US Dollar Coin (USDC) is a stablecoin—a cryptocurrency token pegged to the value of a real-world asset, the U.S. Dollar.

One of the most fascinating ecosystems in cryptocurrency is the stablecoin marketplace. Stablecoins have also become an attractive asset class. These coins are supported by fiat currencies and, most importantly, the US dollar. Stablecoins are attractive to investors because of their stable value.

Continue reading to find out everything about USDC, and how you can buy USDC.

What is USD Coin (USDC).

U.S. Dollar coin is both a stablecoin, and a dollar-denominated crypto that runs on Ethereum.. USDC These securities are issued by licensed financial institutions and backed with Fully reserved assets that can be redeemed on a 1 basis in U.S. Dollars.

USDCs come with one U.S. dollars backing them. This money is stored in a bank. Grant Thornton LLP’s monthly audit allows purchasers to confirm that USD Coin is 100% redeemable in dollars and fully backed with USD.

USDC, unlike other USD stable coins is managed by Centre. This membership-based group sets financial, technical and policy standards for all stablecoins. Ethereum USD Coin powered by Ethereum is an Ethereum token. It has now expanded to include the Algorand, Solana and Solana Blockchains.

Below are key USDC features.

- Regulated: USDC’s parent company is a registered Money Service Business in the United States. It’s regulated by the government’s Financial Crimes Enforcement Network (FinCEN), which combats money laundering.

- Audited:Grant Thornton, one the most respected accounting firms around the globe, audits USDC.

- Fast:USDC provides fast transactions while maintaining the U.S. currency’s stability.

- Liquidity: A high level of liquidity is another benefit to USD Coin’s tie-up with the U.S. dollars.

The U.S. Dollar Coin isn’t mined. It’s available as Ethereum ERC-20, Algorand ASA, and Solana SPL tokens that can be purchased using U.S. You can purchase dollars on many major exchanges.

The history of the USD Coin

Centre Consortium created USD coin. It was jointly developed by Circle and Coinbase. Circle is supported by several well-known companies such as Goldman Sachs. In addition to setting technical and financial guidelines for stablecoin, the Centre consortium is also responsible.

Circle was founded in 2013 to allow people to quickly and easily send money. Since then, it has expanded into cryptocurrency—raising millions in venture capital and acquiring crypto exchange Poloniex.

USDC seeks to address two key issues, high volatility in digital assets and conversion between fiat currencies or cryptocurrencies. Tether was not a good example of a stablecoin that is fiat-backed. The USDC project introduces a stablecoin that has strong governance and transparency. USDC posts a monthly public attestation that there are 100% fiat tokens in reserve on CENTRE.io. The USDC guidelines provide clear guidance for CENTRE members concerning USDC issuance, redemption and other matters. To become an issuer within the CENTRE consortium, members must follow key rules, including licensing, compliance, technology & operations, accounting, and custody of fiat reserves.

USDC can be used as an alternative currency to fiat currencies on major exchanges.

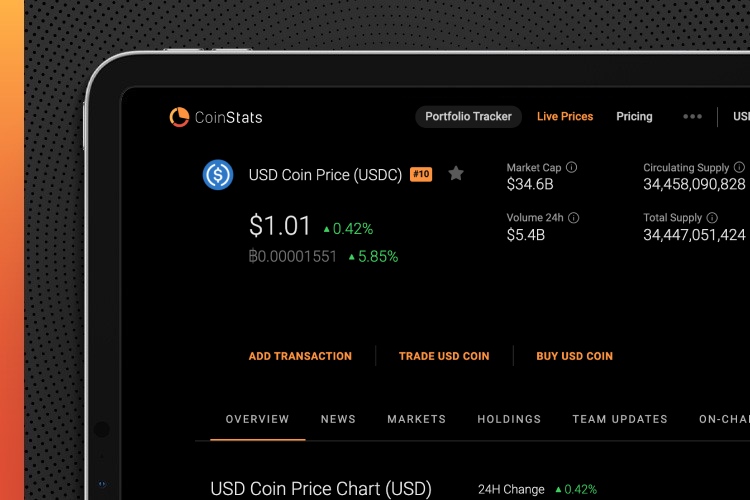

2018 was the year that USD coin markets were created. Its capitalization has increased from $200 million up to $25 billion since then.

