Executive Summary

- PancakeSwap, an AMM-based and decentralized BNB exchange that was launched anonymously by developers, is called PancakeSwap.

- PancakeSwap, according to volume of trades, is third most decentralized exchange.

- PancakeSwap has many features which allow you to win or earn crypto.

- PancakeSwap has a harder fork than its main competitor, Uniswap.

Introduction

The mainstream adoption of crypto has been made possible by centralized cryptocurrency exchanges. These platforms make digital assets accessible to investors who have fiat currencies. There are risks associated with centralized exchanges. They control and own all funds. Investors may be subject to censorship.

The ethos of decentralization inspired the development of decentralized exchanges. They allow users to trade and buy digital assets with no central custodian. PancakeSwap has become a popular, non-custodial exchange that allows users to manage their assets from anywhere.

This deep dive will examine PancakeSwap’s most important features and compare it to other decentralized cryptocurrency exchanges.

What is PancakeSwap?

PancakeSwap is a decentralized exchange (DEX) built on Binance’s BNB chain, which enables users to swap digital assets without profit-seeking intermediaries.

PancakeSwap is known as an automated market maker (AMM) DEX, meaning that it doesn’t employ a traditional order book, where users have to be matched for a trade. Users trade against a liquidity pool instead. (It’s more on that in the next heading). As a BNB-native protocol, PancakeSwap focuses on BEP-20 tokens — the token standard of the BNB chain.

PancakeSwap initially looked very similar to Uniswap. It is not surprising that experienced blockchain developers see PancakeSwap as a hard fork to Uniswap.

PancakeSwap, which has $14.3 billion in monthly trading volume, is both a decentralized and centralized cryptocurrency exchange. According to Coinstats’ data, it’s the 54th-largest.

In terms of trading volume, PancakeSwap is currently the third largest decentralized exchange, with a 24-hour trading volume of $131 million, just behind Curve’s $138 million trading volume. Uniswap however is still the biggest decentralized exchange with a 24 hour trading volume of $1.25 Billion.

How does PancakeSwap work?

PancakeSwap is a decentralized exchange that uses an AMM model in order to automate asset swaps. This eliminates the need for intermediaries or order books. Since traders trade directly against a liquidity pool, there’s no need for an order matching system or trading counterparties.

The question is: Where does all the liquidity come? Liquidity Providers, or LPs, are responsible for the liquidity of the DEX. They stake their tokens into liquidity pools to receive FLIP tokens. Anybody holding crypto can be a PancakeSwap liquidity provider to make passive income.

The advantage of AMM DEXes like Pancakeswap is that users don’t have to wait to be matched with a seller. They deposit the token that they want to trade into the liquidity pool and receive the desired token.

