Timeline for the Collapse

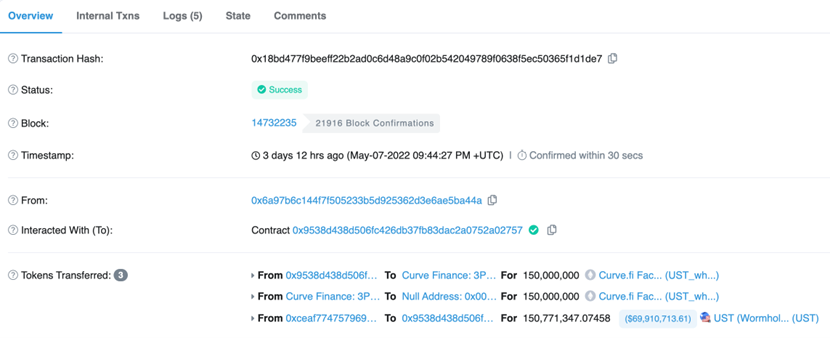

-On May 8th, Luna Foundation Guard (LFG), a Singapore non-profit responsible for maintaining the Terra network in Singapore, took $150 million of UST out of the UST-3Crv Pool. The pool’s TVL was approximately $700 million at that time. This means that it took only $300 million to drain the pool.

– To keep the balance of liquidity in the UST-3Crv Pool, LFG removed another $100 million worth of UST from the pool.

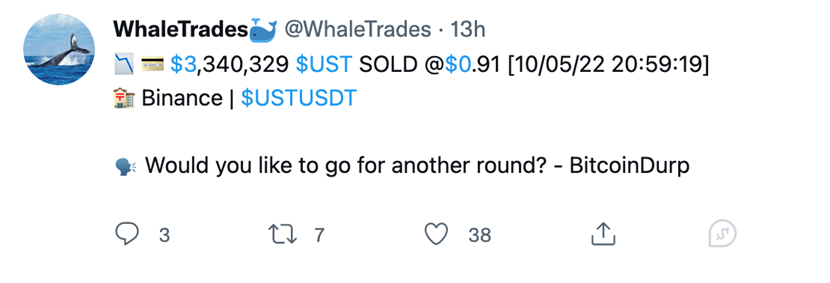

– On the evening of May 8, WhaleTrades, a whale alert account on Twitter, began to “ring alarm bells” frantically: there was a tweet of selling millions of dollars’ worth of UST every hour.

– On the morning of May 10, Jump Trading and LFG may have sensed the problem and stopped selling their Bitcoin holdings to provide support for UST’s peg, letting things drift. UST plunged all the way down to $0.6.

– On May 11, UST seemed to be shorted by Soros-style short sellers, and has plummeted to a minimum of $0.2998 (source: CMC) after rounds of underselling.

On May 11, it was a frightening day: It seemed that short sellers were deliberately shorting UST or LUNA.

– While liquidity is being withdrawn from the UST-3Crv Pool as reserves for the 4Crv Pool, a single wallet dumped $350 million worth of UST on Curve, making UST lose its peg to the US dollar. LFG responded by selling BTC and the short-seller dumped the remainder UST on Binance.

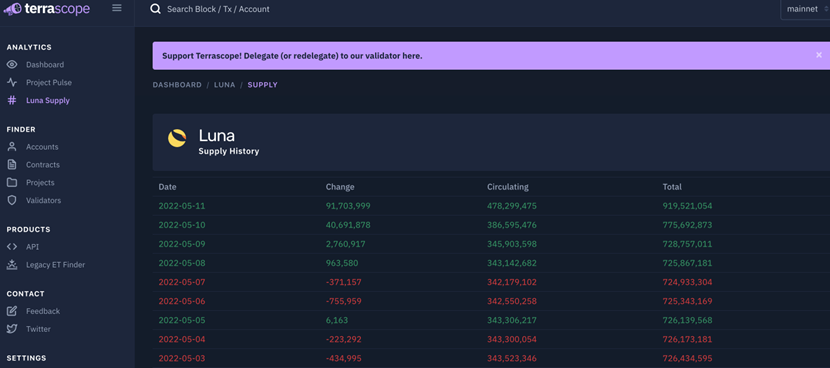

– UST was seriously depegged, followed by a run on UST. LFG stepped in to save the day with plans to lend large amounts BTC. This caused a sharp drop in BTC. The supply of LUNA, which is made from burning UST has increased. This led to its decline.

