The total value locked in decentralized finance has dropped from $257 billion (mid-November) to $250.55 trillion. It also lost more than 5% during the past 24 hours. Defi tokens, such as pancakeswaps, uniswaps, curva tokens, 1inch or sushi, have experienced a 15%-23.9% drop in value over the last seven day.

Defi TVL Drops —Convex Finance and Curve Finance dominate

Defillama.com’s metrics show that the TVL across defi protocols on a variety of blockchains stands at $250.55 trillion as of the writing of this article. The defi total locked lost 5.08% in the past day. Curve is the dominant protocol with an average dominance of 8.07% over most TVLs.

Curve is the automated market maker, Curve (AMM), which commands $20.23 Billion TVL. That’s an increase of 1.3% in this week. Makerdao has $18.56 million, making it the second largest defi protocol TVL. Convex Finance is currently the third-largest TVL for defi protocol TVLs with $15.14 trillion.

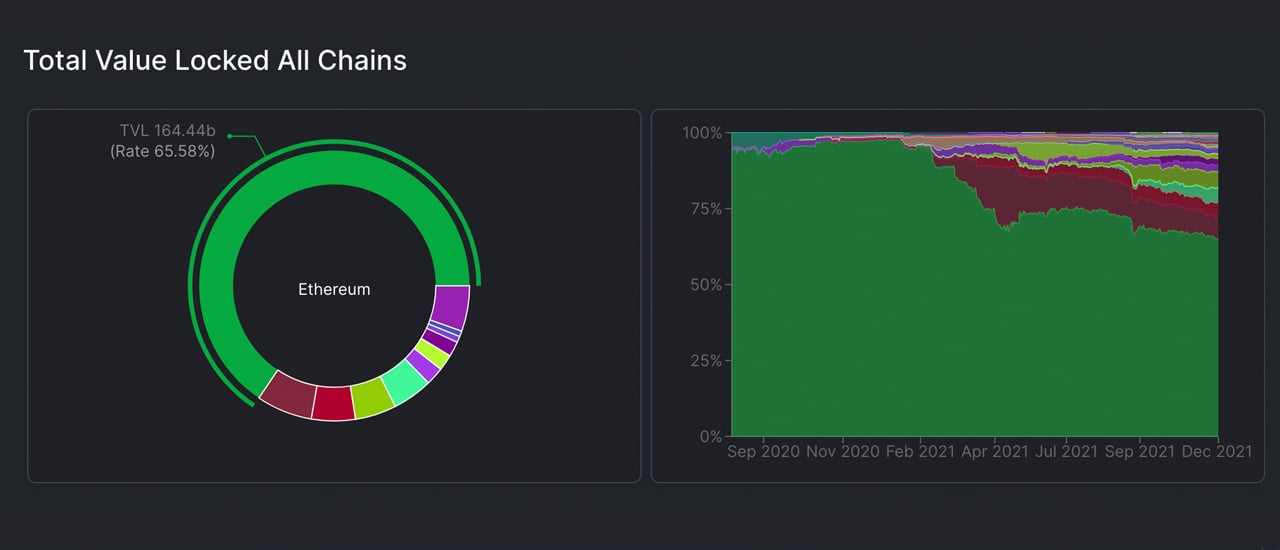

Ethereum Defi TVL Dominance 65, Binance Smartchain 6%, Terra 5 %

TVL per blockchain shows Ethereum commanding $164.36Billion out of $250.55B in defi. Binance Smart Chain, (BSC), captures $16.61 Billion and is second in defi protocol TVLs.

BSC follows Terra (13.29B), Avalanche (12.03B), Solana (11.246B), Tron (5.48B). Ethereum holds 65.58% (at the time this article was written) of the value of $250.55 billion in defi. BSC holds 6.62% of the value, Terra’s TVL has 5.30%.

Rebase and AMM Defini Tokens Slide —Crosschain Bridge TVL Slips 26% in 30 Days

Coingecko.com stats show that $17.2 billion is the decline in market capitalization at the top-automated market maker (AMM), defi tokens. Also, metrics indicate that rebase tokens are down 5.1% to $6.09 Billion on Sunday.

In the past seven days, top AMM crypto asset uniswap has lost 15% The next are pancakeswap (16.7%), curva token (27.2), 1inch (26.3%) and sushi (23.9%).

Tokens of Rebase such as Olympus and wonderland have lost 17.1%, 18.5% respectively. Klima dao, (KLIMA), is at 50.6% and ampleforth (AMPL), has lost 17.7%.

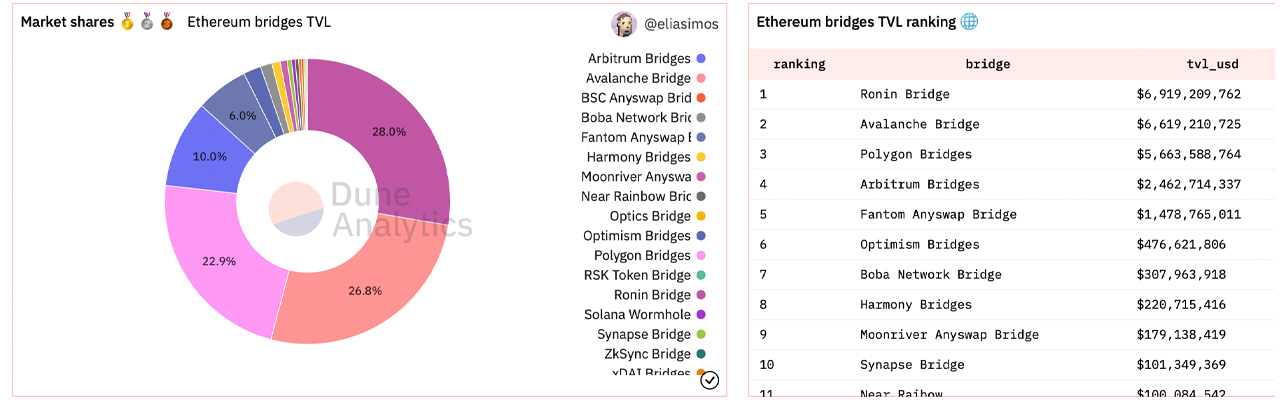

Monthly stats show cross-chain bridge TVLs have slipped 26.9% and today there’s $24.40 billion TVL in bridges to Ethereum, according to Dune Analytics. Avalanche is at $6.6 billion, Polygon $5.6 billion, and Ronin bridge has $6.9 Billion.

How do you feel about today’s state of decentralized financing (defi). Comment below and let us know how you feel about the subject.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.