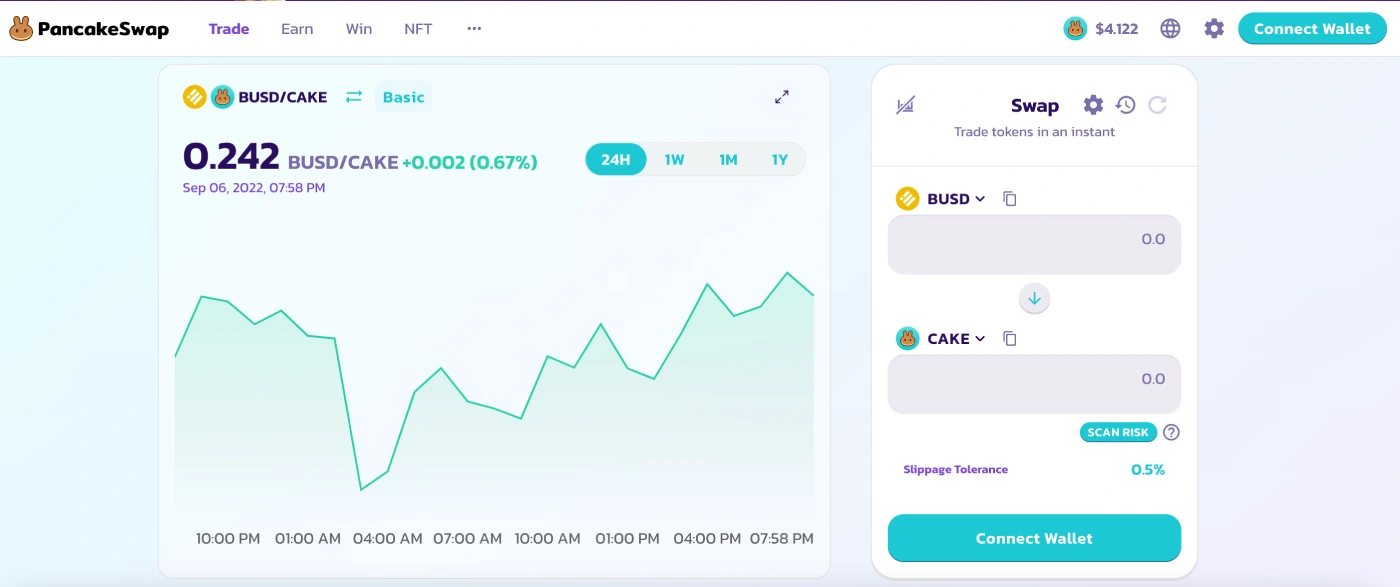

You can easily swap BEP-20 tokens, BNB-native currencies like BUSD, for CAKE. Simply set the amount of tokens that you would like to trade and connect your wallet. PancakeSwap will then find a suitable liquidity pool to execute your trade.

PancakeSwap’s Native Token — CAKE

PancakeSwap is powered by the protocol’s utility token, CAKE. This token is used to pay transaction fees and staking. It can also be used to yield farm in order earn rewards. The token may also serve as an ecosystem governance token, which allows for the voting on proposed ecosystem projects.

Under the hood, CAKE is a BEP-20 token, native to Binance’s BNB Chain. According to CoinStats data, CAKE trades at $3.91 and has a market cap $548 million.