– The profit from short positions of BTC and LUNA of the short seller is estimated to exceed $1 billion, and the cost, mainly the UST dumped, is estimated to be within $200 million.

The LUNA Ecosystem: Impact

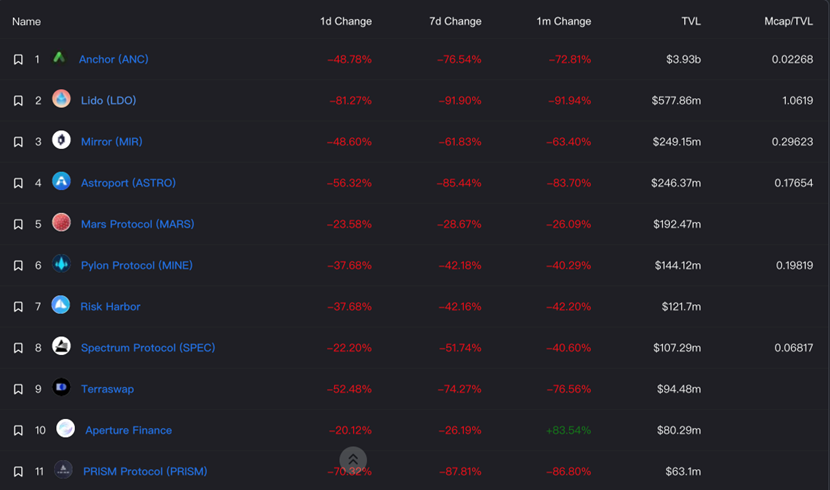

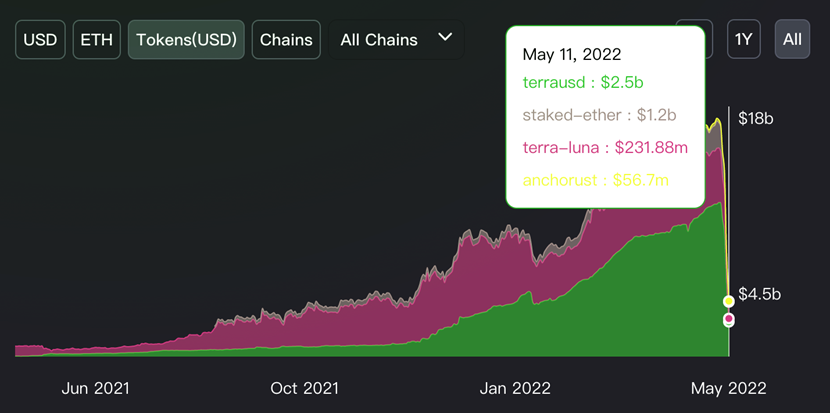

The close relationships between Terra projects and LUNA, UST, as well as DeFi Legos’ reinvestments, profits, and stakings has meant that the UST Depegging has a devastating effect on both the LUNA, UST, margined staking and DeFi, lending margin and other protocols. What’s worse, it even directly triggered the liquidation of protocols, pushing LUNA and UST into a secondary death spiral.

1. Anchor

Anchor, a Terra-based decentralized savings protocol, boasts an APY stable of 20%. This is the most notable feature.

Influenced by the UST depegging, Anchor’s APY rests at 18.9%, but its total deposits plummeted to $3.99 billion from $14 billion last Friday, as suggested by Anchor’s Dashboard.

