Bitcoin has been trending higher over the past few days, as it approaches its mid-range levels. While the benchmark crypto saw some support in recent days, it seems unlikely to regain its former bullish momentum.

Related reading | Data: Bitcoin Long-Term Holder Supply Has Stagnated Since October High

Bitcoin is trading at $42,500 as of the writing date, with a profit of 4% in the previous day and a profit totalling 12% over the past two weeks.

NewsBTC reported that Bitcoin appears to react to U.S. Federal Reserve’s (FED), shift in monetary policies and the ongoing armed conflict between Russia, Ukraine. In the future, the bank will raise its rates by 25 basic points (bps),

The market was pleased with the increase. The FED is not expected to make any major announcements in the near future.

The diplomatic efforts to resolve the conflict have been unsuccessful. There is no winner in the war on armed conflict. It appears that the parties are at an impasse.

Bitcoin’s market is experiencing a calm and uncertain environment. This could cause it to consolidate further between current levels and the $30,000.

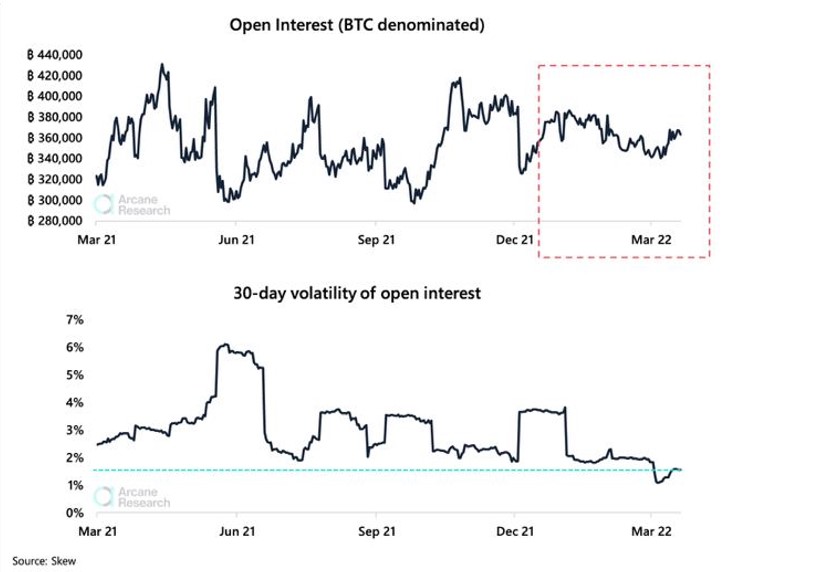

Arcane Research supports this thesis by not recording major changes in Open Interest (OI), for the BTC derivatives sector. Since the beginning of 2022, this metric has been stable at 360,000 BTC or 380,000 BTC.

The OI for BTC Futures is moving in the same direction as Bitcoin’s price, but it has registered a decline in volatility. The BTC market may be in a low period, which could indicate that there are no significant trends.

Bitcoin Open Interest: Consolidation Hinted at Last

Arcane Research stated that there was a 1% drop in volatility in Bitcoin OI OI futures in March. However, it has trended slightly higher the past two week. Current metric stands at 1.5%.

According to the research company, current trading activity is lower than in the same period of consolidation that took place in 2021. Arcane Research also added:

BTC’s open interest at 370,000 BTC is overall still very high. We’ve rarely seen open interest being maintained at such levels for such a long duration without any major squeeze setbacks such as those experienced during the spring and fall bull markets and bitcoin’s short squeeze in July.

Santiment provides additional data indicates Bitcoin’s supply on exchanges has been trending down as the price of BTC consolidates.

As the market reversed its bearish trend, this metric reached a 6-month high in June 2021. As BTC’s price moved further up, the supply followed, but the cryptocurrency managed to score a new all-time high near $70,000.

You may also like these related readings| Ethereum Classic gains 60% in a week, and why the Merge could push its price higher

This chart could indicate a similar trend in which supply decreases and price consolidation is occurring.