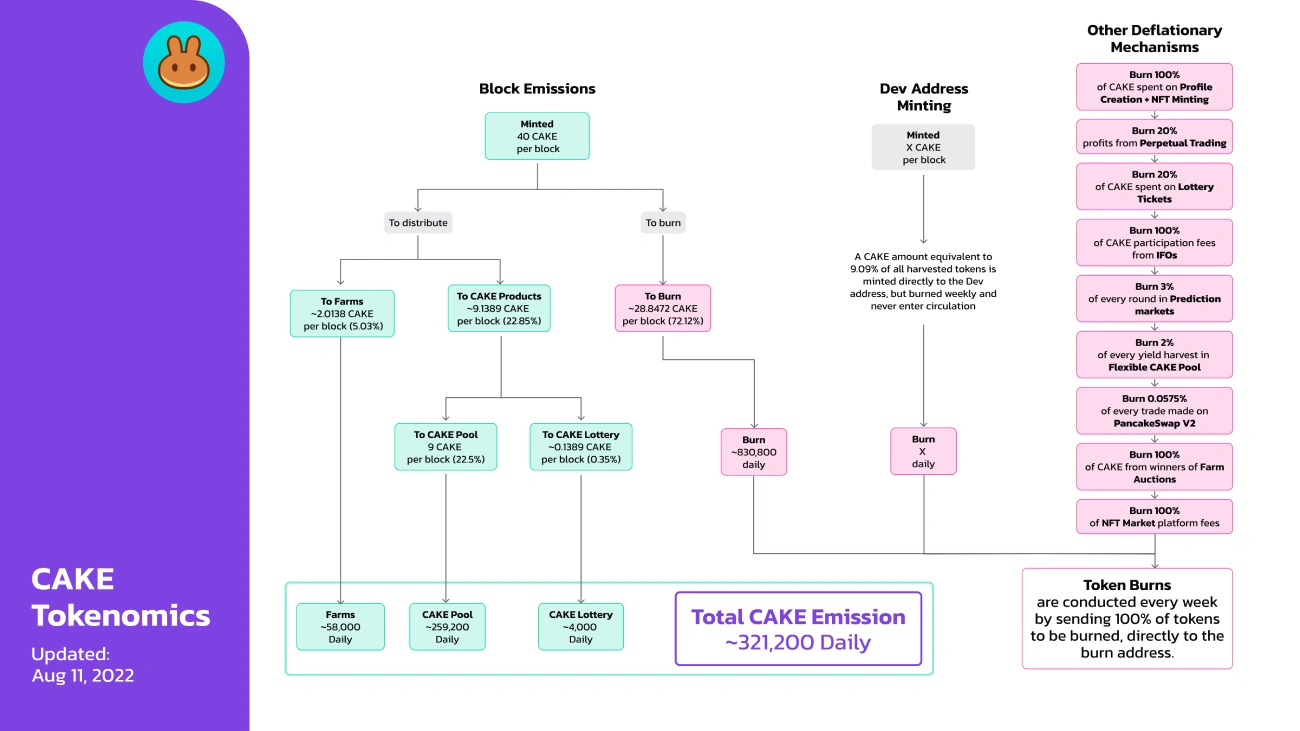

The token used to have an unlimited supply, until a proposal to cap CAKE’s maximum supply has been approved on May 12, 2022. CAKE now has a maximum supply limit of 750,000,000 tokens. It has an aggregate supply of 321,000,000 and a current supply supply of 140,000.6 million.

According to PancakeSwap’s Tokenomics 2.0 litepaper, CAKE will reach its supply cap in approximately 3 years, with the current emission rate of 12.75 tokens/block, or 367,200 tokens/day.

CAKE’s circulating supply is controlled by deflationary mechanisms, which aim to make the token deflationary, by burning more CAKE than the amount that is emitted. PancakeSwap products have a burn feature that developers can use.

On the downside, some of CAKE’s burning mechanisms aren’t decentralized, which the team also noted in a blog post, since 9.09% of CAKE harvested from farms is sent to a dev address (known as Masterchef V2 address) instead of being burned automatically. Each week the wallet’s developers perform a manual burn. They also burn all tokens for development funds.

Governance

PancakeSwap is a community-governed DeFi protocol, where CAKE functions as the project’s governance token.

Anyone holding CAKE can create proposals or vote on existing proposals on PancakeSwap’s native voting portal. Each user’s voting power is equal to the number of CAKE tokens held. Voting is fairly user-friendly on PancakeSwap, and it’s completely free, whereas other protocols often charge users a gas fee to cast their votes.

PancakeSwap’s Funding and Beginning

PancakeSwap was launched by a group of anonymous developers in September 2020, aiming to become the “number one liquidity provider on Binance Smart Chain and the home of new, innovative gamified farming mechanics,” according to their first blog post.

PancakeSwap was funded by Binance as part of the $100 million fund to link DeFi and CeFi in 2020. This funding aims to help yield farm with crypto assets that are on Binance’s Smart Chain. PancakeSwap also received $240,000 of liquidity support from Binance in November 2020.

In June 2022, Binance Labs made another strategic investment (of an undisclosed amount) in PancakeSwap’s CAKE token, to facilitate the next wave of global blockchain adoption:

“PancakeSwap has been leading the development and mass adoption of the BNB chain. Given that PancakeSwap is the most widely used dApp and the DeFi project with the highest TVL on the BNB chain, we have and will continue to provide strong support for the project,” wrote Bill Qian, Head of Binance Labs.

IFO — Initial Farm Offerings

PancakeSwap’s Initial Farm Offering (IFO) feature enables users to directly buy new tokens launching on the BNB chain. It works in the same way as the Initial Coin Offering model. This allows traders to directly invest in new tokens using the power of yield farm.

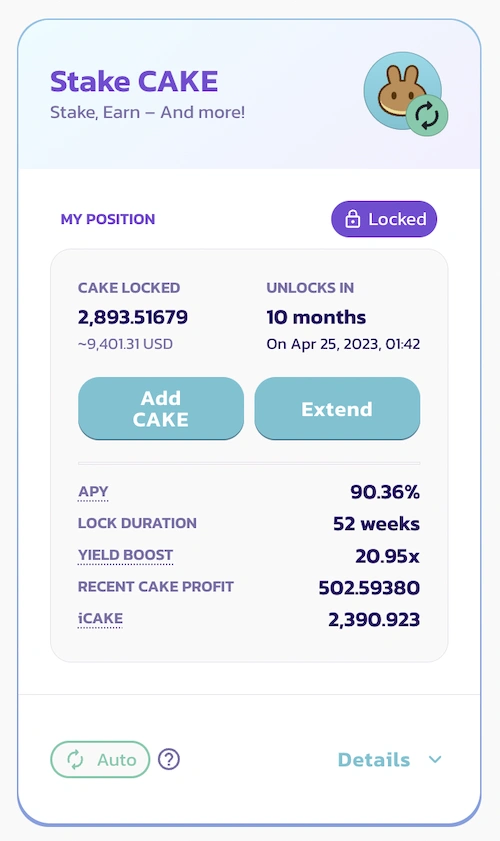

It is easy for CAKE stakeholders who already own iCAKE. All they have to do is commit their CAKE tokens to PancakeSwap’s IFO page. The IFO will end and users will get the new token in return for their CAKE.

