What are some ways your crypto assets could be used? You are unlikely to mention borrowing or lending as one of the top uses for your crypto assets. But crypto loans have become a booming trend in the new crypto industry.

It uses smart contracts to match borrowers and lenders seamlessly. Lenders can earn passive income while borrowers have the option to withdraw their crypto.

Let’s explore how one of the largest lending platforms, Aave, works and improve our knowledge of crypto lending processes.

These are the Key Takeaways

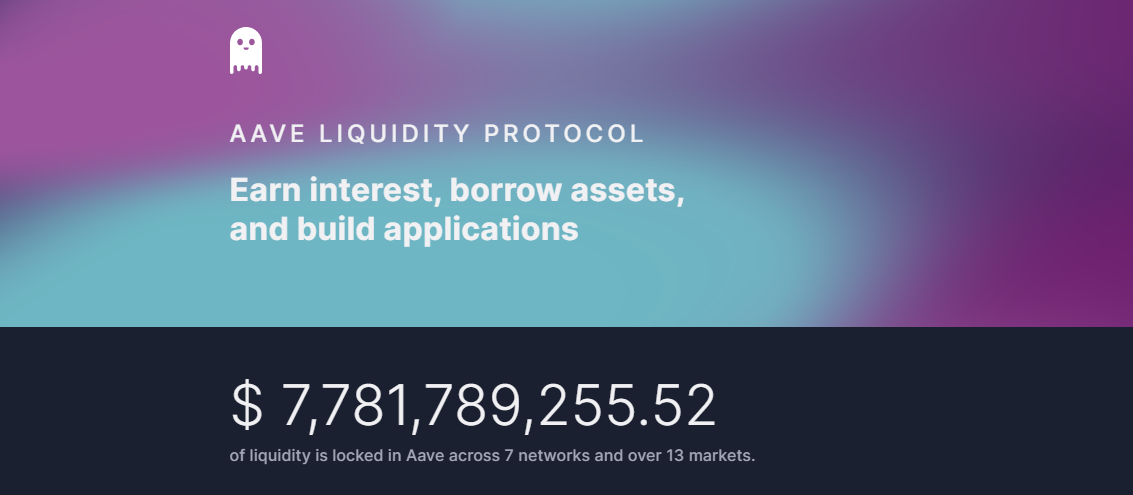

- Aave allows cryptocurrency users to lend and borrow from each other through an open-source liquidity network.

- It offers three kinds of loans to its customers: fixed, variable and flash.

- Aave, which has a market capital of over $1Bn, is the most popular DeFi protocol in the sector.

- AAVE token is the native token of this platform. It is used for accessing additional features on the platform and governance.

What’s Aave?

Aave, a blockchain-based lending platform that allows users to lend and borrow various cryptocurrency without intermediaries, is called a decentralized lending protocol.

The transactions are therefore not controlled by any central authority. Smart contracts instead control transactions. They are responsible for overseeing distribution and allocations of crypto assets. These smart contracts are connected to a network of computers.

Why was Aave Protocol created?

Aave, which was first built, primarily runs on Ethereum. However, it also has six other blockchains such as Avalanche (Polygon), Fantom, and Fantom. The current number of crypto currencies available to lend is 35 and there are 25 available for borrowing. Different pools have different interest rates and pairs.

Aave is a platform that allows users to borrow and lend cryptocurrency. The collateral required by borrowers to be secured before they can borrow is a minimum of $500. While lenders are able to put their crypto into use and make some money, the collateral must be paid in full.

Borrowers

One user may use a particular cryptocurrency as collateral to borrow another crypto. A borrower might use BAT tokens to secure a loan and then borrow Ethereum. Users can now have exposure to a variety of cryptocurrencies, without actually owning any.

Lenders

The Aave Market is a place where cryptocurrency can be traded. This increases liquidity and allows borrowers to access funds. Aave users who lend funds earn passive income to provide liquidity. The income comes in the form interest.

Aave protocols eliminate the need for middlemen. Smart contracts are used to manage everything on the platform. The algorithmic calculation of interest rates is used to determine the amount borrowed or lent.

The algorithm determines interest due to borrowers by dividing the total available funds by the amount needed by the borrower. Lenders, on the other hand, calculate the interest based upon the rate at which they can withdraw and earn.

What Are the Founding Fathers of Aave

Aave first launched in 2017. Stani Kulechov in Switzerland. Kulechov developed Aave during his time as a law student. He received training at University of Helsinki. Kulechov’s initial goal was to create a protocol that would allow users to lend or borrow crypto. The lenders would post loans offers, while the borrowers will request loan funds.

