A finance professor at the Wharton School of the University of Pennsylvania has warned of “bitcoin taking over.” He added that the Fed “has been terribly wrong over the last year” about inflation and must now act to defend the U.S. dollar.

The Fed Must Take Measure to Protect the U.S. Dollar, Finance Professor Demands

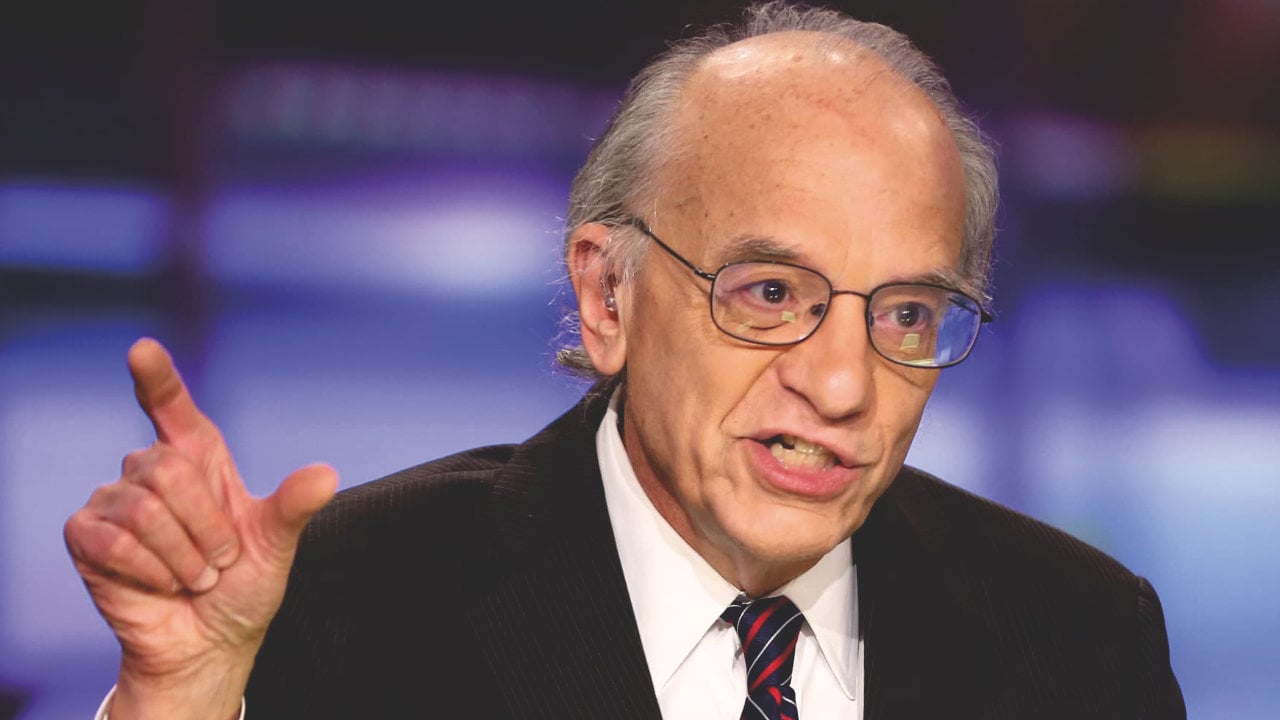

Wharton’s finance professor Jeremy Siegel shared his view on inflation, “bitcoin taking over,” and the need for the Federal Reserve to defend the U.S. dollar in an interview with CNBC Friday.

Russell E. Palmer Emeritus of Finance, Siegel at Wharton School University of Pennsylvania. His research interests include macroeconomics and long-term asset returns as well as demographics.

Siegel was critical of the Federal Reserve Chairman Jerome Powell’s announcement last week that March would see the first rate increase. It will probably be 25 basis points.

“They’re going to have to do much more than that … I’m actually disappointed that Chairman Powell did not look at the history that this is not a time for us to slow down,” the Wharton finance professor stressed, elaborating:

In the last year, the Fed has made a lot of mistakes. All this temporary inflation. Look at the protection they did for inflation last year — so way below what actually happened all the way to December.

He said last week that it would be a “big policy mistake” for the Fed to slow down interest rate hikes because of the situation in Ukraine.

While stating that “Jay Powell is a very good man” and “a good communicator,” Professor Siegel stressed: “The Fed has been very wrong and they are going to have to catch up and they really have to admit they’ve got to bite the bullet here.”

He urged the Federal Reserve, in particular, to act to safeguard the U.S. currency, with a focus on bitcoin.

Bitcoin is being discussed. We’ve got to defend the dollar.

For a while, this professor had been noticing the popularity of Bitcoin’s growth. According to him, BTC is now an alternative to gold for inflation protection.

He also warned that the Federal Reserve is “so far behind the curve that we have a lot of inflation that is embedded in,” predicting that “The Fed is going to have to hike many more times than what the market expects.”

What do you think about Professor Siegel’s comments? Please leave your comments below.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.