Spot market prices have fallen by nearly 12% since ethereumpow’s (ETHW), was launched. Despite the fact that during the last two weeks ETHW has shed 35% in USD value, the network’s token economy and decentralized finance (defi) ecosystem has swelled.

ETHW Spot Market Prices Slide, While the Network’s Total Value Locked in Defi Climbs

Ethereumpow (ETHW) markets haven’t been so hot in recent times and since the crypto asset’s value was recorded before the mainnet went live, ETHW is down roughly 88% from the all-time high recorded two months ago on September 3, 2022.

Ethereumpow’s (ETHW), value has fallen around 35% against the U.S. dollars over the last 2 weeks. The price of a crypto asset traded hands on Tuesday October 18th, 2022 for $6.94 to $8.34 per unit over the course of the last 24 hour.

Furthermore, after capturing close to 70 terahash per second (TH/s) of hashrate, ETHW’s total hashpower worldwide is down to 37.66 TH/s. While the network’s native crypto asset ETHW has performed poorly market-wise in recent times, ETHW’s total value locked (TVL) in defi has skyrocketed.

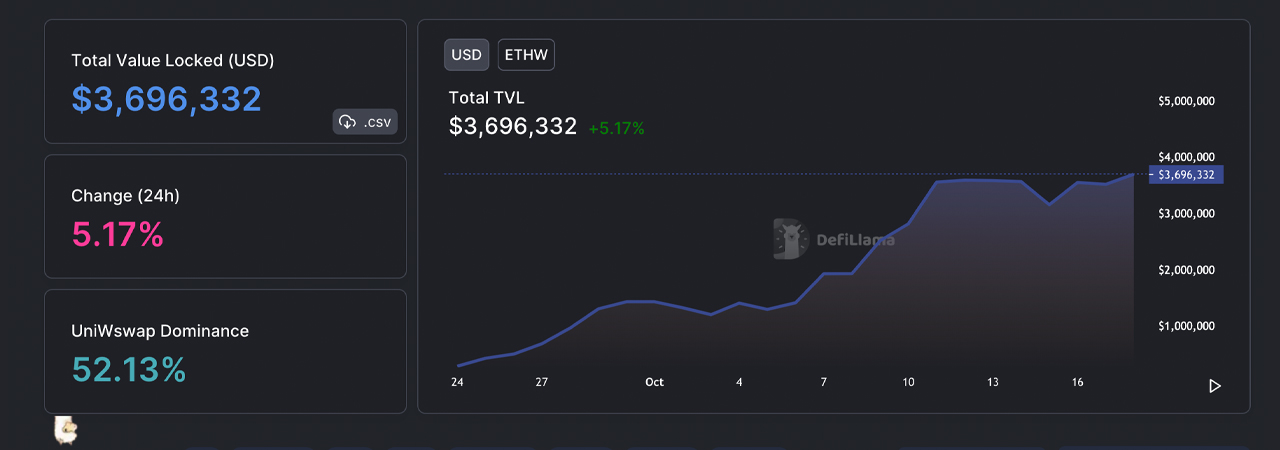

Statistics from defillama.com indicate that ETHW’s TVL is around $3.69 million after records show on September 24, that the TVL was $283,153. This means that since September 24, or over the last 24 days, ETHW’s TVL in defi increased in value by 1,209%.

