Ethereum is in a bearish market since 2022. To date it has fallen 40%, which is far lower than any other cryptocurrency. ETH is a cryptocurrency that has been performing well for a while.

It has outperformed Bitcoin since its inception in 2016. This has led to a smaller gap in market capitalization between the coins. But this year’s performance has taken a big step back from its long-term trends. Due to the decline in the NFT craze, a key incentive for Ether purchases has been removed. Traders are now the main users of ETH, while demand is lower than in late 2017.

Ethereum’s Price Changes

As the market continues to consolidate between $2,600 resistance and $2,500 support, there has been no clear direction for the past 24 hours. We can therefore expect another push either way after the USD/ETH splits.

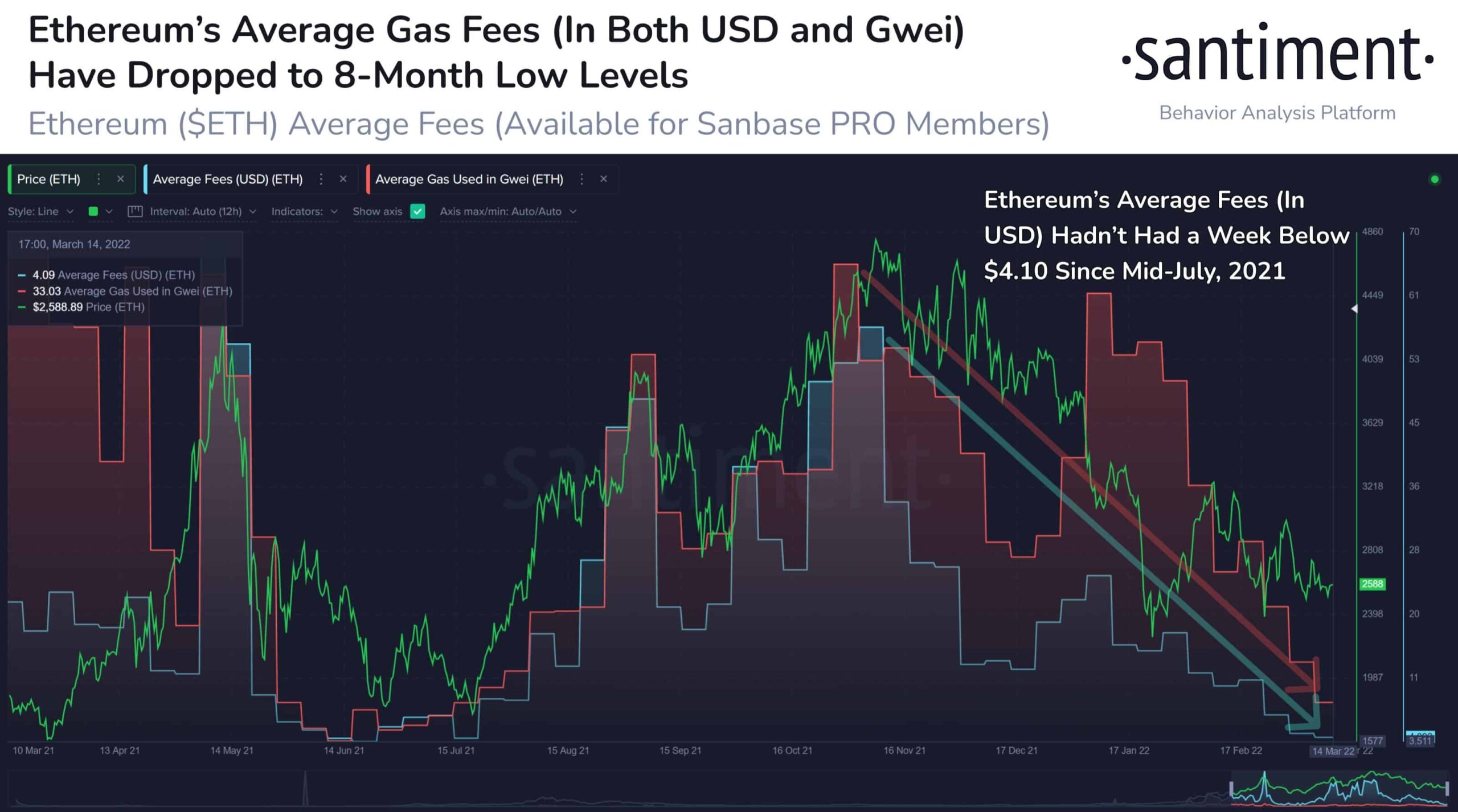

As a consequence, Ethereum’s (ETH) blockchain has been undergoing major changes. Santiment is an online data source that tracks Ethereum prices. This news is good for ETH investors. Santiment claims:

Ethereum’s price is hovering around $2,560 at the moment. Aside from the tight liquidity, #SP500It has a lot of correlation right now, even more than Bitcoin), it’s also seeing 8-month low fees right now. $ETHLast year, fees were below $4.10 by mid-July.

Source: Santiment

The market has seen a slight increase in the past 24 hours. They both continued to consolidate and Bitcoin gained 0.38, while Ethereum gained 0.34. The rest of the market saw similar price activity.

Related Reading| Where Ethereum and Bitcoin Headed After Musk’s Tweet

Investors see the upside

CNBC’s Bill Barhydt told CNBC Monday that Ethereum can reach between $30,000 and $40,000.

Bill’s enthusiasm is growing due to the many use cases and advancements in Ethereum. He spoke out.

“Ethereum’s network effect is based on this idea that it could become the world’s computers. It’s being used for stablecoins, NFTs (non-fungible tokens), defi (decentralized finance) … and gaming now.”

The Ethereum 2.0 update will be available by the middle 2022. He believes that after the initial rush to stake, there may be a “sell-the-news effect.” However, he is optimistic that if the overall gas fee is reduced, ETH investors will benefit. Bill explained,

“If the gas fees and the transaction fees come down, which is the promise of the proof-of-stake, look out, because now all of the impediments of those network effects are taken out of the way. I think, you are talking potentially $30,000-$40,000 Ethereum”.

Trades in ETH/USD close to $2,500 TradingView

Whatever the rationale for Ethereum’s price remaining in the $2,500 range, there are no technical reasons for it to show any strength. ETH has fallen below the 2022 Volume point of control, is still below the bearish pennant and now is under the 61.8% Fibonacci retracement from the all-time high at the trough on the strong bar of the weekly chart, $2,570.

The Ethereum price’s downside risks are most likely restricted to the $1,800 value level in June 2021 and July 2022.

Abra CEO Predicts Ethereum Could Reach $40,000 – But Some Fintech Analysts Don’t Agree| Abra CEO Predicts Ethereum Could Reach $40,000 – But Some Fintech Analysts Don’t Agree

Featured Image from Pixabay. Chart by TradingView.com