In case you’re not already a staker who has iCAKE, you’ll first have to stake some CAKE tokens to one of the SYRUP pools, in exchange for iCAKE. You will receive iCAKE based upon the amount of CAKE staked to the fixed-term Staking Pool.

iCAKE is not a new token, but a numerical metric employed by the DEX’s IFO system. iCAKE is an IFO credit system that determines how much CAKE tokens you are allowed to commit to IFO. You can only commit 100 CAKE tokens to IFO if 100 iCAKE are available.

PancakeSwap: Yield Generation

PancakeSwap is unique among decentralized exchanges because of its many yield generation tools. This gives users multiple ways to make passive income. Below we’ll go through all the different options.

Placement

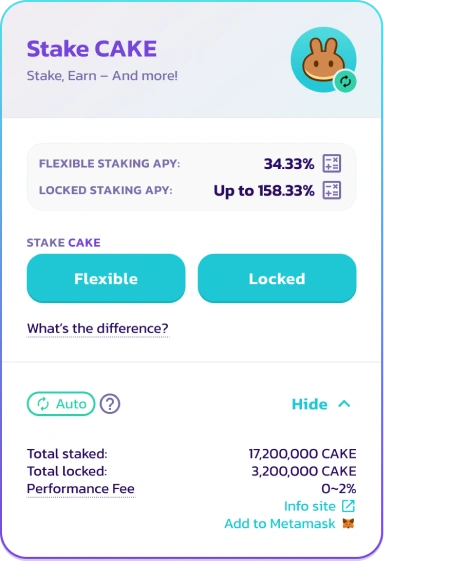

For passive income investors looking to make a profit, the best option is for them to stake their tokens in SYRUP pools. Any CAKE holders can stake their tokens in the DEX’s SYRUP pools, in exchange to earn more tokens.

PancakeSwap is easy to stake. PancakeSwap makes it easy to stake. Users just need to click on the Pools tab and choose a pool that will lock them up. Stakers could earn between 14% and 124% annually depending on their staking pool.

PancakeSwap is a proof-of–stake blockchain network that requires you to stake. Staking is essential for proof-of-stake blockchain networks like PancakeSwap. It secures transactions and allows validator nodes access to them. This involves locking down your funds for a period of time in a smart contract to help you earn more crypto.

Yield farming

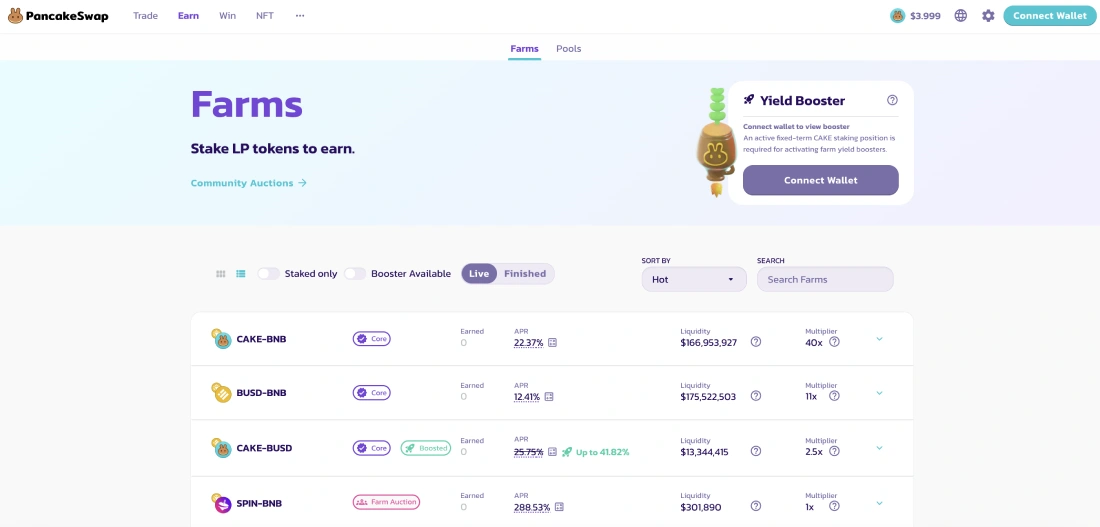

PancakeSwap’s Yield Farming is another popular product for yield generation. It involves locking up a user’s LP tokens, in exchange to earn CAKE.

