In two days’ time, bitcoin’s price dropped to fresh August lows as it dipped below the $20K per unit region for the first time since mid-July. Two addresses were created in December 2013 and sent $10,000 bitcoin to unidentified wallets. The accounts had been idle for nearly nine years. The 10,000 coins that were moved this week are a result of the Mt Gox attack on June 19, 2011, according to onchain data.

Whale Once Having 134,000 Bitcoins From The 2011 Mt Gox Hack Attributed to This Week’s Spending of the Last 10,000

On Sunday August 28th, a whale travelled approximately 10,001.514 BTC and Monday August 29th, 2022. The funds stemmed from two addresses (1,& 2) created eight years and eight months ago on December 19, 2013.

The 10,001 bitcoin transaction was caught by the blockchain parser btcparser.com, a tool that often catches so-called ‘sleeping bitcoins’ moving after sitting idle in addresses for years. Blockchain parsers have caught some sleeping bitcoins, including BTC block subsidies that were mined in 2011 and 2010.

2013, bitcoins were split into smaller transactions. One address could be split in multiple parts of 47.98 BTC and one transfer would cost 200.99 BTC.

The “14RKF” address that sent the 5,000 BTC came from a wallet 18JPr that once held 24,404.50 BTC. 24K BTC was first received from 18JPr in November 2012.

The funds were dispersed to other addresses, although some wallets that received fractions 47.98 BTC Monday still have the funds. Also, the address 15n6b which dispersed 5,001.514 BTC a day earlier on August 28, 2022 came from the 18JPr wallet. This wallet once had 24,404.50 BTC.

According to Onchain Data, 10,000 Bitcoin were moved this week from the Mt Gox Breach in 2011.

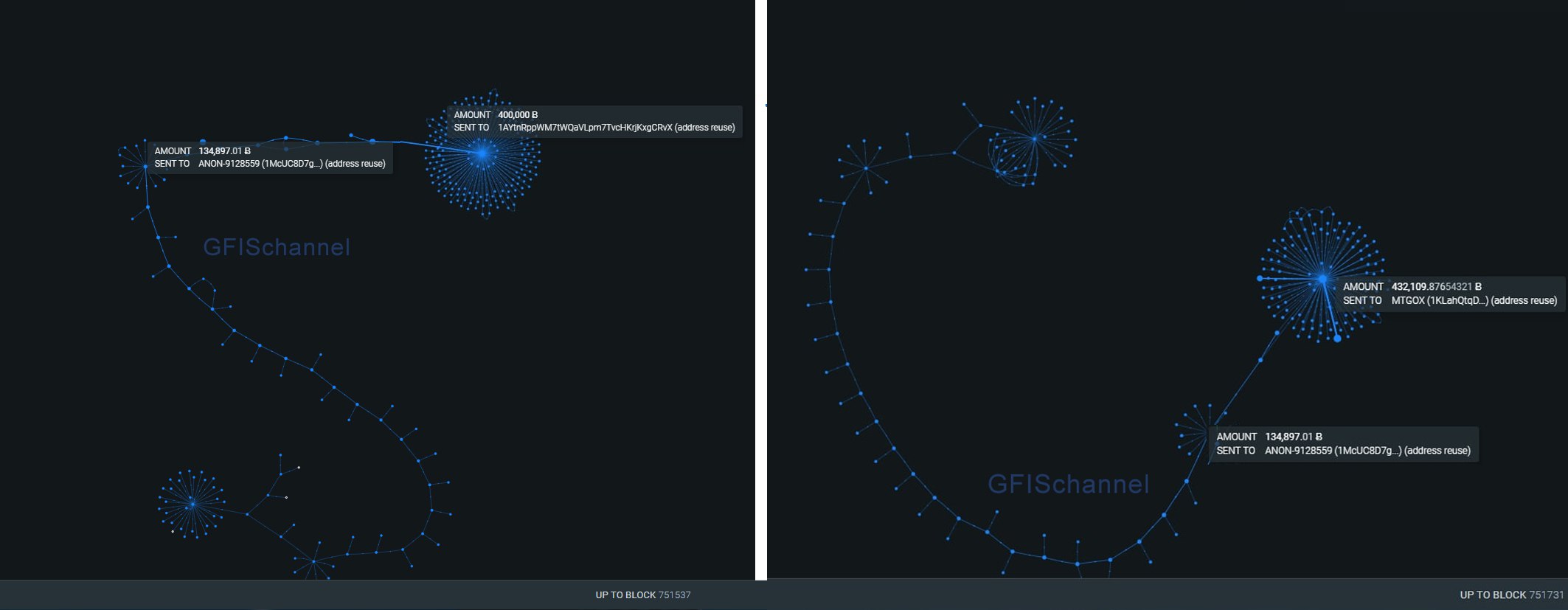

The original source for the Sunday and Monday 2013 Bitcoins was wallet 1McUC. This wallet once contained 134,897.01 BTC. After receiving them on June 19, 2011, it had the coins back. The entity then began moving BTC on July 20th 2011.

The 134.897.01 BTC came from different batches that were sent to 14 different senders prior to June 19, 2011. Further analysis of the chain shows that the bitcoins, including the original 134K BTC and the 10,000 BTC used this week, are likely to belong to one entity.

The transfers between June 2011 up until now, do not show signs of being an exchange, and the whale’s mega stash of 134K BTC gradually depleted in fractions over the last 11 years. It seems that the 10,001 BTC this week was the last from the 1McUC original address.

It is unique because of how the entity used tens to thousands of bitcoins per batch between July 2011 and the end 2013. However, not one cent was spent in the 10001 BTC batches for nearly nine years. On Tuesday, the blockchain researcher and the admin of the Telegram channel “gfoundinsh*t,” Taisia, said that the 10,000 bitcoins came from the infamous 2011 Mt Gox hack.

“The blockchain visualization clearly shows that in each of the transaction chains associated with both withdrawals, the same wallet (1McUC) actually appears, which received a large amount (134K BTC) from Gox, just at the time of the described events,” Taisia told Bitcoin.com News. “And, as we remember, the founders of the BTC-E exchange, which was created later, and later WEX was also suspected of the subsequent hacker attack.”

Taisia added:

The events with these exchange leaders suggest that if they are involved in the cyberattack of summer, these piggy banks could be being opened by law enforcement agencies.

Taisia mentioned also that Taisia thought it an interesting coincidence that 2011 Mt Gox Coins were distributed during rumors about 140,000 Mt Gox cryptocurrency spreading like wildfire over the weekend. Bitcoin.com News published information on speculation and rumors regarding old Mt Gox Bitcoins. Mt Gox creditors calling it “fake news.”

Let us know your thoughts on the Whale that bought 10,001 Bitcoins this Week and its association with the 2011 Mt Gox Hack. Please comment below to let us know your thoughts on this topic.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com doesn’t offer investment, tax or legal advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.