At the time of writing the Bitcoin price was hovering at $19,000, just below the $18,300 local low. The Bitcoin price plummeted to the same level last week when the Producer Price Index and Consumer Price Index data were released.

A surprising rebound occurred, shocking many. With November 02 – when the FED meets again – in mind, the Bitcoin price doesn’t have much room to fall below that level at the moment. A look at the On-chain also suggests that a crash could be imminent, even though there are some positive signs.

AccordingAccording to CryptoQuant, the bear market signal is when all long-term holders’ realized prices (blue line), exceed all other coins purchased (red line), and when all BTC prices fall below both the realized long-term holders’ realized prices and all coins.

This analysis shows that Bitcoin has been in bear markets for 124 consecutive days. As the 50% decline in price from $6,000-$3,000 during the bear market was, this is similar to the $30,000-$18.00 decline.

Despite this, it is possible that the bottom has not been reached yet.

This 41% drop in price from $30.7k at $18.2k is a result of the decrease of $40.7k. BTC could drop 50% to $30.7k, which would mean that it is now $15k. This price represents -18% of the current one. The $14.7k Delta price is similar.

Contradictory on-Chain Data for Bitcoin

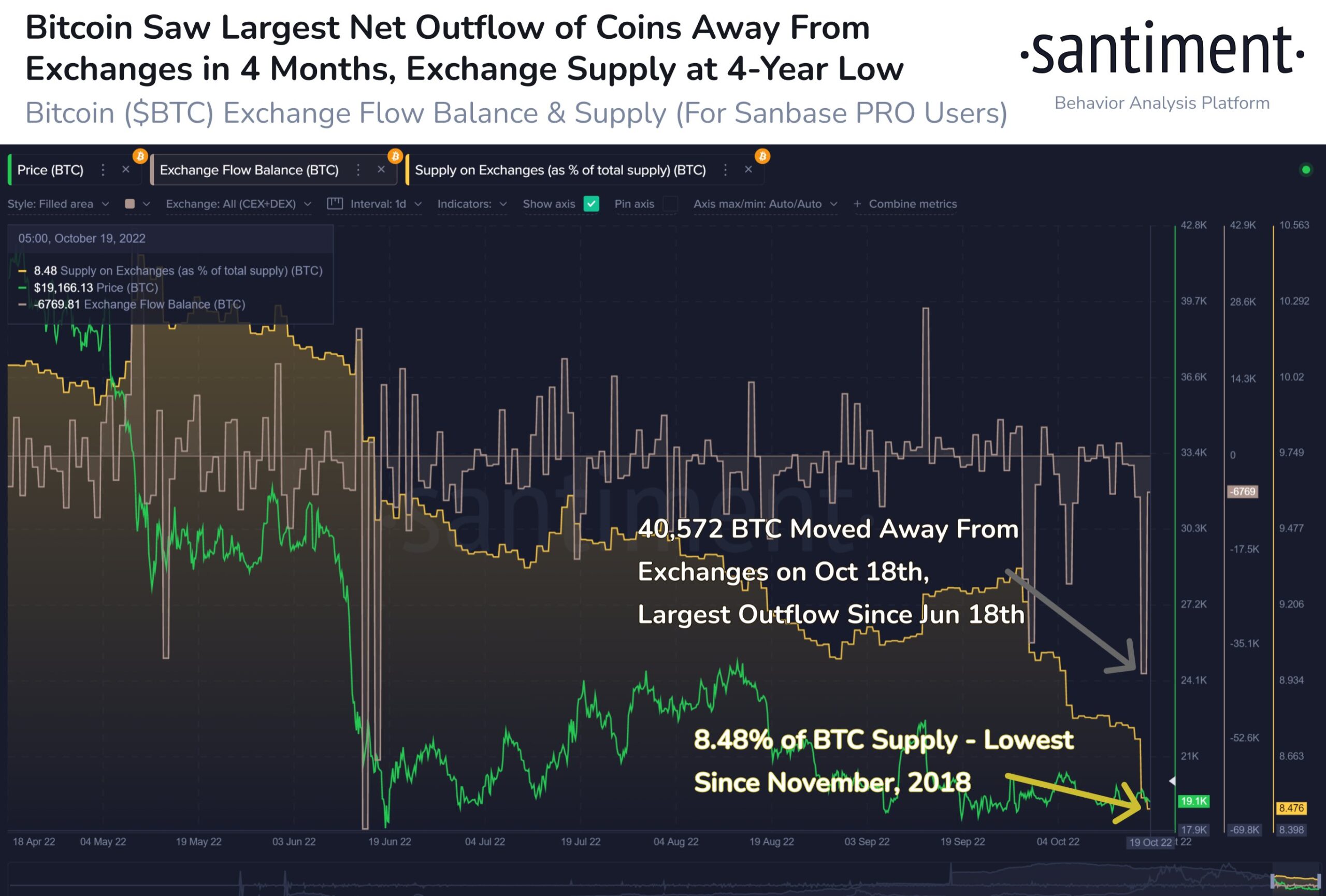

Santiment is another important on-chain analysis company that stated the Bitcoin market should ideally see accumulation right now, while small traders are bearish, spreading doom, and destruction.

This contradictory information is however emerging. Thus, Bitcoin’s small to mid-sized addresses (with 0.1 to 10 BTC) have recently reached an all-time high of 15.9% of available supply. The supply of whales with between 100 and 10,000 BTC has fallen to 45.6% over the past three years.

Bitcoin saw a huge outflow from the exchanges in October 18th, which was bullish. Santiment had the highest daily volume for 4 months with 40,572 BTC. The supply of coins has fallen to 8.48% on all exchanges. The risk of future sell-offs has been reduced at most a little.

Glassnode, the third largest on-chain data provider, also reports bullish data. It is now at an all time low as Bitcoin supply has stagnated for 6 months. The current supply is 18.12% or approximately 3.485million BTC. Glassnode writes:

Mobile supply is usually very small after bear markets.

Jim Bianco was recently elected President of Bianco Research LLC. quoted an old trader’s adage, “Never short a dull market,” which may apply more than ever to the Bitcoin market.

His analysis shows that the realized volatility, which is the amount of backwardation and actual volatility, is at its lowest level in 2 years. It is also one of the highest levels ever recorded.

Apathy is more important than excitement when markets reach their bottoms. BTC and ETH are both apathetic. The S&P 500 is nearly the opposite, as prices move around like a video game. It could also indicate that the tight TradFi/Crypto partnership is ending. This could be a sign that crypto is becoming more bullish in the long term.

This could indicate a shift in the market and trigger long-term, positive trends. Divergence of volatility is one example.