In essence, “farms” are staking pools, but instead of locking up your CAKE, users can lock up different LP tokens to earn more of PancakeSwap’s native cryptocurrency.

Users can access the Farms tab to select a liquidity pool that matches their tokens, similar to how staking works. Yield farmers may earn anywhere between 2% and 137% APY for their investments.

Liquidity

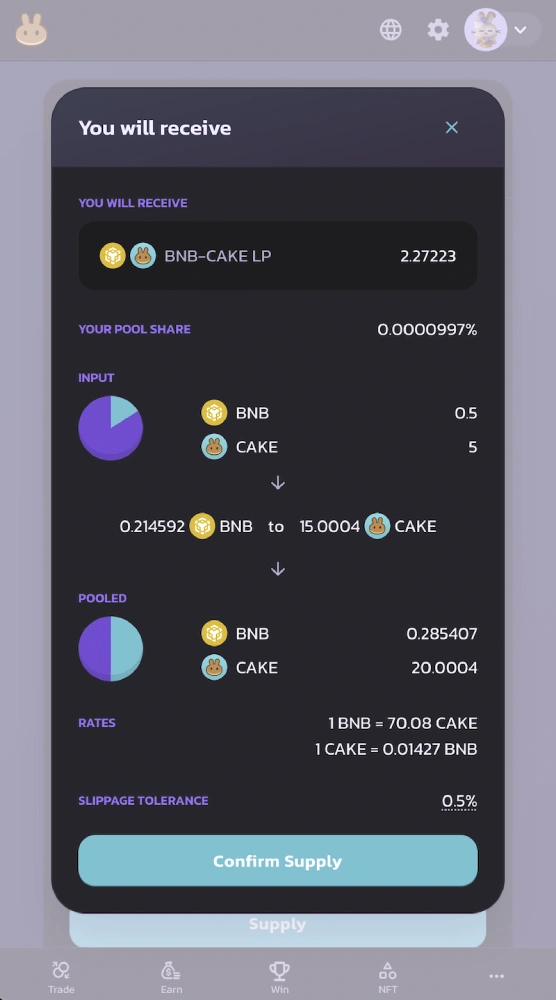

PancakeSwap’s AMM-based, decentralized exchange PancakeSwap relies on liquidity providers for its liquidity. It is the way users swap assets almost instantly, and without any need to use an order book.

To provide liquidity, users must lock two asset pairs, that is, two different cryptocurrency, into a liquidity pool. Liquidity Provider tokens (LP) will be given to users who contribute to a liquidity pool. They also get a part of trading fees.

CAKEBNB tokens will be awarded to users who deposed CAKEBNB traders. This depends on how much CAKEBNB was committed. Liquidity providing has the advantage that you can withdraw your rewards and funds at any moment from these pools.

PancakeSwap users pay a 0.25 trading fee. A further 0.17 is charged to their liquidity pool. When people use a liquidity pool for an asset swap, a portion of that 0.17% trading fee is given to the pool’s liquidity providers.

Additional Notable Features

PancakeSwap also offers lucrative features to help users win prizes as part of GameFI’s mission. Below we’ll explore some of the most exciting features.

Lottery

The PancakeSwap lottery is exactly what it sounds like — a traditional lottery system infused with the perks of cryptocurrency and DeFi.

It is up to the players to guess which order the winning lotto numbers are in. Players will receive a higher reward if they correctly match the numbers. The prize pots for the lottery vary depending on how many people participate. They can be worth more than 27,000 CAKE or around $107,000 at the time this article was written.

A lottery ticket is worth approximately $5 in CAKE. The price for each round of the lottery will be determined before it begins. You can choose to randomly select your ticket numbers, or manually. Every 12 to 36 hours, a lottery draw takes place.

To win the jackpot — worth 50% of the total lottery pool — a player’s ticket needs to match all four numbers in the correct order as the winning ticket.

Lottery V2 leverages Chainlink’s implementation of VRF to guarantee true randomness of outcome for players. In case the lottery isn’t won, the unclaimed prize pool rolls over to the next lottery round, as per PancakeSwap’s Lottery FAQ.