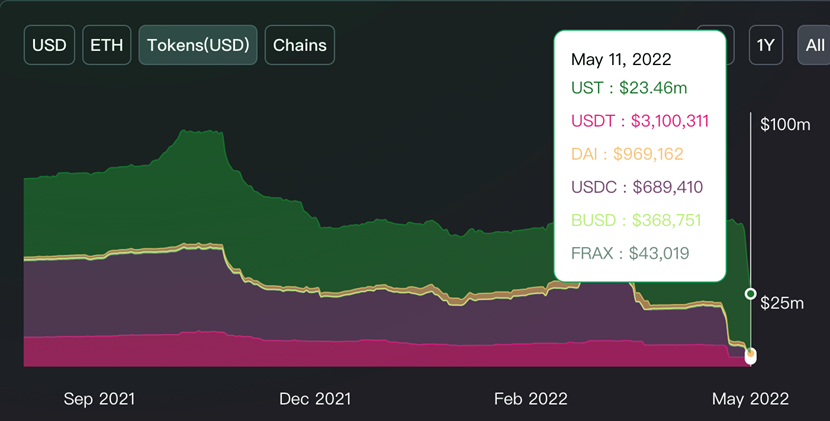

Orion.Money, which is an additional to the Anchor or Terra ecosystems and designed to allow the conversion of stablecoins like USDT and DAI to UST to earn earnings from savings made in the Anchor ecosystem. OrION investors can earn significant returns by investing in the token and receive 10%, 15%, or 20% APYs. The Orion Protocol stablecoin stakings have fallen by over 50% since the UST depegging.

2. Mirror

Mirror’s synthetic assets are all minted using UST as their main collateral in order to reflect various financial assets like stocks and ETFs. The demand for U.S. stocks-based synthetic assets in Mirror is likely to turn into the demand of UST. This stablecoin creates the greatest usage scenario and also provides value for UST/LUNA.

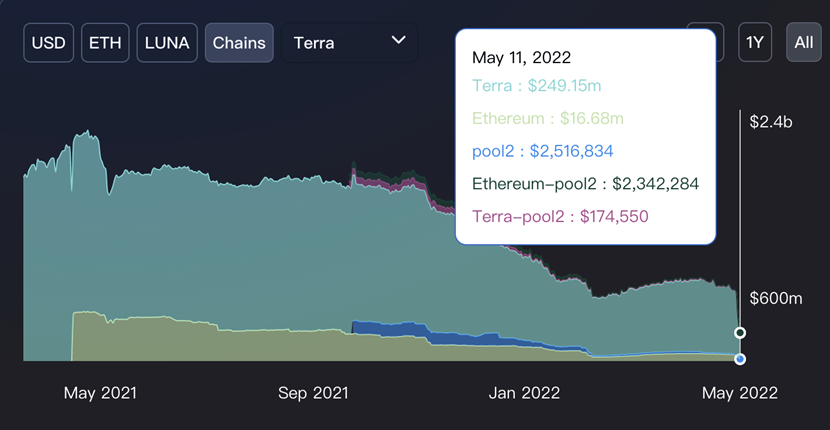

Mirror reported that the TVL of the Terra chain fell 60%, from $600 million down to $240 million.

3. Lido and node staking

Lido is the most popular liquidity staking protocol. It started Liquid Staking for Terra in January 2017. This plan released the LUNA staked at nodes within the Terra ecosystem. Another drop in LUNA staked at Lido was also observed. There was also frantic underselling. As a result, the TVL of Terra’s staking in Lido dropped by 80% on May 11 alone, with a seven-day drop of a staggering 91%.