The USD coin’s price is stable, but their numbers have increased dramatically.

How do I buy USD coin?

USD coin purchaseUSDC can be bought just like any other digital currency.

Step 1: Open an account online

The easiest way to start buying USD coins is through Coinbase, especially if you don’t have cryptocurrency. If you already have crypto, you may sign up for a decentralized platform like Uniswap.

It is possible to link your CoinStats Wallet & App with Coinbase.

You will need to enter your email address, create a password and give personal information in order to open an account at Coinbase.

Buy USDC with Ether tokens, if your crypto is already owned. You’ll need a compatible Ethereum wallet — MetaMask crypto wallet is the best option for Uniswap because it has an easy-to-use Google Chrome extension. You can exchange your Ether tokens for USDC by sending them to MetaMask.

Step 2: Create a digital wallet

Don’t store your USD coins on crypto exchange websites; instead, store them in a secure Ethereum compatible wallet, i.e., CoinStats Wallets and Coinbase Wallets. The cryptocurrency wallets create a series of keys and public keys which encrypt the cryptocurrency. It is also possible to purchase crypto immediately with these keys.

Step 3: Purchase your USD coin USDC

You will have to make a deposit into your bank account in order to purchase a USD Coin. It is simple to connect your bank account with Coinbase. You can also choose to fund it via ACH transfer, or even a debit card. You are now ready to make your purchase.

CoinStats can be described as one of best cryptocurrency platforms. You can check current market prices and the USD coin’s price, as well as detailed information about several of the fastest growing cryptocurrencies.

USDC is the Best Wallet to Keep Your USD Coins Safe and Secure

Coinbase allows you to store USD coins in a software-based wallet like CoinStats. Coinbase has a dedicated wallet application that’s great for storing your cryptocurrency. You can store Bitcoin, Ethereum, USDC, and several other assets on the wallet’s mobile app, free to download. Global transactions USD Coin allows you to transfer dollars from your crypto wallet worldwide to exchanges, businesses and individuals.

You can also use Ledger, a secure and more robust hardware wallet.

Ledger nano S allows you to keep all your crypto currencies in one place.

Trade and convert your USD coin

It is easy to convert your USD coin into fiat money.

- To redeem USDC, users first send a request.

- USDC Smart contract is used by the issuer to convert the tokens into USD. The tokens are then taken out of circulation.

- The user’s bank account is then deposited with the requested amount of USD directly from the reserves. You will be credited with the USD Coin equivalent to your request, less any applicable fees.

Coinbase users are not limited to trading USDC on the exchange. You can now trade USDC on many other exchanges, such as Binance (paired to BTC, BNB), and Poloniex.

Which is Better: USDC or U.S. Dollar Bank account

One of the significant advantages of USDC is that, unlike regular U.S. dollars, it does not require a bank account and isn’t limited to a particular geography.

USDC has another advantage: it is easy to transfer anywhere around the globe in minutes, and much more affordable.

One of the main reasons to hold USDC are its rand-hedging properties. Your USD coins can earn you interest.

USDC has both a stable dollar-linked price and the benefits associated with blockchain technology.

FAQ

USDC: How much?

One USDC equals one U.S. Dollar, and is redeemable at a 1:1 ratio.

Where can I buy USD Coin?

USDC can also be bought at Coinbase, Uniswap and Binance. Follow the instructions above.

How do I store USDC

You can store your USDC on any Ethereum wallet, like CoinStats Wallet or Coinbase wallet. A more secure option is to use Ledger as a hardware wallet.