Competiton in Trading

Trading competition is another one of PancakeSwap’s “win” features. The trading competition is a team-based contest in which traders work together to achieve the most trading volume during the time period. One prize in crypto and NFTs worth $120,000 is available to the winning team.

All eligible participants, regardless of their performances, will be awarded prizes at the conclusion. For example, at the end of the trading competition, all eligible participants were entitled to 300 PancakeSwap and 100 Miners in Dalarnia NFTs.

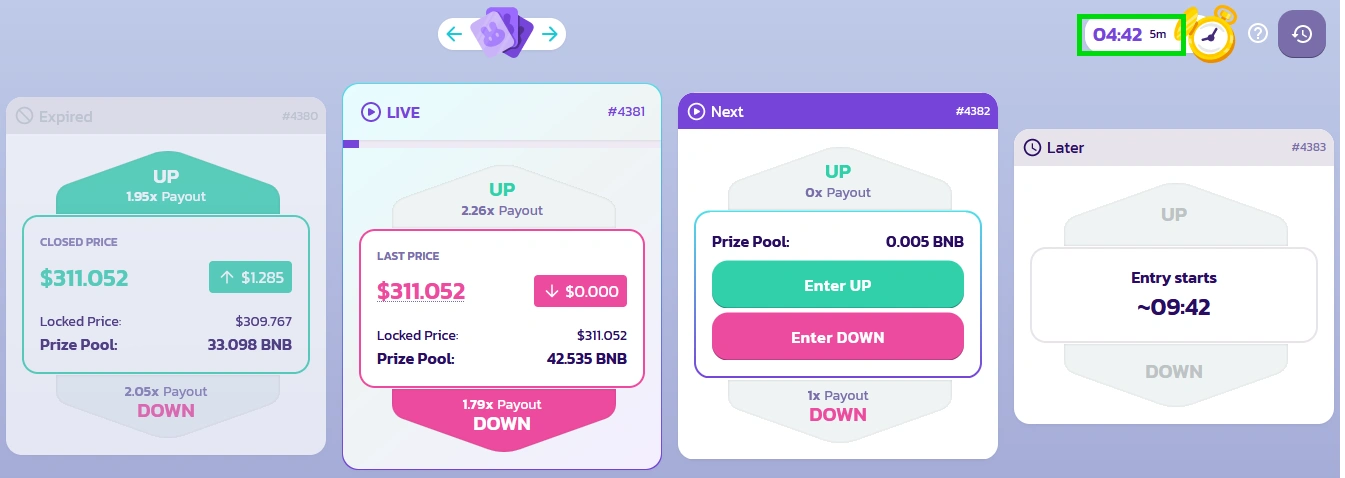

Prediction

Prediction is PancakeSwap’s decentralized iteration of a prediction market. Like other prediction markets users are able to bet directly on the outcomes of future events without intermediaries.

In the case of PancakeSwap’s prediction, users can predict whether BNB or CAKE prices will rise or fall. Users can enter “UP” positions if they believe prices will rise or “DOWN” positions for the contrary.

Each session is 5 minutes long. If you took a “UP” position and the token price went up at the end of those 5 minutes, then you won, and vice versa. The number of participants determines the prize pool.

As a decentralized prediction market, PancakeSwap’s predictions are governed by smart contract algorithms. As of press time, PancakeSwap’s prediction market is still beta.

Pottery

PancakeSwap’s pottery feature combines locked CAKE staking with lottery elements, offering a chance for users to win bigger yields on their CAKE deposit. Even if you lose all of your CAKE tokens, the best part is that you can get them back.

Participants can register their CAKE tokens by depositing them on Mondays. There is a 10-week lock up period. Higher chances of winning are the bigger your deposit. Each weekly draw will see 8 winners. A percentage of the stake rewards will go towards the weekly prize pool. While the prize pool for each weekly draw will be claimed by winners, their original deposit will stay locked for 10 consecutive weeks.

At the time this article was written, Pottery was still in Beta.