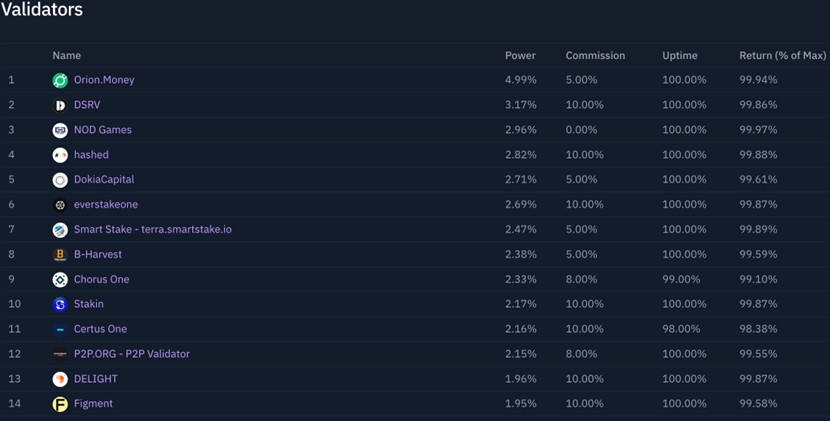

Node staking, on the other hand affects the Verification and Security of Terra Network. For the time being, we haven’t observed a large number of nodes fleeing. Due to the UST depegging more LUNA is in circulation which will push up the supply towards 1 billion.

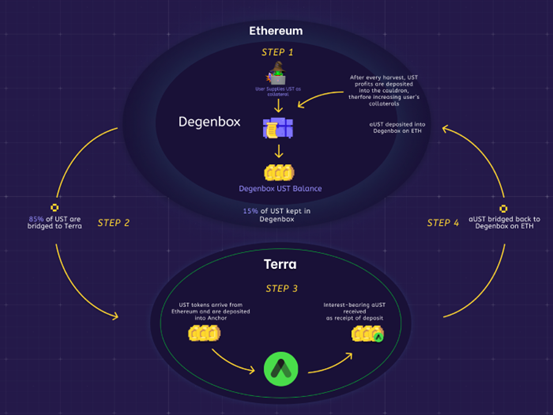

4. Abracadabra

Abracadabra created the Degenbox UST Strategy. To borrow MIM and leverage their positions, users deposit UST tokens to the cauldron. The strategy can be used as long as UST stays at $1. Users are at risk of liquidation if their collateral is lower once UST has been depegged.

In response to market conditions, Abracadabra is currently moving all UST on Terra from its UST strategy to Terra to Ethereum. This protocol pays greater attention to potential liquidations and liquidity.

Relevant Reserve Pools

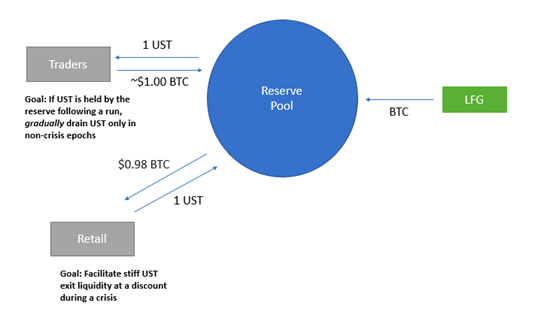

LFG set up a reserve of Bitcoins and AVAX as a support for the stabilization of the algorithmic stablecoin UST due to the earlier death spiral.

Taking BTC as an example, let’s go deep into this mechanism: LFG originally intended to relieve the inflationary pressure using BTC. Trader’s UST to LUNA exchanges reduce the supply of LUNA and makes the system less vulnerable to risk. Jump proposes an on-chain exchange mechanism where 1 UST is worth $0.98 in BTC. For off-chain trades the UST price must be lower than $0.98. Traders can purchase Bitcoin with a discount through the reserve if the UST prices are below that level. Such a variant of the AMM mechanism is called “The Defender”. The reserve pool is the best place for Bitcoin purchases in the market before the delivery price exceeds $0.98. This mechanism provides a hard support for the UST’s peg.

