Bitcoin continues to underperform as a general “risk-off” sentiment has investors driving toward gold as a safe haven asset.

Don’t Risk It

There are still concerns about the Russo/Ukrainian War. U.S. inflation continues to struggle at its four-decade peak and Fed rate rise fears continue. As a result, a global recession instead of recovery is being expected. The IMF’s managing director Kristalina Georgieva called it “a crisis on top of a crisis.”

“The war is a supply shock that reduces economic output and raises prices. We predict that inflation will increase to 5.5 percent among advanced economies and to 9.3 per cent in emerging European countries, except Russia, Turkey and Ukraine. ” The IMF stated last week.

Reuters recently quoted Commerzbank analyst Daniel Briesemann, who talked in a note about the factors that have “lent buoyancy to gold in recent days,” mentioning the “strong buying interest on the part of ETF (Exchange Traded Fund) investors” and news about the Ukraine war.

“Russia appears to be preparing to launch a major offensive in the east of the country – that is generating considerable demand for gold as a safe haven,” the analyst said.

This summarizes the “risk-off” sentiment at the moment. Equities are suffering as investors sell risky assets to buy those that have negative correlations with the traditional markets. The crypto market is also struggling, as is the gold market.

Bitcoin Outperformed By Gold

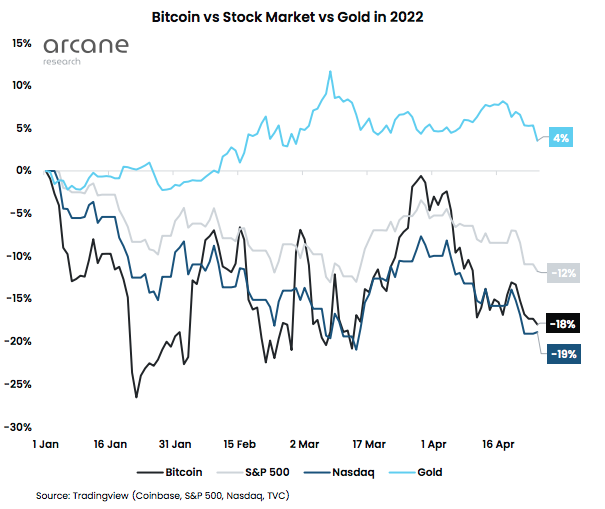

Data from Arcane Research’s latest weekly report notes that it has been a gloomy year for the “digital gold.” In the first three weeks of 2022, Bitcoin sank 25% and it is still down by 18% in the year despite its slight recovery.

Similarly, Nasdaq records a 19% decline in the year, having underperformed against bitcoin “by a small margin,” notes the report, adding that “This is surprising given that bitcoin has tended to follow Nasdaq, albeit with higher volatility.”

Fear over global and macroeconomic uncertainties has made gold the new safe-haven asset. With a gain of 4%, the asset beat all other indexes.

Meanwhile, the currency market is performing with “the same risk-off patterns.” The Dollar has been proving its “risk-off” dominance as the US Dollar Index (DXY) is up 7%. The Chinese yuan has taken a hit over concerns about the country’s “zero-covid” policy –which creates issues for the global supply chain– and the slowing down Chinese economy. For safety, however, many investors are now turning to the US Dollar.

Bitcoin supporters usually refer to the coin as “digital gold” alleging it is a safe haven asset, and this narrative had held well while BTC had been “uncorrelated with most other major asset classes,” but the tide is shifting with the 2022 scenario as investors are rather placing the coin “into the risk-on basket”.

A previous Arcane Research report indicated that bitcoin’s 30 -day correlation with the Nasdaq is revisiting July 2020 highs while its correlation with gold has reached all-time lows.

A pseudonym traded noted that “As Bitcoin The market is becoming more open to institutional investors, and adoption continues. BTC Stocks become more tightly regulated. This is an idea that crypto-worlds have struggled with, but it is more apparent than ever. For a healthy stock market, it is good. Bitcoin.”

The general sentiment among traders is bearish. Many believe the coin will soon reach $30k.