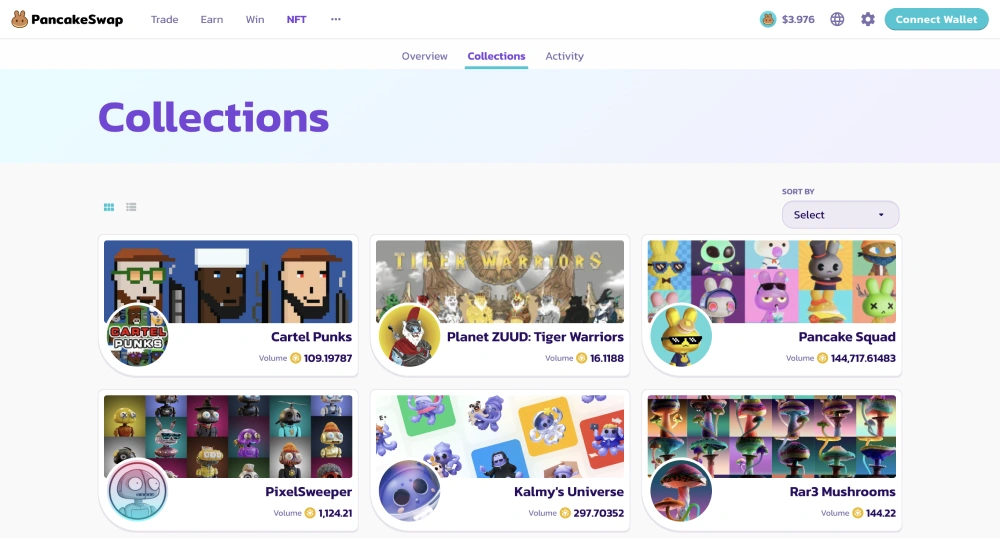

PancakeSwap: NFTs

Another one of PancakeSwap’s outstanding features is its NFT marketplace, where users can mint, buy, and sell non-fungible tokens (NFTs) native to the BNB chain.

There is a 2% platform fee subtracted from every NFT sale on the market, 100% of which are used to buy back CAKE tokens and eliminate them from circulation during the weekly CAKE burn — adding to the deflationary mechanisms of the token.

Some of PancakeSwap’s most popular NFT collections by trading volume include Planet ZUUD: Tiger Warriors, Dauntless Alpies, and Kalmy’s Universe.

What makes PancakeSwap stand out?

PancakeSwap as a completely decentralized exchange is not custodial. Digital assets are never owned nor controlled by PancakeSwap. Instead smart contracts manage user funds as the asset swap occurs. PancakeSwap is a great option for DeFi lovers as it allows them to avoid the danger of being censored.

PancakeSwap offers many more features than Uniswap. PancakeSwap offers two features that can be used to increase the yield of your CAKE tokens. Syrup Pools is the protocol’s second yield farming tool, where users can stake their CAKE to earn more CAKE or other BEP-20 tokens.

PancakeSwap’s “Win” features also make the protocol stand out in comparison to other decentralized exchanges, where users are limited to token swaps. PancakeSwap’s lottery, pottery, prediction markets, and trading competition were built to incentivize more network participation and allow the most active users to win crypto prizes.

PancakeSwap offers better fees than Ethereum-based Uniswap. A token swap on PancakeSwap costs 0.2% in trading fees — 0.17% of which is returned to liquidity providers as a reward, and 0.03% is sent to the PancakeSwap Treasury. Uniswap is charged 0.3%.

The Bottom Line

PanakeSwap is the biggest AMM DEX on Binance’s BNB chain, and the third largest decentralized exchange in the crypto space, with a total market share of 5.4%. While this is still negligible compared to Uniswap’s leading market share of 43.7%, PancakeSwap is aiming to catch up through its yield farming and prize-winning features — although UniSwap is not a direct competitor, since it is an Ethereum-based DEX.

PancakeSwap appears to be getting closer to its rival when you look at the TVL (total value locked). UniSwap is now worth $5.63 billion, but PancakeSwap boasts a TVL value of $2.99B.

While PancakeSwap is nowhere near Uniswap in terms of market share, PancakeSwap’s outstanding features were designed to attract new users and incentivize more trading activity.

Thanks to its low fees, PancakeSwap temporarily flipped Uniswap in February 2022, becoming the world’s biggest DEX by daily trading volume. The reason why users started flocking to PancakeSwap, was the high gas fees on UniSwap — as UniSwap is among the top gas guzzlers on the Ethereum network.

PancakeSwap’s low fees, fast transactions, and features will likely cement it as one of the most popular decentralized exchanges in the DeFi space.