BTC or AVAX are not allowed to be used as collateral. Based on the vulnerability of algorithmic stablecoins this new mechanism is designed to link the coins with stabler assets. This, in turn, hedges against the selling. Despite this clever design, UST/LUNA can’t be redeemed for bitcoin on-chain for the moment. What’s worse, as UST struggles to maintain its $1 peg, LUNA holders suffer a confidence breakdown and get trapped in the death spiral.

LFG had to pull out its bitcoin stash to help the token. According to the report, LFG has lent out $1.3 billion in BTC (28,205 bitcoins) to trading firms to hold UST’s price peg. This was just one drop of the entire bucket. Things have gotten worse with the announcements of a rising interest rate, and a shrinking balance sheet on May 10. As the consistent inflow of established financial institutions into the crypto market for the recent years brings Bitcoin much closer to the US stock market, Bitcoin dropped below $30,000 in response to the collapse of the US stock and LFG’s big loans of bitcoin.

AVAX is another ecosystem that’s closely related to Terra. Do Kwon on April 8 announced that AVAX could be used to create a reserve to protect UST. Users of crypto will then be able to mine UST via Avalanche. The AVAX-powered projects will allow for more uses of UST. Avalanche’s stablecoin ecosystem, however, also requires one. This is why they clicked so quickly. This seemingly flawless partnership has some pitfalls. The working principle of AVAX and UST, similar to that of BTC that we mentioned earlier, is to form a virtual AMM pool where users who have earned UST on Avalanche’s C-Chain can swap $1 worth of AVAX for $1 worth of UST or convert $1 worth of UST into 99 cents’ worth of AVAX. The asymmetric arbitrage mechanism will be tapped only when UST drops.

AVAX can not be used directly to make UST at this time. Do Kwon’s AVAX reserve only includes the 100m AVAX that LFG acquired. A transaction which will be done through the Avalanche Foundation under an over-the counter (OTC). Specific details (e.g. The details (e.g., the price and lock-up period) remain secret to the public. AVAX’s drop in value by more than 20% is not as dramatic as the nearly 99% fall of LUNA. This was due to general market impact. The meltdown also raised alarms for all public sector agencies. Is it necessary for all ecosystems to have a stablecoin in order to function? NEAR launched USN, an ecosystem-based stablecoin USN, in its early days. Market confidence was lower than AVAX and NEAR suffered more.

