Background

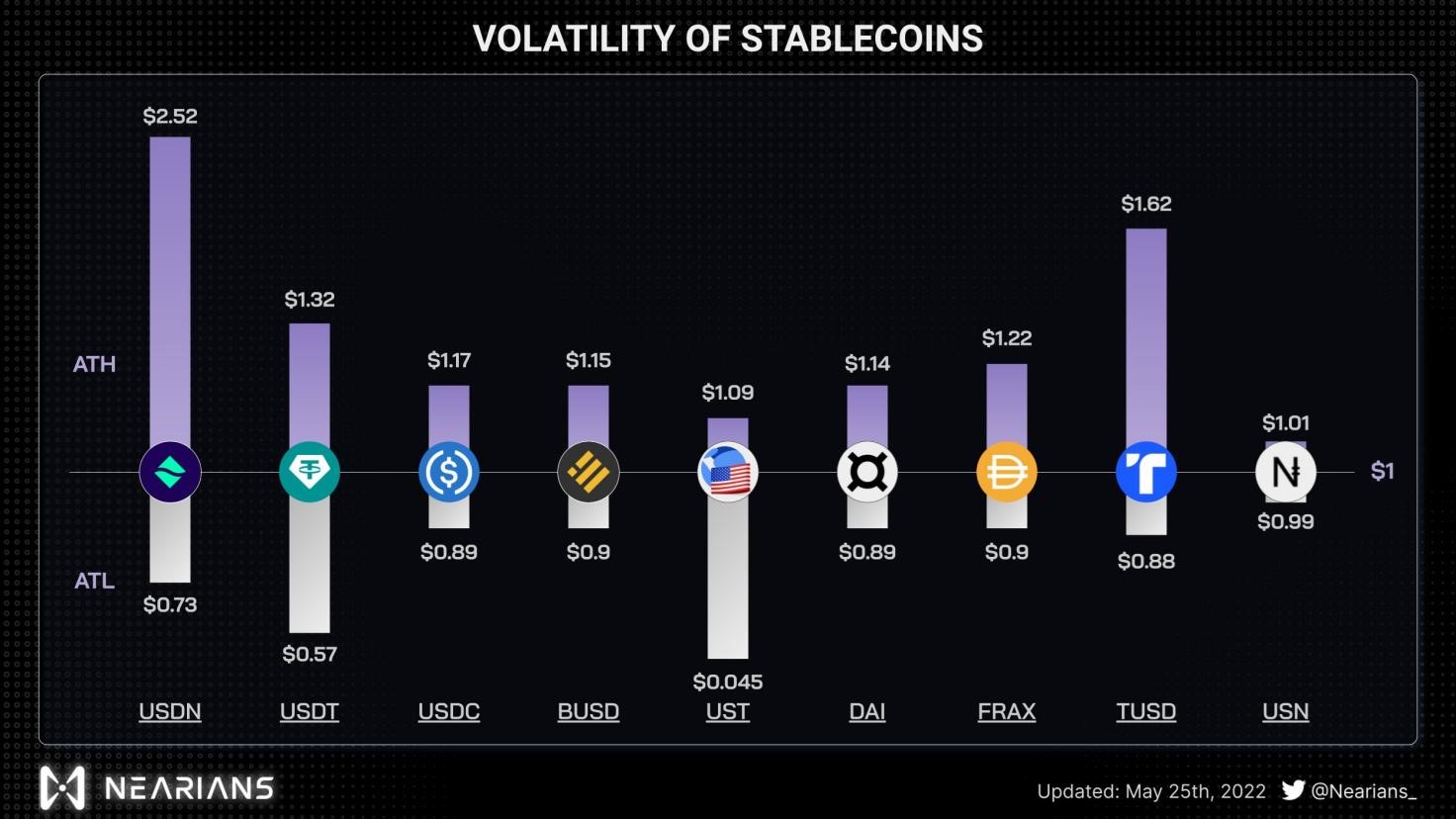

In Could 2022, UST and LUNA, which as soon as recorded a complete market cap of over $40 billion, collapsed in a single day, and loads of customers suffered large losses in consequence. Following the crash, algorithmic stablecoins have as soon as once more develop into a well-liked crypto subject. USN, a stablecoin native to an rising public chain named NEAR, was launched nearly similtaneously UST collapsed. The autumn of UST confirmed this nascent stablecoin how the loss of life spiral of an algorithmic stablecoin can engulf and destroy all the things like a terrifying black gap, and customers additionally wonder if USN may keep away from the same ending sooner or later.

