Although the crypto economy suffered a massive loss this week, total value locked in decentralized financial protocols fell to $196.6billion. Defi’s TVL lost a little over 3.16% in the past day. The $592 billion worth of smart contract tokens fell in value by 3.5% in the same period.

Dex Trade Volume Drops to $200 Billion and Numerous Protocols Sell Billions of Dollars, DefiTVL Slides Below $200 billion

For the first time since March 16th 2022, the value of defi is below $200 billion. The total value of defi (TVL) at the time this article was written is $196.6 billion. This represents a decrease of 3.16% over the past 24 hours.

Except for Anchor, all ten top defi protocols have experienced significant TVL percentage drops over the past 30 days. Curve Finance is at 11.74%. Lido lost 13.73%. Makerdao lost 16.81%. Convex Finance lost 10.59%.

Aave Protocol, which has lost 21.98% in the past 30 days, was the biggest loser. Curve Finance is the leading defi protocol as it dominates by 9.56% with today’s TVL of around $18.8 billion.

Today, the TVL on Ethereum-based Defi Protocols still holds the dominant position with 55.55% or $109.21 million. The Terra blockchain holds 14.36% or $196.6 billion of defi TVL. Terra’s TVL today equates to $28.23 billion and $16.48 billion resides in Anchor.

In terms of the defi TVL size behind Terra and Ethereum, there are blockchains like BSC ($12.04B), Avalanche (9.38B), Solana ($6.09B).

Curve and Lido are among the five most popular defi protocols in terms of TVL size. Terra’s Anchor Protocol saw a 30 day TVL increase of around 4.15% last month.

Aave version 3 (v3) has seen a substantial increase in the past 30 days, despite the initial loss of 21.98%. Aave version 3 (v3) has a TVL of $1.38 Billion today, an increase of 2,711% from last month.

Statistics show that on Saturday, May 1, 2022, there’s 428 decentralized exchange (dex) platforms with a combined TVL of around $61.44 billion. There’s also 142 defi lending protocols with $48.87 billion total value locked.

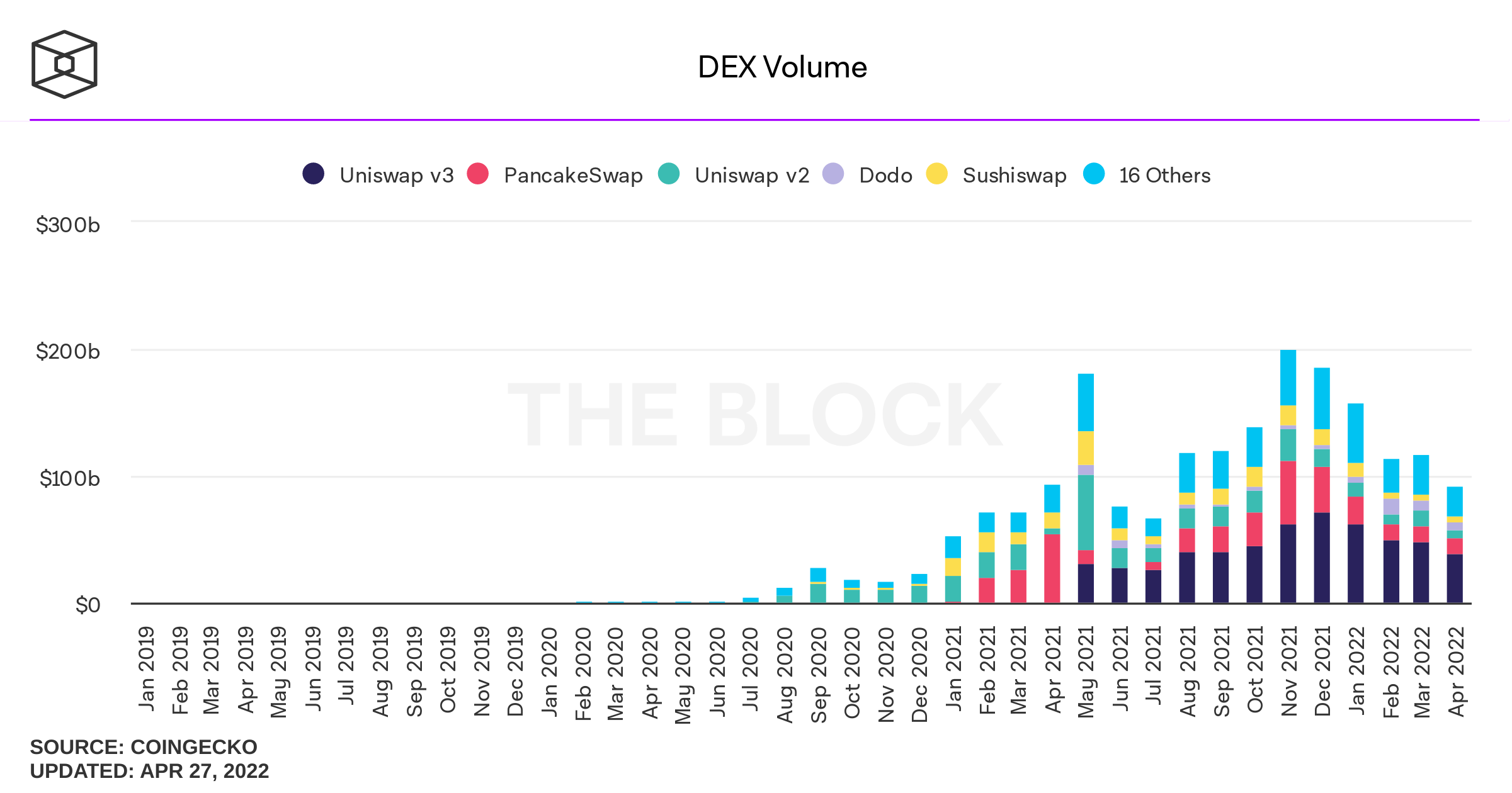

The data also shows that April’s dex volume decreased. In March dex volume was around $117 billion and statistics show that April’s dex trade volume was only around $92.18 billion.

Do you believe that the defi value is falling below the $200 billion mark this week? Please comment below to let us know your thoughts on this topic.

Credits for the imageShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This is not an invitation to purchase or sell directly, nor a suggestion or endorsement of products, services or companies. Bitcoin.com doesn’t offer investment, tax or legal advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.