Algorithmic Stablecoins

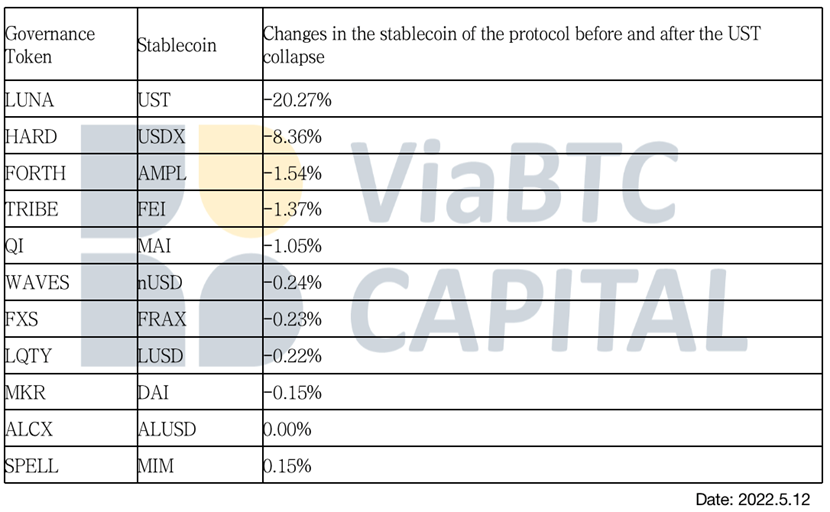

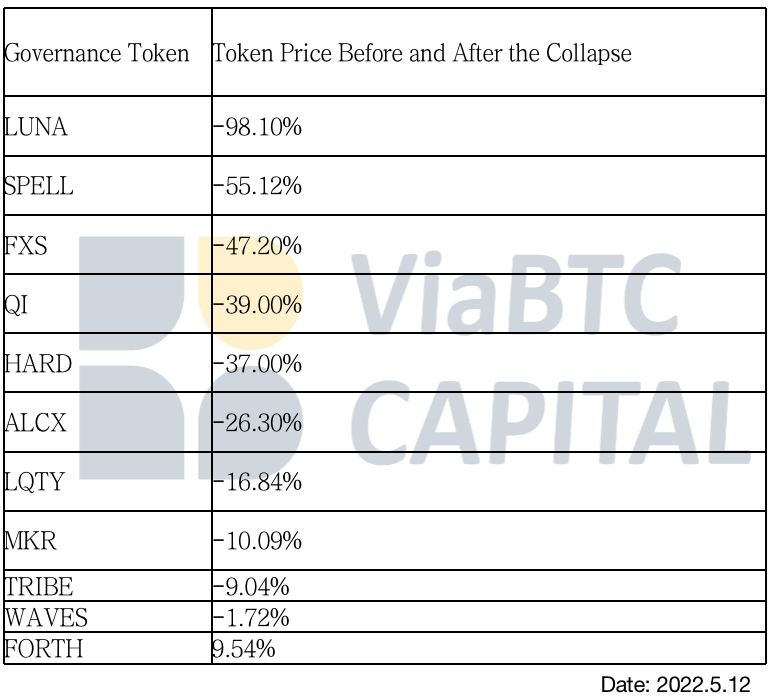

The crisis of confidence in stablecoins caused by the collapse of UST has extended to other stablecoin protocols, but this is also a good opportunity to test users’ confidence in other protocols and their underlying mechanisms.

Decentralized stablecoins have not been seen to show large-scale depegging (except for fiat-collateralized USDC and USDT) Prior to or following the collapse of UST, the depegging threshold was set to 5%. An exception is HARD Protocol’s USDX which saw a drop of about 8%. FRAX and FEI, which are partially collateralized, have not experienced severe depegging.

UST is a major problem for stablecoins. It has impacted confidence, particularly in algorithmic stablecoins or protocols with low collateralization. FXS and SPELL.

Dynamics:

According to some sources, the LUNA meltdown could be masterminded by HF Citadel Securities, suggesting that this famous Wall Street player shorted the market by lending out 100,000 bitcoins, which crushed LUNA’s peg mechanism and resulted in a vicious spiral.

Do Kwon was the first to seek help. He tried to sell LUNA at a discounted 50% and raise $1 billion. But, the offer was turned down.

Then he announced Proposal 1164. It was approved with 35 votes in favor and four abstention. It aims to increase the speed of UST’s burning. More specifically, it will increase the base pool from $50 million to $100 million in SDR and reduce the Pool Recovery Block from 36 blocks to 18, which will increase UST’s minting capacity from $293 million to $1.2 billion.

Terra holds large traditional Korean funds belonging to many major Korean corporations. Terra, a Korean fintech company, stores these assets in the form UST. Legal consequences will be incurred if such assets are found. UST, unlike LUNA which only affects crypto investors and involves funds from non-crypto communities, is much more extensive than LUNA. Such funds have more legal requirements and responsibilities than LUNA, which mostly affects crypto investors. If you are asked which one of these funds would be preferred, LUNA is likely to be lost to protect the value of UST. The only solution is to continue minting LUNA in order to burn UST, and then to turn LUNA into other valuable assets (BTC/USDT), stabilizing the UST peg. The stabilization of the UST peg via the continued exploitation of LUNA’s value is the only feasible way to save UST. External funding might be necessary to stop the LUNA prices from falling further.

LUNA, in a word has been removed from its pedestal.

As of the writing of this article, the price per LUNA was $0.8 and $0.68 respectively.

*The above cannot be relied on as any investment advice.