About USN

As the primary NEAR-native algorithmic stablecoin, USN is soft-pegged to the US Greenback and backed by a Reserve Fund that comprises collaterals reminiscent of NEAR and USDT. USN is positioned to be an efficient option to bootstrap liquidity within the NEAR ecosystem whereas including a brand new layer to NEAR’s utility as a token. USN’s core stability mechanisms encompass on-chain arbitrage and the Reserve Fund based mostly on the Forex Board precept. Decentral Financial institution (https://decentral-bank.finance/), the DAO creating and supporting USN, manages the good contracts of $USN and its Reserve Fund. The DAO can vote to stake the NEAR from the Reserve Fund and distribute the staking rewards to the customers of protocols that combine USN.

USN’s issuance mechanism

The preliminary provide of USN is double-collateralized by NEAR and USDT through the Reserve Fund. Decentral Financial institution points the preliminary provide of USN by way of over-collateralization of the preliminary collateral (NEAR) at a ratio of two:1. Subsequently, the brand new USN will likely be immediately minted with NEAR or different stablecoins at a 1:1 ratio. In different phrases, after preliminary issuance, customers can mint new USD with NEAR or different stablecoins at a 1:1 ratio, and so they can even immediately convert NEAR into new USN within the Sender pockets. Nonetheless, in contrast to Terra’s UST minting mechanism, NEAR used for such conversions shouldn’t be immediately burned however will likely be channeled into Decentral Financial institution’s Reserve Fund. In the meantime, when USN is burned, an quantity of NEAR that’s well worth the equal worth will likely be added, which resembles UST’s burning mechanism.

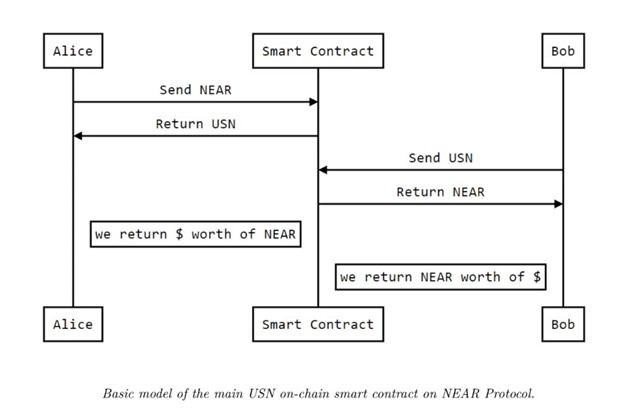

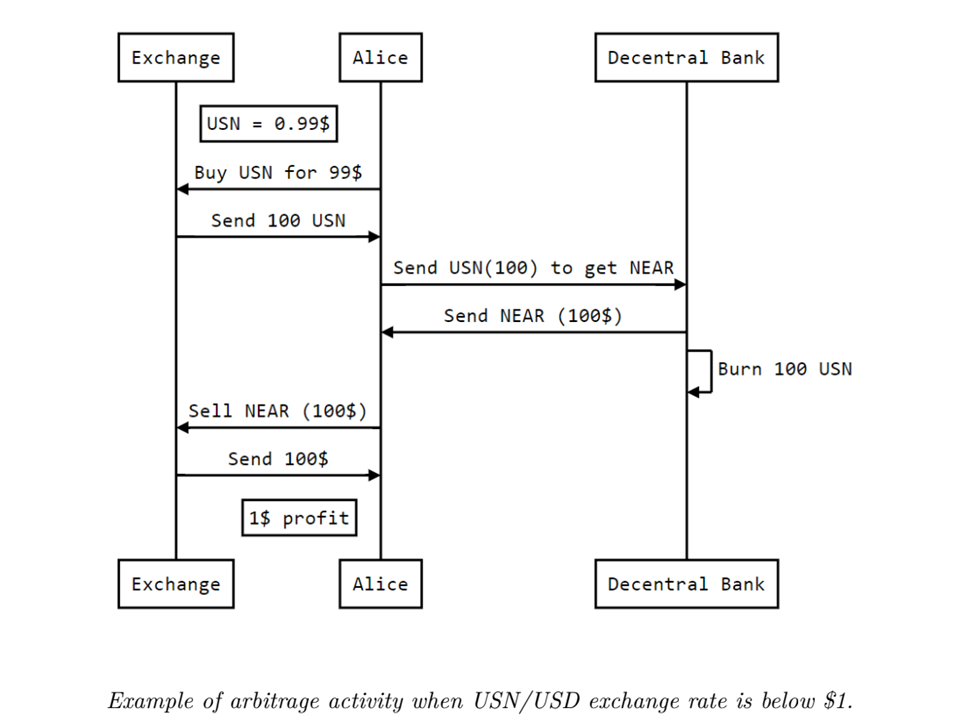

Pegging mechanism

USN’s 1:1 peg to the US Greenback is secured by way of on-chain arbitrage and the Reserve Fund. USN maintains its peg by way of a wise contract which permits for the change of NEAR for USN with 0 slippage and minimal commissions. As quickly as USN loses its peg, arbitrageurs will exploit the value distinction between NEARUSN and NEARUSD till USN returns to its peg. At its launch, part of the USN provide will likely be deposited into Ref Finance’s StableSwap to enhance the stablecoin’s liquidity by way of liquidity mining incentives.

