Inflation in the US continues to rise because it climbed at its quickest fee in 40 years since February 1982. Statistics from the U.S. Labor Division’s Client Worth Index (CPI) jumped 7.5% increased than it was a 12 months in the past.

US Inflation Continues to Surge

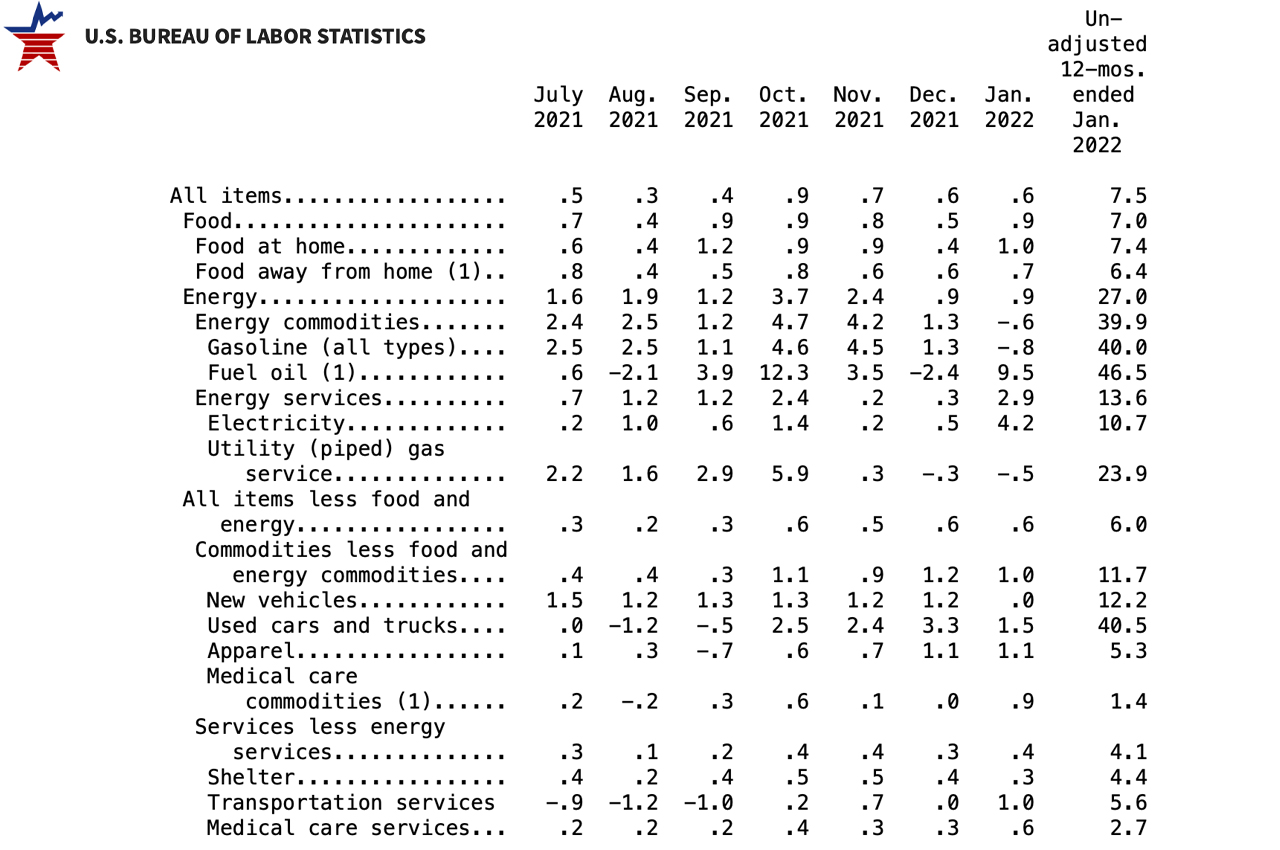

On Thursday, the U.S. Labor Division printed its CPI report which exhibits inflation shouldn’t be abating any time quickly. The Client Worth Index (CPI) primarily measures the common change over time that U.S. residents pay for a basket of varied shopper items. The CPI for all of the gadgets jumped 0.6% final month which elevated the nation’s total inflation by 7.5% since this time final 12 months. Furthermore, core inflation rose to six% and knowledge additional signifies that the citizenry’s salaries elevated 0.1% on the month.

The information has sparked a large number of conversations on boards and social media. The co-founder of the cryptocurrency trade Gemini, Cameron Winklevoss stated it was an opportune time for the main crypto asset bitcoin (BTC). “Inflation hit 7.5% in January,” Winklevoss tweeted. “[The] highest in 4 a long time. It continues to speed up. One of the simplest ways to protect your self from this pernicious, silent tax in your life’s work — your blood, sweat, and tears — is bitcoin,” he added.

The economist and gold bug Peter Schiff threw in his two cents in regards to the rising inflation as properly. As we speak the yield on the ten-year U.S. Treasury hit 2%,” Schiff said. “With official inflation at 7.5% and precise inflation a lot increased, consumers are assured to lose. If the Fed doesn’t develop QE the yield will quickly hit 3%. If by then QE hasn’t been expanded the rise to 4% will probably be even faster.” Schiff continued:

As a result of the Fed has no capacity to struggle inflation with out crashing the markets and the financial system it pretended that inflation was transitory to justify its failure to start out a struggle. Now that it stopped pretending inflation is transitory it’s now pretending it’s ready to struggle it.

Market Analyst Sven Henrich: ‘The Whole Fed Board Ought to Resign’

The founding father of Northman Dealer, Sven Henrich, mocked the Fed after the inflation report was printed and said that the “total Fed board ought to resign.” “Not solely had been they utterly improper, they stored deceptive the general public with their transitory narrative and continued on it when the info was already displaying they had been improper. And nonetheless they maintain injecting liquidity. Reckless,” Henrich added. The market analyst continued to mock the U.S. central financial institution when he said:

Sending the property of the wealthy to the moon, showering the poor and center class with 7.5% inflation [and] destructive wage development. We’re the U.S. Federal Reserve and we’re right here to assist.

In the meantime, each valuable metals markets and cryptocurrencies dropped rapidly after the announcement however then rebounded again. Bitcoin (BTC) jumped 4% increased in USD worth round 11:45 a.m. (EST), and gold’s value per ounce jumped 1.15% from $1,821 to $1,842 per ounce. Equities markets noticed a lot of the carnage as Nasdaq slid 90 factors decrease and the Dow Jones Industrial Common slipped 129 factors decrease round 11:45 a.m. (EST).

What do you concentrate on the rising inflation within the U.S.? Do you assume inflation will abate any time quickly? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any injury or loss prompted or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.