Bitcoin traded at $40,000 with strong bullish momentum over the past 24 hours. Today the U.S. Federal Reserve will likely begin tightening monetary policies.

You may also like these related readings| Bitcoin Hits $40K; Key Upside Break Indicates Trend Change

This financial institution may raise interest rates and pull liquidity out of global markets. Bitcoin and other risk-on assets like equities could turn bearish. So far, BTC’s price has failed to meet expectations.

Bitcoin is trading at $44,416 as of the writing. This represents a profit of 4% for the last day.

Bitcoin is acting on its own, with resistance to any shift in U.S. Dollar monetary policy. In step of trading as a stock, BTC’s price seems more akin to Gold’s (XAU) price action.

Although the precious metal broke through $2,000, it has lost some of its gains. This downtrend could be short-lived and could predict what’s coming for Gold and Bitcoin. The inflation hedge narrative can sometimes be used to trade two assets.

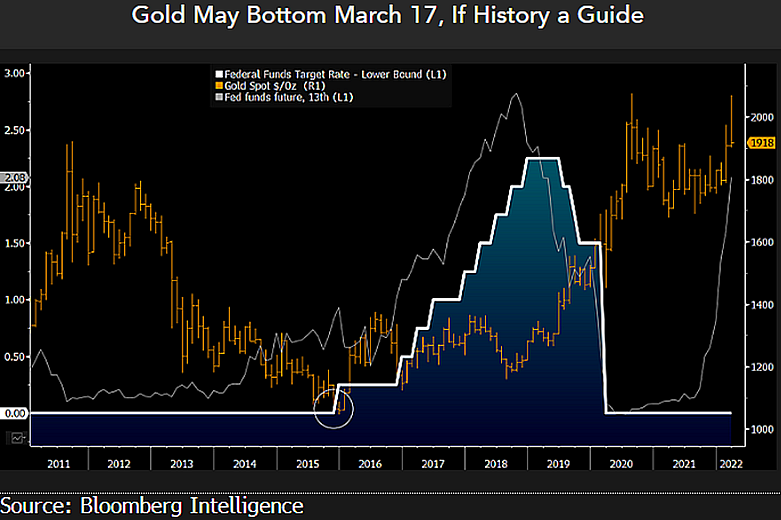

Mike McGlone, Senior Commodity Strategist at Bloomberg Intelligence indicatedIn 2015, the FED raised interest rates by 25bps (or 0.25%) for the first time. The gold price was recovering from a long-term downtrend that started in 2011.

After the 2008 economic crisis, precious metals appreciated, but investors began to reduce their holdings of gold as they recovered. As seen below, 2015 was the last time during the past decade that Gold’s price saw a low at around $1,000.

Gold began an upward movement, as McGlone noted, the “next day” after the FED announced the beginning of a new tightening cycle. A new Gold rally could result from the current inflationary climate and the possibility of an extended conflict in Europe.

Bitcoin On A Tightening Cycle

Bitcoin may disappoint those who are waiting to get their hands on the low 20000s. According to pessimist traders, Bitcoin has enjoyed a positive environment since 2020.

However, the XAU/BTC chart shows Bitcoin has been appreciating for the past decade despite the FED’s monetary policy, or because of it.

The short-term reaction to the FED announcement could hint at what BTC’s price will do in the coming months. NewsBTC reports that cryptocurrency could rise if the financial institution offers a more moderate monetary policy.

Read Related Article: Bitcoin Value takes a Hit as U.S Inflation rises| Bitcoin Value Takes A Hit As U.S Inflation Rises

TedTalksMacro analyst via Twitter:

Fed raises 25bps today. Risk assets (BTC and equities), are up on the news. Powell indicates at the press conference that more hikes to come (4-5 by EOY) – how the market moves during/after the press conference to be decided by whether it’s a dovish or hawkish hike Dovish hike will be signaled by any mention of caution during the press conference. If there is an intention to keep increasing rates/tightening in spite of negative effects on economic growth, it will indicate a hawkish increase.