The cryptocurrency market’s trends are driven by market sentiment. There are two simple assumptions – most investors get greedy when the market is bullish, while fear results in bearish trends, making them panic sell when the value of crypto assets (primarily Bitcoin’s price) drops sharply.

The Crypto Fear and Greed Index aim to take human psychology into account and analyze the crypto market behaviour to help crypto investors forecast the course of the price action and make informed trading decisions by putting the general market sentiments into perspective.

If people behave the same way in certain contexts, is it possible to profit by being “fearful when others are greedy and greedy when others are fearful,” as quoted by world-renowned investor Warren Buffet?

To answer that question, the Fear and Greed Index provides insights into crypto market sentiments.

Let’s get right to it!

What’s the Crypto Fear and Greed Index

CNNMoney created the Fear and Greed Index for the US Stock Market to provide an analytical tool that can be used to assess market sentiment. The index generates one value, ranging from 1 to 100. Extreme fear can result if the index is between 0-24. Investors feel extreme fear and may sell their investments in an irrational response. The general rule is that prices rise when the index is below 1, which is usually a sign of a good buying opportunity prior to high-priced crashes. Anything higher than 24 is fear, while anything below 50 indicates concern. The value of 50 is neutral in the market.

When the value of the index lies between 51 and 74, it’s an indication of a greedy market; however, if the value is 75 or above, it means traders are experiencing extreme greed (i.e., buying more assets), pointing to market greed prevailing. Extreme greed could indicate the end of bullish markets. Therefore, it’s a good idea to sell your digital assets.

The technical indicator is a great tool for investors. It’s important to have high-quality data in order to obtain meaningful results.

What is the Use of Crypto Fear and Greed Index?

Don’t you think it is a waste to measure fear and greed?

Crypto market behavior is highly emotional. Many investors invest based on their emotions. Market rises can lead to greedy traders and FOMO (Fear Of Missing Out) which leads to crypto investors buying at an all-time high. This chart shows how FOMO-ed traders bought Dogecoin during a time when the price had reached an all-time peak. Dogecoin Prices.

In the same way, traders frequently sell their coins when they see red numbers.

Crypto Fear and Greed Index – which analyzes the sentiments of the cryptocurrency markets – is an invaluable tool that traders can use to determine whether they should acquire more in a panicky market or sell their crypto assets during a positive market.

What is the Crypto Fear and Greed Index?

The Fear and Greed Index is determined by multiple factors, including the volatility of the crypto market, social media, market volume, and Bitcoin’s dominance.

