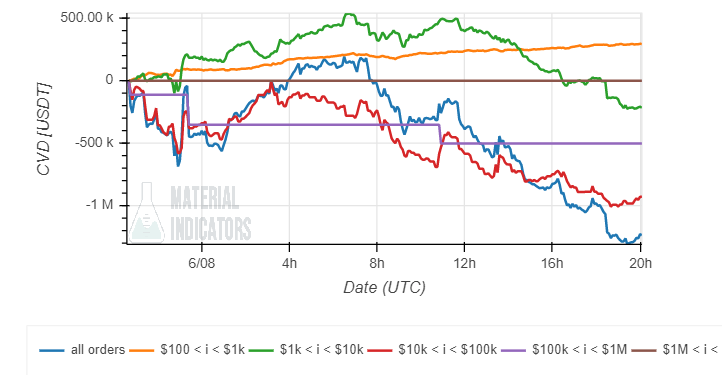

Data from other material indicators also shows an increase in orders from retail investors for shorter timeframes. Although larger investors appear to have been buying into current price action it’s too early to know if this trend will continue in the future.