This protocol is called ETHLendThe application was not met with much success. The major ones were that adequate liquidity wasn’t being provided to the pool, and it was difficult to match willing lenders with ready borrowers. It was also affected by the bear market. These factors combined led to the collapse of its stock market in 2018.

Aave started with the name ETHlend. ETHlend was able to raise 16.2 million in the 2017 initial coin offering. LEND was its native token. The company sold over a billion units. Now, the token is known as AAVE token.

Following the fall, the team reviewed ETHlend 2019, and made the necessary changes to convert from the peer–to–peer model into the current peer–to–smart contract model. Aave was chosen as the new protocol name.

Aave to ETHLend

The tokens were traded in a ratio 100 LEND/1 AAVE at the time of migration from LEND2AAVE. In an effort to decrease the token supply, this was done. Following the completion of the migration, total supply stood at 18 million AAVE cryptos.

Aave was officially launched on January 2020.. The team also announced an upgrade to the protocol in August of this year.

What Was Aave Made?

Aave was developed to satisfy the ever-growing demand for decentralized financial markets. Numerous users demanded a Methods to borrow cryptocurrency from an unregulated source without intermediaryAave also came to our rescue.

Aave users are no longer subject to a central authority managing their resources. The users can access their funds, manage them and do transactions as they wish. Users don’t even have to know the identity of the person they are transacting with. These smart contracts take care of all the details.

Anyone with a web3 wallet is able to use Aave for lending and borrowing transactions.

Aave is a popular choice because of its versatility.

A number of factors have contributed to Aave’s popularity. This protocol plays a crucial role in the development of decentralized finance in areas such as technology and liquidity. The protocol is considered one of the most highly-ranked money markets within the sector. Aave was instrumental in helping J.P Morgan to complete its first DeFi transaction.

Aave uses Distributed Ledger Technology, (DLT), to record transactions. However, this is not Aave’s main selling point. Users can borrow or loan a variety of cryptocurrency coins using the protocol, which includes highly-rated crypto coins like Ethereum and USDT.

The major reason behind the popularity of Aave is its unique “A flash loan” feature. The feature lets users borrow cryptocurrencies with no collateral. However, the transaction must be done within the transaction block’s time limit.

For flash Aave loans to work, the borrower must place a request, use it, and pay it back (plus a 0.09% fee), all within the same transaction block – in Ethereum’s case, 13 seconds. The transaction will be cancelled if the borrower does not meet the deadline. All traces of the transaction are erased as though it never took place.

Both the borrower and Aave are protected from any risk.

Aave’s popularity is also due to its interoperability. Decentralized lending protocols can be interoperable with many decentralized finance platforms. Users who use Aave for their borrowing and lending transactions will find this unique feature very useful.

What is Aave Token?

AAVE token is the governance token for the Aave protocol. AAVE token owners have the ability to control what happens in the network. A token holder can vote for and choose the results of Aave Improvement Proposals.

It is important to note that an AAVE token equals one vote. More tokens equals more votes.

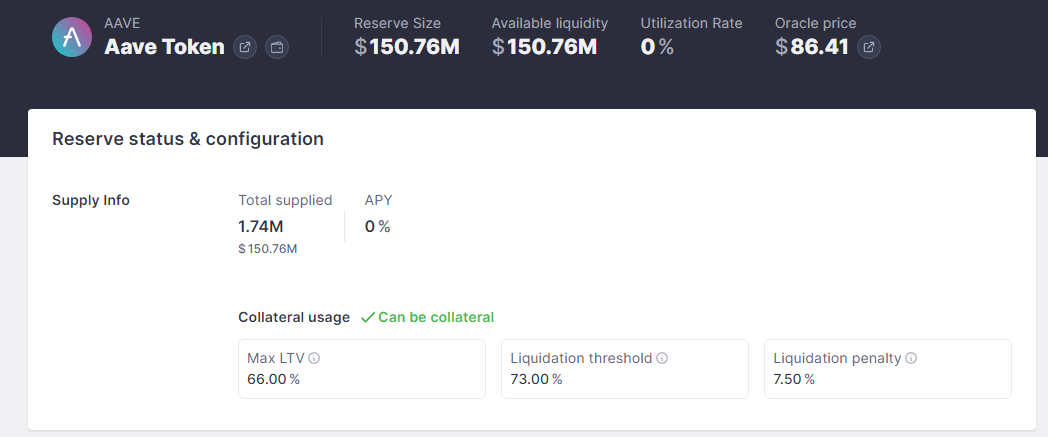

Aside the AAVE token, a second token or a group of tokens is used in the Aave protocol. These tokens can be called the aTokens. Lenders who contribute to the pool receive aTokens. Tokens can be issued for lenders who want to lend liquidity to the pool.