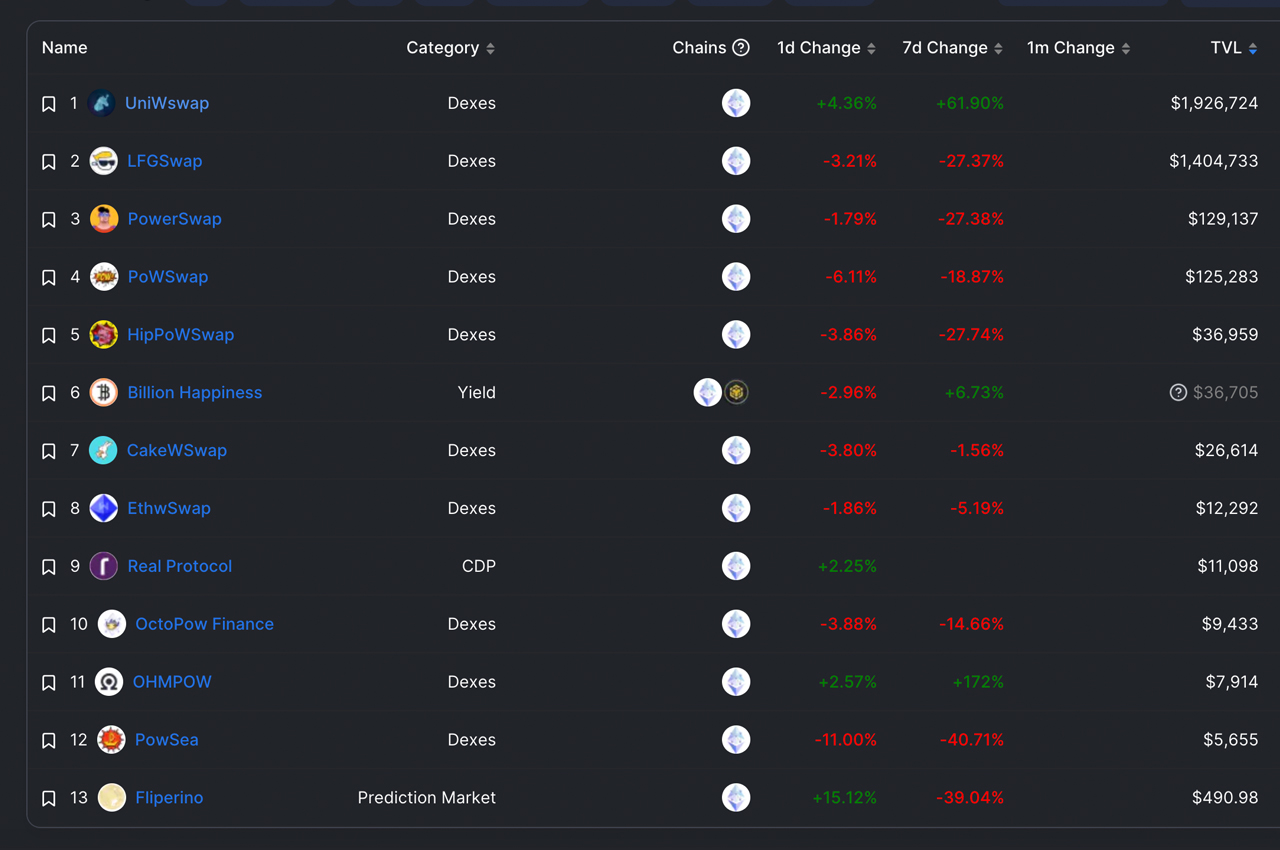

Defillama.com stats indicate that there’s roughly 13 different ETHW defi protocols dedicated to the network. Uniwswap (decentralized exchange) is today’s largest defi protocol, with 52.13% of the $3.69million.

Data recorded October 18 show that the dex platform holds around $1.92 million. According to data recorded on October 18, the dex platform has approximately $1.92 million in value. Lfgswap is second. This means that Uniwswap and Lfgswap dominate most of ETHW’s defi ecosystem in terms of TVL.

ETHW holds approximately a dozen tokens, with the whole ETHW ecosystem (including ETHW), valued at around $800 million. The ETHW protocol ranks number 83 among all defi positions, with Ethereum Classic (ETC), at number 119. ETC’s defi ecosystem is much smaller than ETHW’s, in terms of TVL size, as defillama.com metrics show Ethereum Classic’s TVL today is $537,243 among five different defi protocols.

The majority of ETC TVL is divided between two defi protocol that use the Ethereum Classic chain. These protocols are Hebeswap or Etcswap. ETC’s value compared to ETHW’s is a lot larger and the asset’s $3.24 billion market cap is also colossal compared to the newly introduced crypto asset.

What do you think about ETHW’s recent spot market action and the network’s defi TVL increasing during the last few weeks? Please comment below to let us know your thoughts on this topic.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.