Regardless of the current downfall of the crypto market, the projection of Bitcoin (BTC) to cross the $100k threshold stays seen as a matter of time. Again in December, Bloomberg Intelligence indicated that the anticipated mark would occur finally “as a result of financial fundamentals of accelerating demand vs. lowering provide,” and new knowledge shed some mild on that concept.

Bitcoin Vs. Crude Oil

In a brand new Bloomberg Intelligence report, knowledge exhibits developments that would favor Bitcoin and Ethereum costs.

The report famous that “Representing advancing expertise, Bitcoin is gaining traction as a benchmark world digital asset, whereas oil is being changed by decarbonization and electrification.”

Lack of provide elasticity is an attribute shared by Bitcoin and Ethereum that “units them aside from commodities”.

For commodities, “rising costs thwart demand and enhance provide”, however the prime cryptocurrencies would possibly inform a unique story.

“Growing Bitcoin and Ethereum demand, and adoption vs. diminishing provide, ought to comply with the essential rule of economics and lift costs.”

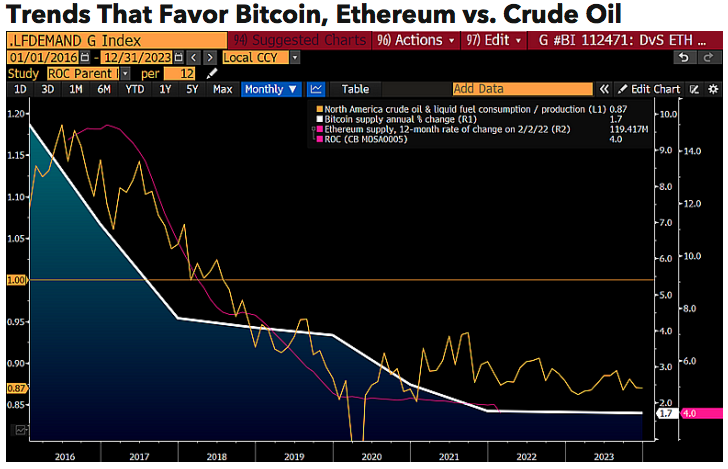

Within the following chart, Bloomberg exhibits a juxtaposition of the lowering BTC and ETH provide together with the surplus of crude oil and liquid-fuel manufacturing in comparison with consumption heading towards 13% in 2023, noting that the U.S. “has been a prime headwind for commodity costs”.

Associated Studying | Why The Bitcoin At $100K Discourse Stays Robust Regardless of Market Crashes

Mainstream Adoption

Consultants assume that BTC “is properly on its option to changing into world digital collateral”, whereas its revolution within the “digitalization of finance” is in its early days. Future mainstream adoption will result in elevated demand for bitcoin.

The report predicts that the longer term developments within the macroeconomics and politics of the U.S. –greenback dominance, jobs, votes, taxes, and the intention to oppose China’s insurance policies and discover leverage in opposition to them– will lead U.S. policymakers into creating correct rules for cryptocurrencies and ETFs.

Past El Salvador adopting BTC as authorized tender, the proximity of the U.S. midterm elections has evidenced the American senators and politicians’ race to comply with alongside. In Wyoming, Arizona, and Texas politicians are pushing to show the digital coin right into a authorized tender, pointing at Bitcoin as a brand new defining issue to get properly positioned within the polls.

A wider acceptance of bitcoin is predicted to occur with extra regulatory readability as a result of concern and misinformation might diminish, thus extra buyers would bounce in which means mainstream adoption.

The report additionally notes that this better mainstream adoption of Bitcoin is wanting unstoppable, which might possible profit its worth.

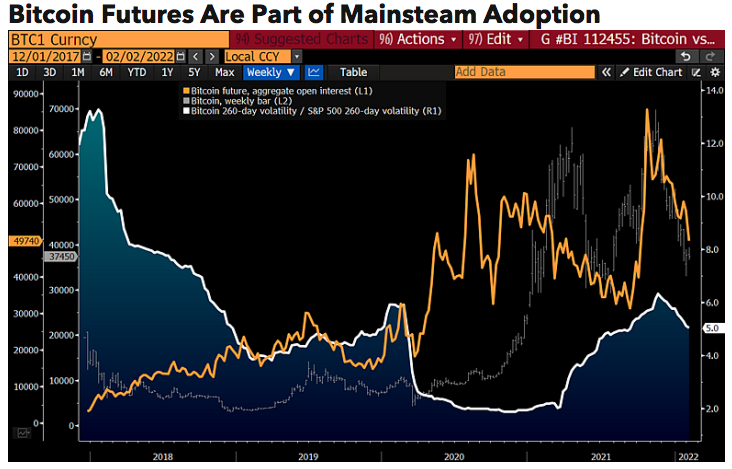

“The launch of U.S. futures-based exchange-traded funds in 2021 seems as a child step by regulators that we expect culminates with ETFs monitoring precise cryptos through broad indexes.”

Bloomberg knowledge exhibits that “Rising demand, adoption and depth of Bitcoin ought to go away few choices for volatility however to say no.” Because of this, they assume it’s going via a “price-discovery stage”.

The next chart exhibits “the upward trajectory of Bitcoin futures open curiosity vs. the downward slope within the crypto’s volatility vs. the inventory market”, noting that Bitcoin’s 260-day volatility is 3x of the Nasdaq 100, which contrasts its volatility throughout the launch of futures in 2017, which was nearer to 8x.

Concerning the Federal Reserve’s tightening measures, Bloomberg specialists had beforehand predicted that “Bitcoin will face preliminary headwinds if the inventory market drops, however to the extent that declining fairness costs strain bond yields and incentivize extra central-bank liquidity, the crypto could come out a major beneficiary.”

Associated Studying | Bitcoin Leverage Ratio Suggests Extra Decline Might Be Coming