Bitcoin has been stuck at its 2017 high of $1,047. Bitcoin’s volatility is low over the last few days. A new monthly candle is expected to be close by the crypto market in the near future. The event will move BTC, and other cryptocurrency. But in which direction?

Bitcoin (BTC) is trading at $19,000 as of the writing. There has been a 0.4% profit and an average 2% loss over the last 24-hours and 7 days. As XRP (+30%), and Solana (+17%), take the leader positions in the market top 10, the benchmark cryptocurrency has had one of its worst performances.

Market Volatility Will Return After Bitcoin Option Expiry

Market participants may be making a change as the monthly candle close coincides with the expiration date of option contracts worth over 100,000 BTC. As big players try to push the price towards their strike price, this event can often cause volatility in the market.

Coinglass data indicates there’s over $5B in open interest for Bitcoin options. As big players shift their positions, it is expected that the cryptocurrency will see greater action. KingFisher is a platform that allows users to see data about crypto derivatives. According to them, it’s more likely to be the upside.

Bitcoin’s price could rise to $20,000. In the near term as options expire and monthly close pass, The spike in short-term positions that were opened when BTC was trending sideways at the current level could fuel volatility.

Bulls could push Bitcoin higher by taking out short positions. This would make the price action more powerful and help fuel a long relief rally. This is what King Fisher’s team said.

It is possible that vanna hedge activity was involved in the end of the month

In a matter hours, we could witness a leap to 19.8k

TWAP Long-term, Either reducing carry, vol funds, or options desk.

We have seen some liquidation in the engine, but we can expect to see more soon. pic.twitter.com/MQ9xEdSRks

— TheKingfisher (@kingfisher_btc) September 26, 2022

The Benefits of a Green Monthly Close for Bitcoin

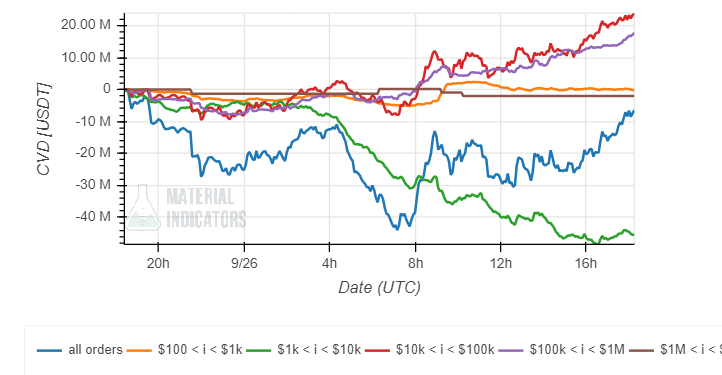

Other dataMaterial Indicators, the company behind Bitcoin claims there are two key resistance levels for Bitcoin if bulls close above 20,000. They are located at $20,100 to $39,000.

The current macroeconomic environment makes it unlikely that Bitcoin can reach those levels. However, Bitcoin might be able to reclaim its high of $20,000. Material Indicators supported this thesis by noting a surge in activity among investors who placed bids of $100,000.

The activity from these investors was able to “offset the week’s sell pressure with $117 million in market buys”. This buying pressure could continue, and the crypto market may see some relief after two weeks of declining trend.

Material Indicators still indicate that the middle-term will bring more pain.

While there may be short-term signs of a pump, crossing key moving averages is indicating that the overall trend towards a lower level will prevail. Refrain from FOMO (Foster Overtrade)