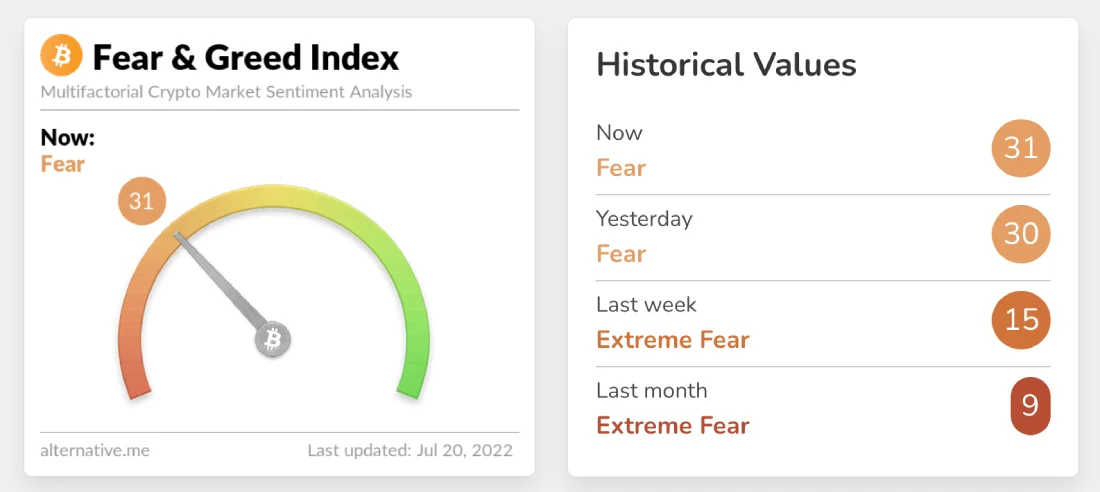

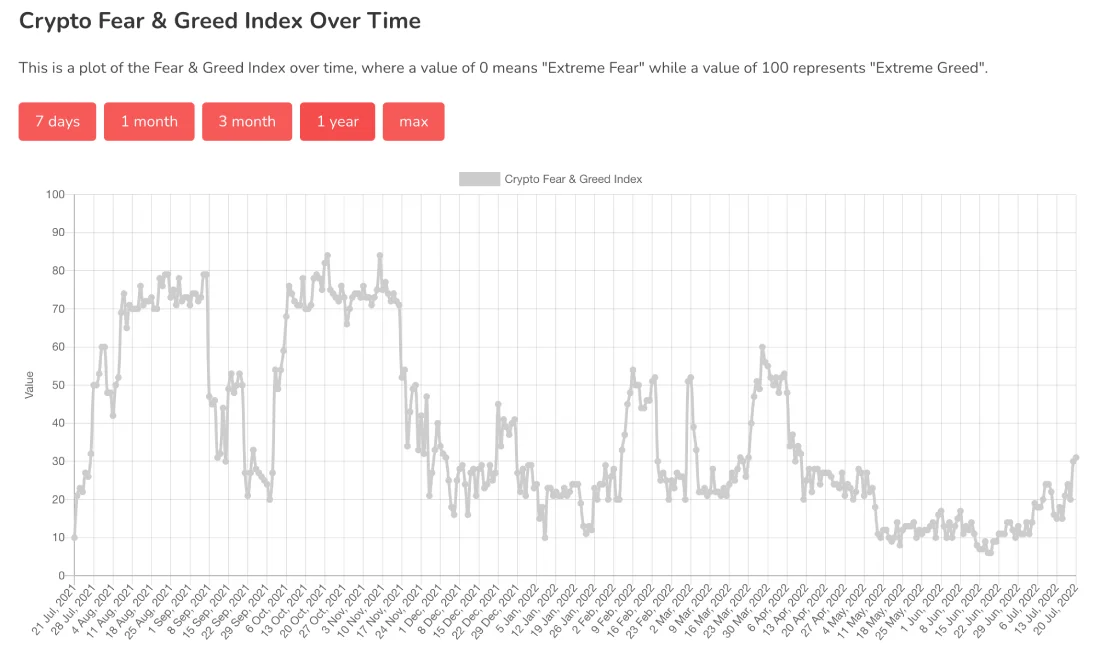

The index analyzes current market conditions, sentiments and Bitcoin prices and places them in a simple scale of 0 to 100. On top of that, the Fear and Greed Index is color coded, i.e., when it’s close to zero, the color is “Red,” and when it’s closer to 100, the color is “Green.”

This is how the Fear & Greed Index is measured:

- 0–24 = Extreme Fear

- 25–49 = Fear

- 50–74 = Greed

- 75–100 = Extreme Greed

Sources of data are gathered from multiple sources. The index chart is updated every 8 hours between 00:00 and 08:00 and 16:00 UTC.

How is the Fear and Greed Index calculated?

These are the factors that make up the Fear and Greed Index rating for Bitcoin.

Volatility (25%).

Fear and Greed Index compares Bitcoin’s current price to those of the previous 30 and 90 days. A high level of volatility can directly impact the price. This is a sign that investors are worried about the future and there’s a lot of uncertainty.

Market Momentum (25%) and Trading Volume

Bitcoin’s current trading volume and market momentum are compared to the last 30 and 90-day average values and then put together. Market momentum may be in an up- or downtrend, as can changes in trading volume. An optimistic or greedy market is one that has high daily buying volumes.

Social media (15%)

This algorithm analyzes the text of tweets that are tagged with specific hashtags, such as #Bitcoin. It also evaluates the speed at which people tweet the hashtag. An increase in interactions is usually indicative of growing interest in the currency and is a sign that there has been greedy market behavior.

The Index creators currently experiment with Reddit’s sentiment analysis by using the same text processing algorithm.

Surveys (15%).

Currently suspended, surveys use data from around 2000-3000 people to combine information. To get an idea of investor sentiment, weekly crypto polls are conducted asking people to describe their views of the crypto market.

Bitcoin Dominance (10%)

Bitcoin dominance can be compared to crypto’s total market capital share. Historically, it has been observed that whenever Bitcoin dominance rises, it’s caused by a fear of altcoin investments and the possible reallocation of it into Bitcoin since Bitcoin is increasingly becoming the safe haven of crypto.

Google Trends (10%)

The Google Trends data for Bitcoin-related search queries are also analyzed and considered, with more people searching for “Bitcoin price manipulation,” signifying extreme fear in the market.

Conclusion

For crypto investing to be successful, it is important that you use every resource and tool available. Crypto Fear and Greed Index measures the predominant market sentiment. Along with technical analysis and fundamental analysis, it can help you make well-informed investment decisions.

For further information, check the CoinStats guides on “Dogecoin: How do you buy it?,” “Shiba Inu: How do you buy it?,” “Coinbase Exchange,” and “Coinbase Review.” Read our CoinStats guide, “What exactly is deFi?,” to gain a fundamental understanding of Decentralized Finance, and see our “Crypto Portfolio Trackers” to learn more about the best crypto portfolio trackers in the market.

Investment advice Disclaimer This website contains information that is intended to be informative only. It does not recommend you to purchase, sell or hold any financial products or instruments. You are responsible for your actions and decisions.

The market for cryptocurrency can be volatile. Do your research and consult your financial advisor. Only invest what you are able to afford to lose. Mobox’s past performance is not indicative of Mobox’s future.