AAVE token ownership comes with other benefits, including voting. AAVE tokens can be used as collateral to get discounts on transactions fees. Borrowing the AAVE token will usually be free.

The AAVE token is used to deflationize the currency. The token will be burned continuously. Simply, burning means sending a certain amount of tokens to a wallet address that is not protected by a key. It will decrease the amount of tokens that are in circulation, which will cause their value to rise.

Around 80% of transaction fees are spent on the burning process. To encourage the expansion and growth of AAVE, the team also reserved 3,000,000 AAVE tokens. These coins are kept in Aave’s Ecosystem Reserve Contract.

Current market value of AAVE token makes it one of DeFi’s most popular tokens. AAVE tokens are available for trading, exchanging, and buying on many trusted crypto exchanges. Your AAVE tokens can be stored on any Ethereum-supporting blockchain wallet.

Is there a shortage of AAVE tokens in circulation?

AAVE has a maximum supply of 16 million tokens. Only about 12.5million coins remain in circulation, however.

A majority of transaction fees paid is used for the purchase of AAVE tokens, which are then burned. The transaction fees regulate the amount of tokens that are in circulation. They also help to maintain the liquidity of this pool.

The market cap of the AAVE token is determined by multiplying the circulating supply with the token’s market price at any given time. The market cap is the measure of a coin’s position in the marketplace. The market capital is the most important determinant of market rank.

What is the Value of AAVE Tokens?

AAVE value is linked to its utility. There are many uses for the Aave protocol, and some features that increase its value. The value of the token is also tied to its supply, which is capped at a fixed value of 16 million.

Aave’s DeFi protocol system uses 80% of the fees to purchase AAVE tokens and burn them. The token’s overall value is increased by this reduction in tokens. To reward those who loan funds to the liquidity fund, incentives and/or rewards are provided by 20% remaining in transaction fees.

Its popularity and acceptance directly impact its value. A protocol’s worth is determined by its popularity and acceptance.

What is Aave?

Aave acts as a central money market. Aave does not connect individual lenders with borrowers. Instead, it uses liquidity pools. This allows lenders to add their cryptos to Aave pool, and then they receive rewards based upon the amount that they have deposited.

Pools are automatically maintained and automated loans are made. You can choose from one of these types for your loan:

You can also get loans in LINK and BAT cryptocurrencies.

