The U.S. equity markets rose on Thursday after stock traders felt some relief following a series of weekly losses. After falling nearly 8 weeks straight, all major stock indexes recovered. However, the crypto economy suffered some losses, dropping 4% to the U.S. Dollar over the last 24 hours. Meanwhile gold has been hanging below the $1,850 per ounce mark as Kitco’s Neils Christensen says gold markets remain “under pressure, seeing no major buying momentum.”

Analyst Says ‘Doom and Gloom’ Predictions ‘May Have Been Overdone’ Amid Stock Market Rebound

The Dow Jones Industrial Average, S&P 500, the Nasdaq, and NYSE composite all rallied during Thursday’s trading sessions. The S&P 500 rose about 2% reaching 4,057.84 by the closing bell, while Nasdaq spiked 2.7%, hitting 11,740.65.

Markets checking: The market is looking better as stocks continue to recover from their lowest level in more than a year.

Nasdaq 100 is currently up 2.99% https://t.co/SvxNwDuX3N pic.twitter.com/gbsgAlPP8B

— Bloomberg Markets (@markets) May 26, 2022

As the Dow Jones index gained for the fifth day straight, it jumped 1.6% Thursday afternoon. Quincy Krosby, LPL Financial’s chief equity strategist, believes the rebound may be a sign that some of last week’s doom and gloom predictions were overhyped.

“Although this was an expected, and highly talked about potential ‘oversold’ rally, the underpinning for today’s market climb higher, suggests that last week’s doom and gloom about the all-important U.S. consumer may have been overdone, along with the dire recession headlines,” Krosby told CNBC’s Tanaya Macheel and Jesse Pound on Thursday.

Many Believe Cryptos Have Decoupled, Alex Krüger Says ‘Worst Case Scenario for Crypto Is Here’

The cryptocurrency market suffered a setback on Thursday amid the rebound in equities. It lost 4% over the last 24 hours. Bitcoin (BTC), a cryptocurrency, lost 0.7% Thursday.

Ethereum (ETH) lost 6.9% along with a variety of other crypto assets, which saw greater losses than bitcoin. Although stock markets are improving, crypto assets are still in decline. However, traders continue to discuss crypto decoupling with stocks and the implications of correlation.

Crypto Twitter: The decoupling of crypto and twitter is not happening!

Nasdaq: This week, +4%

ETH: -33% This Week (-13% Open to the Trough).

— Alex Krüger (@krugermacro) May 26, 2022

Economist and trader Alex KrügerTalked about Crypto Decoupling From Stocks on Thursday

“Worst case scenario for crypto is here,” Krüger said. “Apathy and decoupling. It is no longer possible to link equities with anapathy. It’s been largely gone since Monday afternoon. Now equities bounce alone.” After his statement, Krüger doubled down on his commentary. “Watch people who don’t trade and barely watch charts or correlations disagree with this tweet. It’s ok. Everybody copes differently,” Krüger added.

The Bitcoin advocate Luke MartinThe host of the Stacks podcast, Jeremy, spoke out about how digital currencies don’t bounce back like equities.

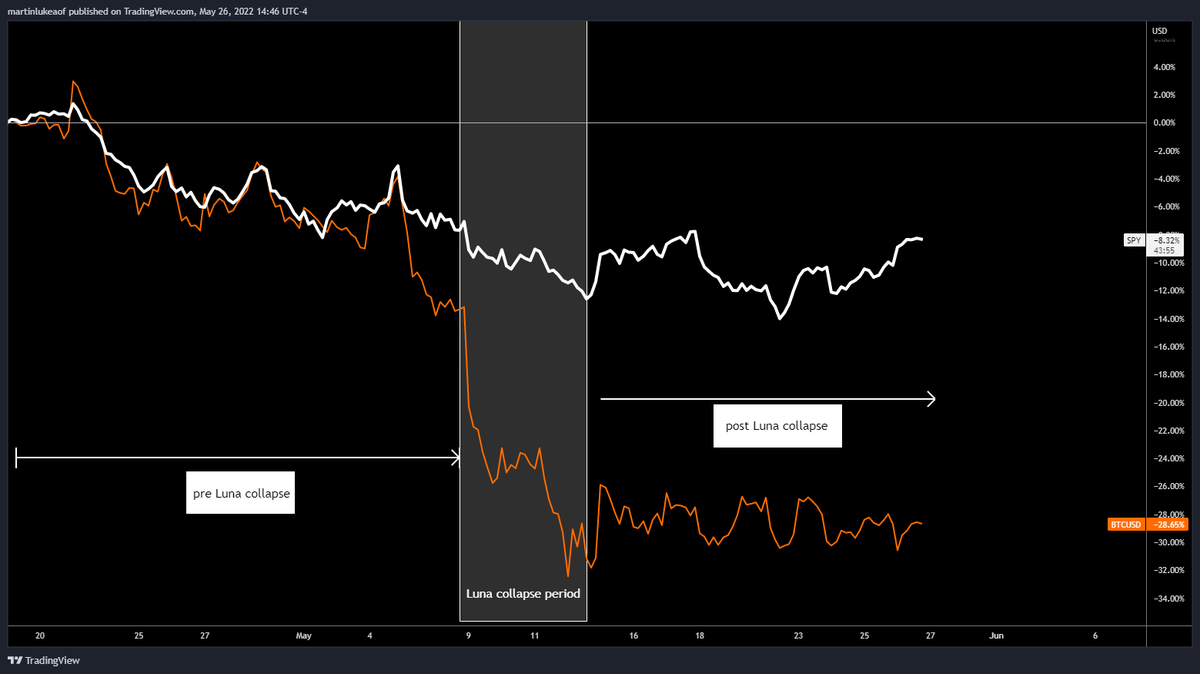

“Seeing lots of tweets about stocks [and] crypto decoupling, and crypto not bouncing with stocks,” Martin tweeted. “Charting gives a better picture of what’s happening: 1/ We had high correlation 2/ Luna collapse leads to more severe crypto selloff 3/ Post collapse crypto not making up the difference.”

As Gold Markets Slump, Peter Schiff Discusses the US GDP Contraction and Bitcoin’s Decoupling

The price of gold has not increased and is still below the $1,850/ounce range against the U.S. Dollar. According to 30-day statistics, an ounce fine gold has fallen by 1.67% over the past 30 days and was also lost 0.27% in 24 hours. On Thursday, Kitco’s Neils Christensen discussed gold’s slump in a report that highlights the recent U.S. Commerce Department report that notes the first-quarter gross domestic product (GDP) declined at a 1.5% annual rate. “The gold market is not seeing much reaction to the disappointing economic data,” Christensen explained on Thursday.

The gold bug, economist Peter SchiffThe GDP fell 1.5%, and Schiff also spoke out about bitcoin (BTC), which has been decoupled with Nasdaq. “The U.S. economy, supposedly the strongest it’s ever been, contracted by 1.5% in Q1, .2% more than analysts expected,” Schiff saidThis Thursday “If [the]If GDP contract again in Q2, the economy officially enters recession. When the economy is in recession, GDP will contract. [strong], imagine what happens when it’s weak,” the economist added.

Schiff continued on Thursday and made sure to throw salt on bitcoin’s recent market wounds. Schiff remarked:

Could bitcoin be finally free from its strong correlation to the Nasdaq While tech stocks rise today, Bitcoin is plummeting to $28K. My guess is that Bitcoin will continue to maintain its positive correlation with the Nasdaq, but only when it’s falling.

How do you feel about current economic and market conditions? Please comment below on your views.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.