Automation of Treasury Administration

Automation of Treasury Administration is a design distinctive to USN. Each USN issued is backed by the corresponding collateral that’s saved within the Reserve Fund. Decentral Financial institution, the supervisor of the Reserve Fund, manages such collaterals by way of NEAR-based good contracts. These on-chain contracts routinely execute Treasury Administration methods in order that they might carry out dynamically configurable, real-time small-volume transactions to keep away from any extreme imbalances within the Reserve Fund. In line with USN’s whitepaper, the first Treasury Administration methods are as follows: When the NEAR value rises to the purpose the place the upward pattern slows down, Decentral Financial institution would promote NEAR to steadiness the property of the Fund. Conversely, it might purchase NEAR when the value drops to a degree the place the downward pattern slows down. With this design, Decentral Financial institution plans to promote NEAR to move off the bubbles when the value turns into overheated and hold the market secure when the customers begin to panic on account of value drops.

Comparability between USN and different algorithmic stablecoins

USN comes with its personal distinctive options and incorporates the options of another algorithmic stablecoins. The preliminary provide of USN is issued by the Reserve Fund through the double over-collateralization of NEAR and USDT. That is barely totally different from the issuance mechanism of DAI, which is minted by collateralizing an quantity of ETH that’s value twice the worth of the DAI to be minted.

A controversial side of UST is that the UST minted can be extra precious if the LUNA value soars. In the meantime, the LUNA provide would go down, which might drive up its value, thereby creating an upward spiral. Nonetheless, as soon as LUNA goes downhill, redeeming LUNA with UST would result in a LUNA crash, giving rise to a loss of life spiral. In contrast to the non-collateralized UST, the NERA spent on minting USN shouldn’t be immediately burned or erased from circulation however enters the USN Reserve Fund as an alternative. The Reserve Fund then stabilizes the market upfront by way of Automation of Treasury Administration to keep away from any extreme value impacts that the USN provide might have on NEAR. Other than NEAR, USN can also be partially backed by USDT. UST, however, is backed by Luna Basis Guard, which holds reserve property reminiscent of Bitcoin and AVAX which are extremely correlated with LUNA. As such, when the market declined, Luna Basis Guard failed to assist UST preserve its peg. From the angle of collateral, USN is, to a sure extent, extra like FRAX, a fractionally-collateralized stablecoin.

Might USN keep away from the loss of life spiral?

As of Could 31, the USN provide is value $108 million, whereas NEAR includes a $4.3 billion circulating market cap, a $6.1 billion FDV, and a $607 million 24H buying and selling quantity. In contrast with NEAR’s market cap and buying and selling quantity, the chance dealing with USN continues to be manageable. As well as, when USN is issued, the Reserve Fund, based mostly on the Forex Board precept, will obtain a corresponding quantity of NEAR or different stablecoins. It routinely balances to take care of a backing of $USN at a fee better than 100% always. Subsequently, below regular circumstances, a severe USN de-peg is unlikely to occur.

Nonetheless, because the USN provide expands, customers can solely mint USN with NERA, which implies that the Reserve Fund might not essentially have the equal quantity of stablecoins. If the Reserve Fund didn’t swiftly reply to an enormous value drop of NEAR below excessive circumstances, then USN may lose its peg, and loads of holders would possibly discover it arduous to redeem their USN: changing USN into the equal worth of collaterals.

As such, to get ready for the affect of utmost circumstances, USN should enhance the revenue of the Reserve Fund through such strategies as minting charges, Automation of Treasury Administration, and NEAR staking income. In the meantime, the provision of USN must be capped to keep away from the era of extreme bubbles when the market overheats, bubbles that will be an insufferable burden if the market turns bearish.

Conclusion

No algorithmic stablecoin is ideal, and USN additionally has its professionals and cons. Luckily, NEAR’s USN witnessed the historic Terra/UST meltdown throughout its infancy, which gave a powerful warning to the builders and customers of USN. By way of such components as the present provide and collateral reserve, USN is unlikely to run right into a loss of life spiral. Nonetheless, as stablecoin turns into extra broadly adopted, the provision will broaden, and the chance of a loss of life spiral will enhance. By then, USN will face extra challenges.