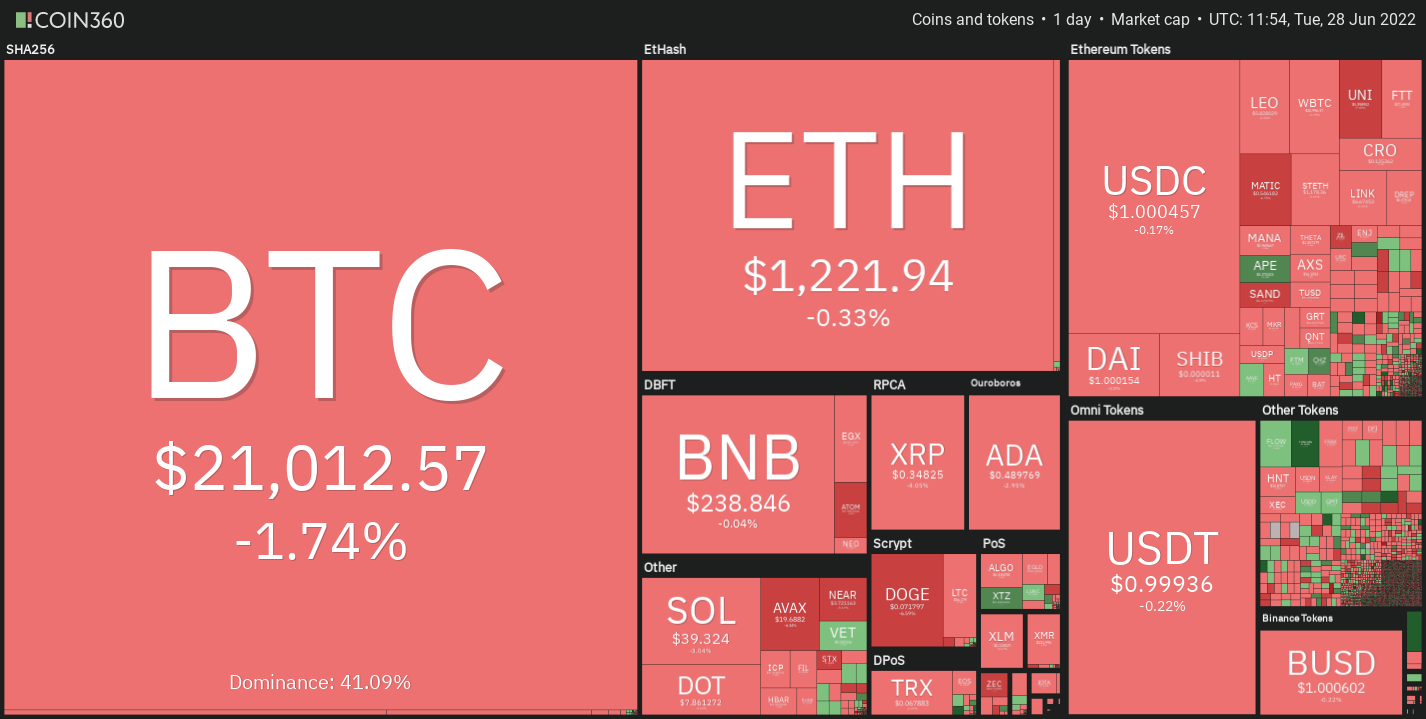

During the past 30 days, $285 billion has left the crypto economy and bitcoin’s USD value hit a 2022 low at $17,593 per unit on June 18. Moreover, last month’s statistics show bitcoin’s market dominance was 2.9% higher and ethereum’s market dominance was 2.1% higher than it is today.

Bitcoin and Ethereum have seen their dominance drop in the last month

Many continue to question if crypto market turmoil will not continue. After the latest sell-off which saw BTC drop to $17.593 per unit, ETH dropped to $877 per token, there was a short consolidation in the market.

Both coins have seen a significant amount of fiat value removed since last month and BTC’s and ETH’s market dominance has decreased since then as well. BTC was traded for $28,946/unit on May 27, 2022 and ETH for $1745/unit at the same time.

BTC and ETH are currently exchanging hand for just over $21K each unit. BTC dominated $1.25 trillion of crypto currency by 43.9%, while ETH had a dominant rating at 17.1%. 30 days later, data shows that BTC’s current dominance is 41%, while ETH commands 15% of the entire crypto economy.

The Tether, USD Coin and the BUSD Dominance Rises

The stablecoin tether (USDT) captures 6.94% of the digital currency economy’s net value and usd coin (USDC) commands 5.77%. Tether’s market cap has grown since last month as it was hovering around 5.72% at that time.

In mid-May, USDC’s market capitalization represented 3.77% of the crypto economy. The Binance-issued stablecoin BUSD equated to 1.43% of the crypto economy in terms of dominance, and today it’s 1.8%. In fact, between USDT, USDC, and BUSD, the combined market capitalizations equate to 14.51%, which is just shy of ETH’s 14.7% dominance rating.

While BTC saw $18.7 billion in global trade volume during the past 24 hours and ETH saw $13.5 billion, the combined $32.2 billion in trade volume is still eclipsed by USDT’s $48.58 billion during the last day. 60.62% are bitcoin trades that were made with tether (USDT) during the last 24 hours.

Sellers gravitated to stablecoins due to lower dominance ratings of ETH and BTC. This trend suggests that it is possible but not guaranteed that much of the stablecoin funds are people waiting on the sideline for ETH’s and BTC’s official bottoms.

What do you think about bitcoin’s and ethereum’s dominance ratings sliding during the last 30 days, while stablecoin market caps have swelled? Comment below and let us know how you feel about the subject.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This is not an invitation to purchase or sell directly, nor a suggestion or endorsement of products, services or companies. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.