The overall worth locked (TVL) in decentralized finance (defi) has jumped again above the $200 billion vary, hovering round $216.49 billion on Saturday morning (EST). The TVL in defi has elevated 13.60% since tapping a low of $190.57 billion 13 days in the past on January 23. The decentralized trade (dex) Curve’s $19.41 billion TVL dominates the overall worth locked by 8.84%

Ethereum’s Defi TVL Dominates by 61% Growing 10% Throughout the Final Week, Cross-Chain Bridge Worth Jumps 16.2% in 30 Days

The worth locked in decentralized finance (defi) has climbed increased for the reason that low it noticed on January 23 dropping $10 billion under the $200 billion mark. Immediately the TVL is 13.60% increased as the worth locked has elevated an incredible deal throughout the previous few days.

The protocol Uniswap’s TVL jumped 9.44% over the last seven days, Balancer elevated by 9.25%, and this week Makerdao’s TVL swelled by 9.10%. Moreover, good contract platforms, when it comes to market capitalization have elevated their general worth to $674 billion up 8.3% within the final 24 hours.

The highest good contract platform token ethereum (ETH) has seen its worth swell by 18.5% within the final seven days. Binance coin (BNB) jumped 8.8% this week, and cardano’s (ADA) worth elevated by 9.3%.

On the similar time, solana (SOL), polkadot (DOT), terra (LUNA), and avalanche (AVAX) noticed double-digit weekly beneficial properties. SOL climbed the best this previous week, leaping 25.6% in opposition to the U.S. greenback.

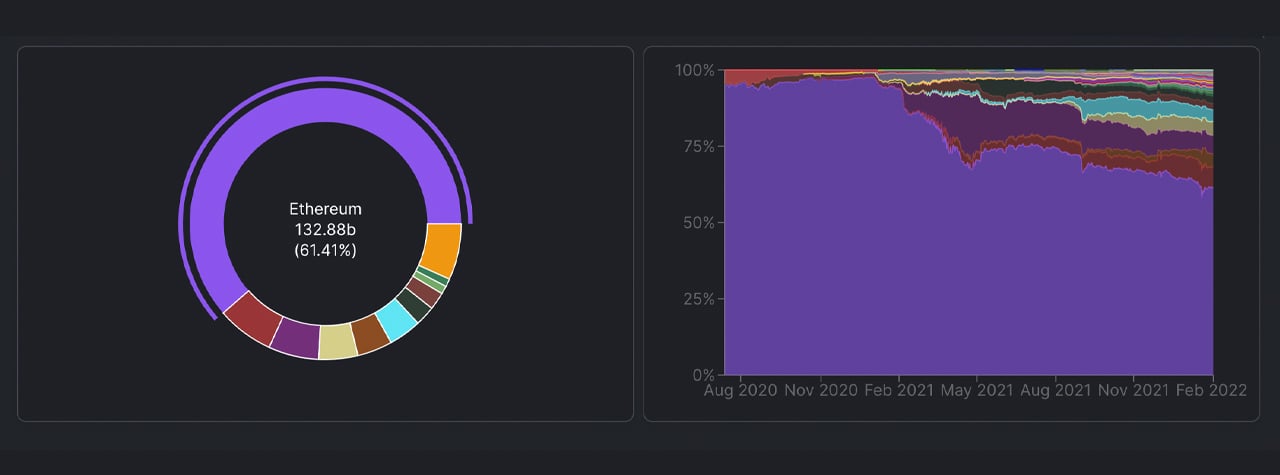

By way of defi TVL per blockchain, Ethereum nonetheless guidelines the roost with 516 defi protocols and $135.78 whole worth locked at present. ETH’s TVL represents 61.41% of all the $216.49 billion locked in defi. The second-largest defi chain is Terra with the community’s 17 defi apps commanding $14.67 billion in worth at present.

Whereas Ethereum noticed a seven-day change by growing its TVL by 10%, Terra’s defi TVL jumped 7.49%. Avalanche (AVAX) noticed one of many largest jumps this week within the high ten TVLs by chain with a 19.38% enhance to $10.08 billion.

Cross-chain bridge TVLs have elevated over the last month by 16.2% and at present, there’s $25.11 billion locked throughout varied bridges. Whereas Polygon’s bridges lead the pack with a $5.59 billion TVL, Avalanche has $5.53 billion locked on Saturday.

Wrapped ethereum (WETH), ethereum (ETH), and USDC are probably the most leveraged crypto property on cross-chain bridges this weekend.

What do you consider this week’s defi motion and good contract token markets? Tell us what you consider this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any injury or loss brought on or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.