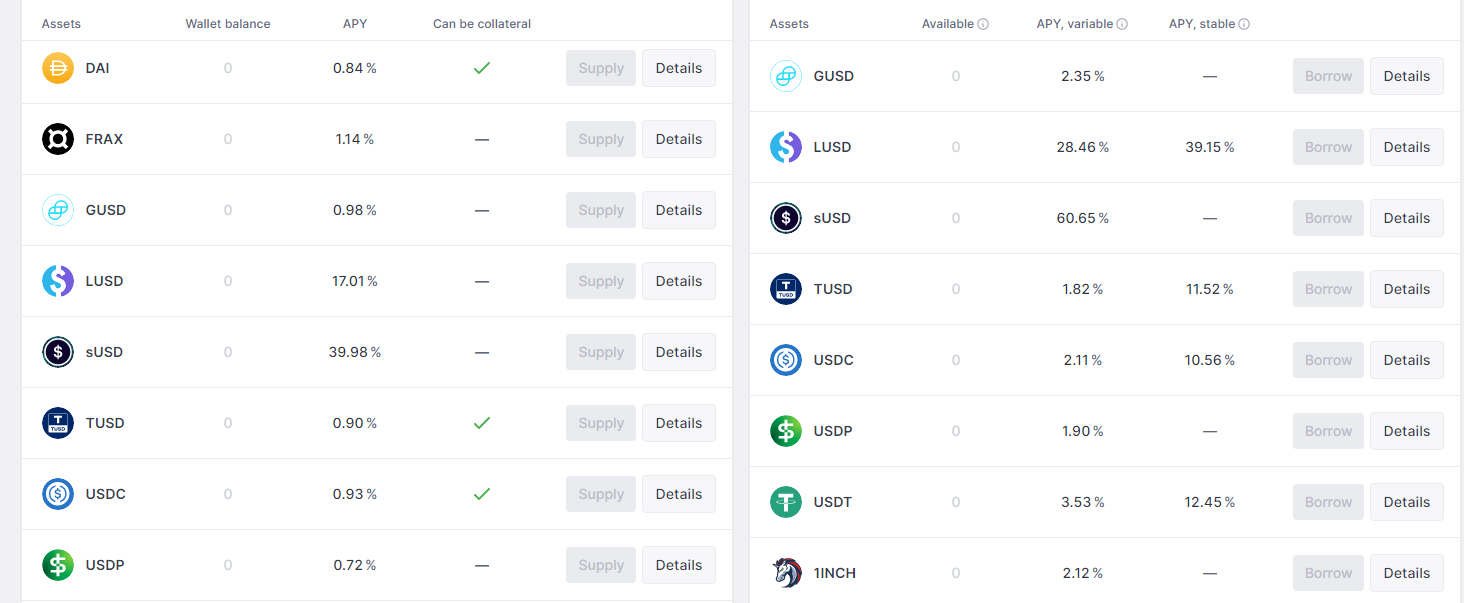

Each cryptocurrency has its unique borrowing rate, all of which are listed on Aave’s official website. The forces of demand and supply determine the rates. Higher demand means that the interest rate will be higher to encourage depositors to make more crypto.

To encourage people to borrow crypto, the interest rate is lowered if there’s more supply than demand.

ATokens are rewarded for every transaction made on Aave.

Each cryptocurrency comes with its own token. For example, a deposit in ETH will generate aETH and a payment of BAT will create aBAT. The tokens correspond in 1:1 with the asset’s value.

You can store these tokens in crypto wallets or exchange them for other cryptocurrencies. These tokens will allow users to gain access to many cryptocurrencies, without having to own them.

Before being permitted to borrow, the borrowers must deposit collateral. The loans are not over-collateralized. The collateral’s expected value is greater than the amount being borrowed.

Aave’s loaning program is great for those investors that need liquidity and don’t want to give up their crypto assets. Once the collateral has been deposited, it is given over to the lender. If the borrower is unable to return the collateral within the time limit, the lender retains the collateral.

Aave operates on a noncustodial basis. The liquidity pool contributors do not have to give up their ownership rights of digital assets.

The volatility factor can have a significant impact on cryptocurrency assets. There are measures to reduce the volatility.

If the crypto’s value increases after depositing the collateral, the initial deposit will also increase in value and will be collected by the borrower after repaying the loan.

The protocol will lose the deposit if the value falls below 82.5% and it will be given to the lender.

Reserves

Aave can lose its business due to extreme market swings. Aave reserved money for liquidity pools to prevent this. This fund has a value of 3 million AAVE tokens. It acts as a buffer and protection for lenders.

Oracles

The real-time valuation of collateralized assets can be determined using Aave. Aave works in collaboration with Chainlink to act as an oracle for communicating with other blockchains.

Flash loans

Aave’s flash loans revolutionized the crypto lending market. These loans are repayable in one block.

Interchangeable Interest Rates

A user can also change the structure of their interest rates. Aave gives you the option to select between constant and fluctuating rates anytime you want. Continually changing rates are determined by the liquidity pool’s demand. In contrast, stable rates are based on an item’s average interest rate over the previous 30 days.

Aave’s Pros and Con

Aave is just like any other DeFi Protocol.

The Aave Team

Solid institutional support

Aave has the backing of many trustworthy crypto institutions. Two of the most popular are Winklevoss Capital Capital and DTC Capital. This strong support makes it easier for the Aave development team to be trusted during an upgrade.

Multi-faceted uses

Aave may be used for loans. But flash loans offer more than an obvious advantage. The flash loan is different than normal loans in that it must be repaid within one block. It can increase your gains by scalping any discrepancy between crypto prices.

Aave Cons

Over-collateralization

Aave’s business model requires the over-collateralization of loans. This model protects the system but it means that average users can’t take out loans above what they have.

Interest rates low

Aave provides low-interest rates. This might be attractive to borrowers but the core system, Lenders might prefer competition with higher rates.

Are Aave Products Safe?

Aave Protocol is extremely secure. The smart contract undergoes periodic audits in order to make sure it is secure. Lenders and borrowers are able to seamlessly access the Aave platform for lending and borrowing. To avoid liquidity problems, loans are nearly always fully collateralized. The platform can continue to function even in case of default. Aave has another way to ensure positive liquidation. This is by setting a threshold for collateral. The smart contract places loans in liquidation automatically if the limit is reached.

These funds are also used by the platform’s reserve liquidity pools to protect against market volatility. These reserves also protect lenders’ money, which will still be available when they need it.

Bottom line

Lending and borrowing are two ‘crypto languages’ that will not be going out of vogue in the cryptocurrency market. As in traditional markets, traders will need loans to either leverage arbitrage opportunities, or get additional items without having to liquidate their cryptocurrency holdings. Aave is a strategic player through its flash loans, oracles and interest-bearing tokens. We will see how the market reacts to this crypto bear market.